A stark reality for the euphoric stock market? Next week may present the closest to a calculation for bullish investors until 2021.

It is the busiest week of the fourth-quarter earnings season, highlighted by the expected results of heavy companies like AT&T T,

Apple Inc. AAPL,

Facebook FB,

and Tesla TSLA,

In all, about 118 companies are expected to show quarterly results in the last trading week of January, including 13 components of the Dow Jones Industrial DJIA industry average.

John Butters, senior analyst at FactSet Research, told MarketWatch.

And more than 60% of this weekly attack will take place between January 27 and 28.

The frantic period could become a crucial moment for a market that could be looking for its next spark as the administration of President Joe Biden, recently coined, develops its policy initiatives and plans to deal with the COVID-19 pandemic.

So far, optimism is high among equity investors, with sentiment data from Ned Davis Research at a reading of 74.4%, a level that has only reached 7.4% of the time since 1994.

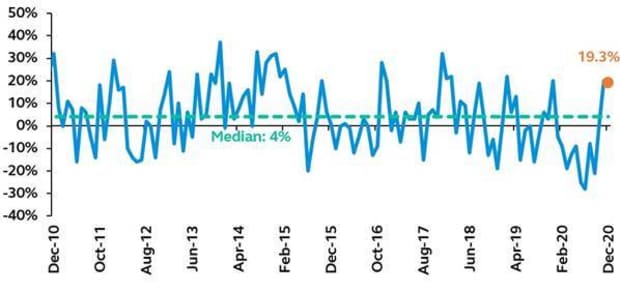

Similarly, the bear difference was 19.3% versus an average of 4% as of Dec. 31, according to the American Association of Individual Investors survey.

Source: American Association of Individual Investors, the world’s leading investors

Ned Davis Research says the buying mood seems to have crushed the appetite for bearish bets that stock prices will face a significant correction in the short term. “One thing investors have done less is short selling,” analysts Ed Clissold and Thanh Nguyen wrote in a Jan. 19 research report.

According to NDR data, the short-term sales ratio, the number of shares sold short divided by total traded issues, peaked from 2011 to November.

You don’t have to search hard to find evidence of the treacherous path that short sellers face these days.

Case study, GameStop GME shares,

is on its way to its best monthly increase in its history, 245% more, as fans investing in retail promoted stocks and urged users of social media-oriented platforms like Reddit to buy shares to squeeze activist investor and short seller, Andrew Left, Citron Research.

The actions of fanatical investor groups have gone beyond attempted hacking and piracy and have included what Left described as “serious crimes such as harassment of minors“, Wrote MarketWatch’s sister publication, Barron’s.

For some, this is the excellence of the market at its peak. Short sellers restricting companies and retail investors trying to demonstrate their new power.

Is that what the precursor of a bubble feels like? Are we in one? When will it appear, if so?

The Fed

These are all questions that can be asked of the Federal Reserve when it offers the backdrop to next week’s other big event: the latest monetary policy update.

Fed Chairman Jerome Powell has often been accused of helping prevent a calamity in financial markets during the outbreak of the coronavirus pandemic in March last year, as well as fueling too many risks.

The Federal Open Market Committee, led by Powell, quickly cut interest rates to near 0% and pumped billions of dollars of liquidity into the financial market that had been shaken by COVID-19.

Some critics argue, however, that Fed policies have favored exposed risk-taking. Bears also claims that the endless printing of money will have consequences for the US dollar, for the economy and, ultimately, for the financial markets in the long run.

Biden is proposing an additional $ 1.9 trillion in federal government spending to help pull the U.S. economy out of recession, as coronavirus cases and deaths hit a new high this month.

All of which can add meaning to next week’s Fed meeting.

“All eyes will be on Powell’s presidency at next week’s FOMC meeting. We look for it to take on a more optimistic but prudent tone, “economists Lydia Boussour and Gregory Daco of Oxford Economics wrote in a research note on Friday.

In recent speeches, Powell has already indicated that the Fed is reluctant to withdraw soon from accommodating monetary policy, including rising interest rates from historic lows or reducing asset purchases, a source of support for financial markets.

The Fed meeting begins Tuesday, with Powell & Company presenting its policy update on Wednesday at 2 p.m. in the East, followed by a press conference hosted by the president.

US economic growth?

On Thursday, a day after the Fed’s decision, market participants will await the official bulletin on the health of the U.S. economy.

According to consensus estimates among U.S. economists surveyed by MarketWatch, the U.S. economy could have grown by about 4% annually in the last three months of 2020, which would normally be phenomenal, but it occurs as a result of a increase of 33.4% third quarter.

However, if the GDP reading continues to show upward progress, it may underscore that the economy is moving in the right direction, even as the coronavirus pandemic continues to rage.

After all that is done and is done if the Dow, the S&P 500 SPX index,

and the Nasdaq Composite COMP,

they are still at a scrupulous distance of record highs, the bulls may find themselves even more animated.