Rising Treasury yields have contributed to the sale of the highest pandemics in the stock market, but it will probably not be enough to damage the attractiveness of bond stocks in 2021, according to one analyst.

U.S. equities investors “have focused on the recent 10-year Treasury yield increase over the past week, which is back to mid-February 2020 levels,” wrote Lori Calvasina, head of RBC Capital Markets U.S. equity strategy, in a note Tuesday. Bond yields and prices are inversely related.

10-year Treasury yield TMUBMUSD10Y,

it reaches its biggest rise in six weeks, which has been blamed for causing a backlash led by technology-oriented actions that had benefited more from the stay-at-home dynamics created by the COVID-19 pandemic.

Related: Can the bullish stock market survive the rise in inflation and bond yields? That’s what the story says

The relationship showed the opposite on Tuesday, as yields yielded yielded following the testimony of Federal Reserve Chairman Jerome Powell, which allowed major benchmarks to clear or cut significant losses. The Nasdaq Composite COMP, a very heavy technology,

which has led the way down, reduced a loss of about 4% to finish 0.5% as yields declined; the S&P 500 SPX,

earned a five-day losing streak, while the DIA Jones Industrial Average DJIA, more cycle-oriented,

erased a loss of more than 360 points to finish a little higher.

Meanwhile, Calvasina said that taking a look at what the shares offer in terms of dividend profitability and earnings relative to bonds, as well as a reminder of the type of bond movements that have caused problems for stocks, offers some security. that 2021 is unlikely to become a low year, she said.

Dividend yield

In terms of dividend yield, RBC measured the percentage of firms that continue to outperform the 10-year Treasury yield. While this has fallen to 51.5% from 64% earlier this year, it is still within a range typically followed by a 17% gain for the S&P 500 over the next 12 months, he said. .

Income performance

The profitability of the S&P 500 has also deteriorated, to the lower end of the range since the end of the financial crisis. It now remains close to the level seen in 2017-18, but remains in a range that has been followed by 9.3% of the S&P 500’s average gains over the next 12 months, Calvasina said.

“In other words, this analysis recognizes the case for a short-term downturn in the S&P 500, but does not necessarily indicate that long-term investors should head for the exit,” he wrote.

Calvasina also highlighted a “significant difference” between 2018, when the trade war posed a threat to the U.S. and global economies, and now, when gross domestic product forecasts are rising rapidly.

Treasury yields and shares

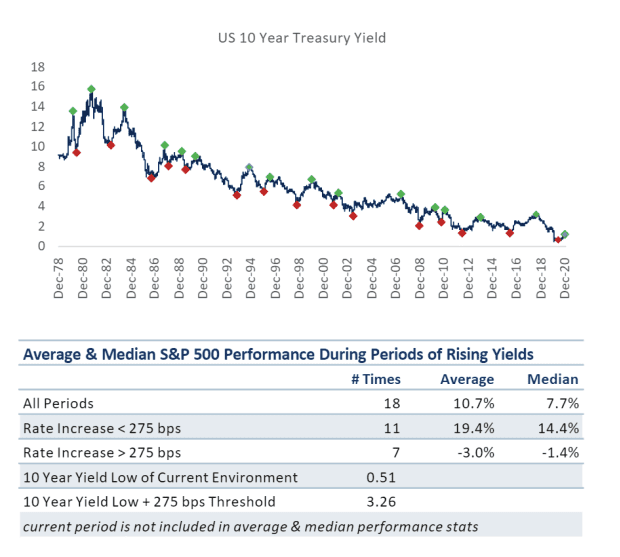

Finally, what about the Treasury’s rise? After all, many market observers have argued that while yields remain low by historical standards, the size of the increase may be the most worrying for stocks. Calvasina broke the relationship between performance movements and stock market performance in the following chart:

RBC Capital Markets

Calvasina said U.S. equities have tended to struggle when the ten-year yield rises more than 275 basis points, or 2.75 percentage points. Leaving its 0.51% low, a move of 275 basis points would bring the yield around 3.26%. The ten years ended Tuesday with 1.363%.