“

“What I would like to point out here is that we have come dangerously close to the collapse of the entire system and the public seems to be completely unaware of it, including Congress and regulators.”

”

This is Thomas Peterffy, founder and president of Interactive Brokers Group Inc., who detailed on Wednesday on CNBC the dire situation the market was in in late January when individual investors on social media platforms came together to send a handful of very short actions, including bricks. video game retailer GameStop Corp. GME,

and AMC Entertainment Holdings AMC,

to high levels, with shock waves recorded throughout the market.

As Peterffy told MarketWatch in an interview last month, the so-called short squeeze that broke out caused compensation and forced a number of brokers to try to protect themselves by increasing margin requirements and limiting trade in certain actions to avoid wider chaos. in the markets.

Peterffy’s comments come ahead of a much-anticipated noon hearing Thursday, where the House Financial Services Committee is set to lead executives from Robinhood Market, Melvin Capital and Kenneth Griffin, owner of hedge fund Citadel LLC and its Citadel Securities stock trading arm. Social media firm Reddit and Keith Gill, an independent investor who gained sudden fame during the GameStop affair, will also be questioned about their roles in the frantic trade that took over the public and briefly helped spark a mini-investment. -selloff at the Dow. Jones Industrial Average DJIA,

the S&P 500 SPX,

and the Nasdaq Composite COMP,

indexes.

Clearing centers play a crucial role in markets, from equities to derivatives. They are held between the parties to a trade to secure payment if waived.

Read: GameStop frenzy highlights clearing centers as investors weigh fears on systemic risk

This crucial piece of financial market plumbing was at the center of the issue, Peterffy said.

Peterffy said existing protocols around the short circuit can cause calamity in the stock market, as in several cases, the shares of the company targeting short sellers exceed the total outstanding shares.

“So as the price goes up, short films are the default for runners, runners should now be covered, [and] this raises the price, so brokers breach the clearing service and you’ll end up with a complete mess that is virtually impossible to fix, ”the president of Interactive Brokers told CNBC.“ So that’s what almost happened. “.

In a testimony prepared before his hearing, Robinhood CEO Vlad Tenev gave his perspective on the January action: “What we experienced last month was extraordinary and the trade limits we set in GameStop and other actions were necessary to enable us to continue to meet the clearing center deposit requirements we pay to support customer trading on our platform. “

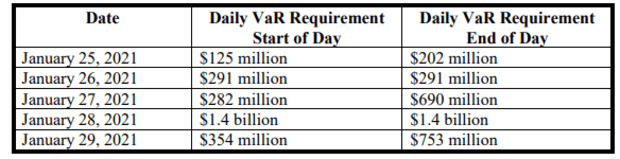

The CEO of Robinhood says the brokerage, which bills itself as an average investor, said its daily value at risk, or VAR, rose nearly 600 percent from $ 202 million on May 25. January to $ 1.4 billion on January 28th.

Witnessed from Robinhood Markets to the House Financial Services Committee

The increase in its deposit requirements forced Robinhood to raise $ 3.4 billion in additional capital to allow customers to resume normal operations across its entire platform, the CEO said.

Take a look at: A Reddit millionaire investor will have to tell Congress “I’m as bullish as ever” in the GameStop shift

Peterffy said lawmakers and regulators can solve current problems related to short-term selling by asking for more frequent data on short-term selling and increased margin requirements, or leverage used, on short-term stocks. .