The IRS began issuing direct deposits of these payments on Dec. 29 and says up to $ 100 million has already been completed.

But according to Intuit TurboTax spokeswoman Ashley McMahon, “millions of payments were sent to the wrong accounts and some may not have received their encouragement.”

According to a source in the banking sector, it is possible that approximately 13 million people have been affected.

The people most likely to be affected are those who used loans to anticipate returns or similar products. In these cases, your incentive payments may have been directed to the temporary bank account established by the online tax preparation company they used when the 2019 return was filed.

It may also have affected some people who changed banks over the past year, and the IRS has not yet registered its new checking account.

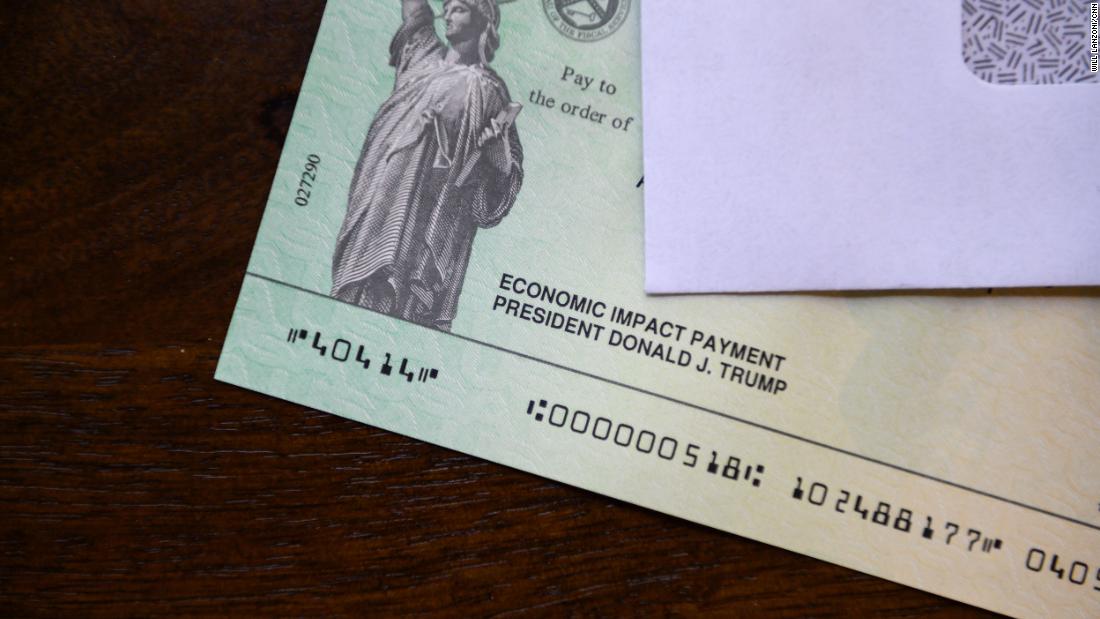

Earlier this week, the IRS attributed the error to the speed with which the new law required the agency to issue the second round of economic impact payments.

“Stimulus payments will begin to be deposited on January 8 for millions of our customers affected by the IRS error,” the company wrote on its blog. “We expect most of these payments to be available that day, but banks could take a few business days to process.”

TurboTax said it will send an email to customers when their payments have been deposited.