Tesla’s stock S&P500 is set to start trading as part of the SPX,

On December 21st, the apartment investment and management replaces AIV,

A Wall Street analyst calls the “mother of all” market restructuring events.

Meanwhile, Tesla DSLA,

Like the mother of all bubbles, according to long-term short sellers and at least one notable financial blogger who don’t know how to turn their heads around the electric-car maker’s relentless rally.

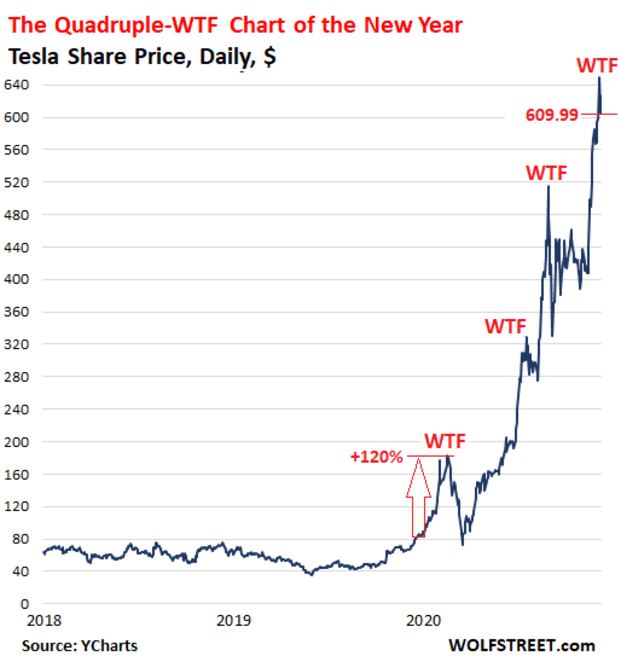

It’s been very unique ever since, when Wolf Street blog wolf Richter Tesla’s incredible year series began with “WTF Chart of the Year” in February and hailed the stock as an “unnatural event”.

This takes us to the fourth iteration of Richter’s scene:

For a brief overview of what a company rating means:

Richter, like many suspects, is set to capture more than 600% of Tesla’s rally this year.

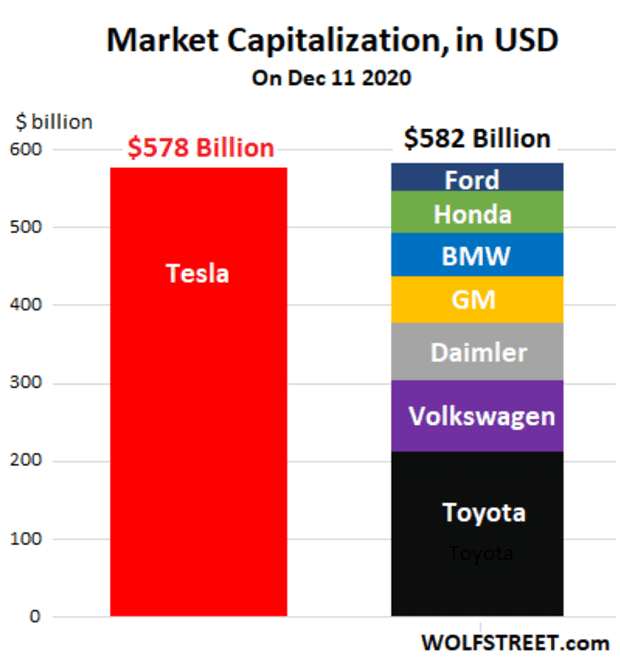

“Having earned 50 to 0.50 per share in the last four quarters, Tesla has a PE ratio of 1,220 times the revenue, while 10 to 20 would be profitable if we were still allowed to see something like the Antiluvian as PE ratio.

Richter said the inclusion of such heavyweights in the index would be more than 1% of the wider market metrics.

“This massive market cap transforms the regular event of transforming the S&P500 index into a global display,” he said. “Tesla is taking advantage of this situation: it has received $ 12.3 billion in new funding from investors through three share sales this year.”

Now that the Tesla investor is swimming in money, Elon Musk has left Richter to offer some advice on the direction his company should take.

“At this rate, Tesla is better at building cars and factories and handling warranty issues and regulators and dealing with faulty suspensions and auto pilot deaths and reminders and inquiries about whatnot. It sells for a very high price, ”Richter wrote.