With agricultural prices rising, metal prices higher in years and oil well above $ 50 a barrel, JPMorgan Chase & Co. he says: it looks like commodities have started a new one year earnings supercycle.

A long-term boom across the commodity complex seems likely, with Wall Street betting on a strong economic recovery from the pandemic and protection against inflation, JPMorgan analysts led by Marko Kolanovic said on Wednesday. Prices may also jump as an “unintended consequence” of the fight against climate change, which threatens to limit oil supply, while increasing the demand for metals needed to build renewable energy infrastructure, batteries and electric vehicles, said the bank.

Everyone, from Goldman Sachs Group Inc. to Bank of America Corp. and Ospraie Management LLC, calls for a bullish commodity market as government incentives are initiated and vaccines are implemented worldwide to fight coronavirus. Optimism has already raised hedge funds ’stakes in commodities to a one-decade high, a dramatic change from last year when oil first fell below zero and farmers they were pouring products into the middle of thick supply chains and falling in falling demand.

“We believe the new rise in commodities, and in particular the oil growth cycle, has begun,” JPMorgan said analysts said on his note. “The tide of yields and inflation is changing.”

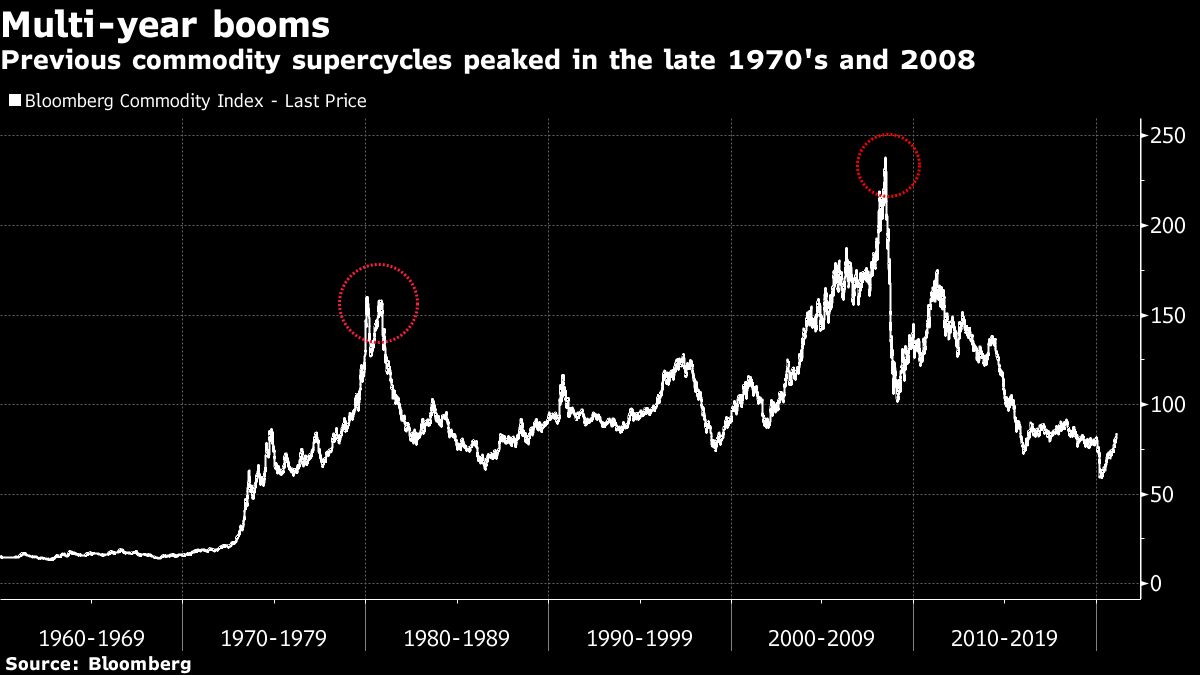

Commodities have seen four supercycles in the last 100 years, with the last one peaking in 2008 after twelve years of expansion.

Although that was driven by China’s economic growth, JPMorgan attributed the last cycle to several engines, including a post-pandemic recovery, “ultra-loose” fiscal and monetary policies, a weak US dollar. stronger inflation and more aggressive environmental policies around. the world.

Similarly, hedge funds have not been so low in commodities since the mid-2000s, when China was storing everything from copper to cotton, while crop failures and Export bans around the world raised food prices, eventually toppling governments during the Arab Spring. The backdrop is now beginning to look similar, with a broad commodity price value peaking in six years.

Corn and soybean prices have risen as China increases American crops. Copper reached a maximum of eight years amid growing optimism over a broader economic recovery. And oil has experienced a sharp recovery from the depths of the Covid-19 pandemic as global supply consumption is reduced.