Look who’s back.

After a long absence, active individual investors have returned with revenge. And while that may be literally true to some extent at GameStop Corp. GME,

saga, the biggest questions for investors of all stripes are whether it will last an apparent resurgence on the retail front and what it will mean for the stock market as U.S. benchmark indices reach historic highs.

It’s been a long time.

Shares saw the strongest bullish market in history after the 2008 financial crisis “without any retail trading interest,” Chris Konstantinos, chief investment strategist at RiverFront Investment Group, said in an interview.

He noted that total bond fund flows have surpassed securities flows by nearly $ 3 trillion since 2007. In fact, individual investors seemed interested in almost anything else, from real estate to cryptocurrencies, he said. Constantine.

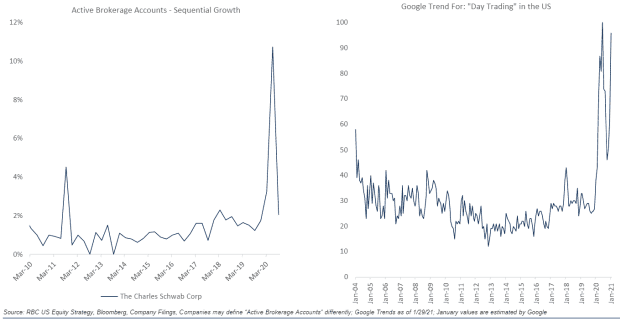

A change began last year when the coronavirus pandemic consolidated. Sequential account growth in brokers like Charles Schwab Corp. SCHW,

which served individual investors “was remarkable” at the end of the second quarter of 2020 and was followed by a significant increase in growth in the following quarter, said Lori Calvasina, head of US equity strategy at RBC Capital Markets, in a February. 2 notes.

At the same time, Google searches on “daily operations” also increased, he noted (see graphs below).

RBC Capital Markets

Calvasina and others acknowledged that a combination of blockchain-related boredom and U.S. government stimulus controls likely played a role in increasing individual investment interest.

The jury does not know if the growing interest in retail will continue, said Ed Clissold, chief U.S. strategist for research group Ned Davis, in an interview. It’s unclear what part of the uptake in retail only reflects that people throw extra money through stimulus checks into the market, he said.

This type of trading feels more like betting than investing, he said, noting that “sparkling” market stock tends to disappear quickly.

But others argued that individual investors are likely to stay.

“Structural change”

Calvasina said RBC suspects that “there may be structural change and that retail investors are likely to continue to be bigger players in the U.S. equity market.”

If so, this will require an adjustment of attitude by Wall Street professionals, who used to pay little attention to individual investors.

After all, the powerful waves of passive and systematic investments have made individual investors largely irrelevant to analysts preparing market forecasts, Société Générale strategists wrote in a note on Thursday.

But the market volatility created by the GameStop situation served as an wake-up call, analysts said.

While GameStop and other highly abbreviated names skyrocketed, hedge funds and other investors were seen liquidating long positions elsewhere, to make profits and cover losses, pressuring equity markets. The main benchmarks ended in January with a sour note, with the Dow Jones Industrial Average DJIA,

S&P 500 SPX,

and Nasdaq Composite COMP,

recording the largest weekly declines since October.

See: “My family won’t let me go hungry”: two young traders reveal the dangers of trying to navigate the epic wave of GameStop

However, US stocks rebounded last week, with benchmarks hitting all-time highs as GameStop fell more than 80%.

You need to know: GameStop’s meteoric gains are almost gone; here are tips for those who didn’t come out on time

SocGen analysts exposed the phenomenon as part of a broader trend that has seen individual investors drive demand for investments that take into account environmental, social and corporate governance or ESG standards.

“Instead of criticizing retail investors and their patterns of behavior, it’s better to include them in the money equation,” they wrote. “After all, not only are office workers locked up at home on snowy days, but so are very active day traders with access to affordable platforms.”

Cabin fever is hardly the only factor that has seen renewed market interest driven by individual investors, whose ranks are not made up exclusively of fast-fire traders.

Leveling of the field

Some individual investors who had previously shied away from equities could eventually succumb to the notion that ultra-low bond yields and elsewhere leave little alternative to the stock market. Stocks still look attractive when it comes to dividend or profit returns, Konstantinos said.

In addition, there is a level playing field between institutional and individual investors over the past few decades. FD regulation (for “full disclosure”) and other regulatory changes, as well as the rise of low-rate trading platforms, have placed individual investors “at a point closer to institutional investors than at any other time. the story, ”he said.

In fact, some market watchers have argued that the conventional brand of individual investors as “dumb money” seems increasingly wrong, especially after the GameStop episode showed investors supposedly “smart money” who have more than 100% of the company’s shares, leaving them open to a painful short squeeze.

The frenzy in retail that surrounded GameStop’s short budget and a handful of other heavily short-cap stocks raised a red flag for investors waiting for the foam type indicating a rally. it is entering the kind of euphoric phase that is usually followed. for a setback.

The next stage?

While this may turn out to be the case in the short term, some investors argue that a sustained uptake of active individual investor interest could help fuel the next stage of a bullish market.

Individual investors could continue to foster interest in more value-oriented, more capitalized names and higher volatility, Konstantinos said.

And a sustained interest in individual stocks could mean more “dispersion” or variation in returns between stocks and individual sectors, Clissold said, an element that has been lacking over the past decade for the pain of active fund managers.

Calvasina argued that retail interest in specific stocks is likely to decline and flow, as it has done over the past year, but is unlikely to fade.

Unless the door closes (i.e. through a major regulatory change), we don’t see why retail investors ’interest in trading specific names will be fully taken into account by the high amount of cash on the margin between consumers, ”he wrote.