Inditex closed the 2020 financial year, the most complicated it has had to go through in its history, with a net profit of 1,106 million euros, which represents a 70% decline with respect to the previous year’s figures. A year marked by the pandemic, store closures and time restrictions, and increased demand for the online channel. All of them ingredients that have been noticed in the account of results of the Galician textile group, in spite of which has managed to keep the positive result. Of course, this is the lowest since 2006. The company’s shares fell above 1% at the start of the trading session, moderating the mid-session decline and even growing slightly.

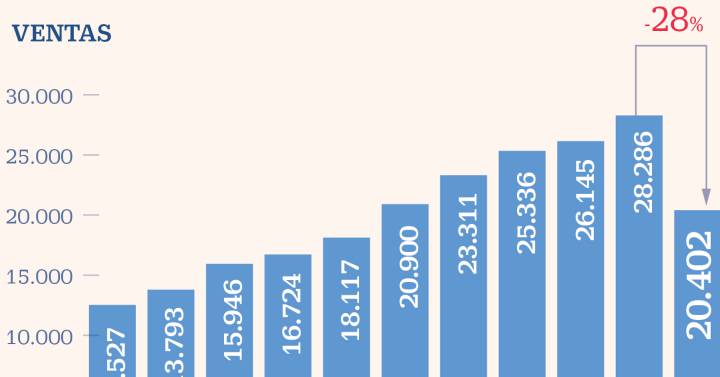

2020 will go down in the company’s history as being the first in which its revenues are reduced compared to the previous year. Inditex billed 20,402,000, 28% less, With the ballast of the first half of the year and a fourth quarter in which the recovery in sales took a step back. If in the third it had managed to cushion the fall to 13.5%, in the last year, when the restrictions were accentuated again, the decline was almost 25%, with a turnover of 6,317,000 . The profit in this period was 435 million, 53% less. According to the company, on January 31 of this year, the end date of its fiscal year, it had 30% of its physical stores completely closed, When at the end of the third quarter this percentage was 8%. In the whole year the hours of sale were reduced by 25.5% and 100% of its stores have suffered at some time of the year closures or limitations. On January 31st its store network was 6,829 units, 640 less than a year earlier.

Something that managed to compensate in part with the growth of the online sale. This did so by 77% to 6,612,000 euros, representing 32.4% of total sales, so that it has far exceeded the target set for this channel to account for 25% of turnover in 2022. In 2019 this percentage was 14%. The group also highlights a 50% growth in visits to its online stores.

“Inditex comes out stronger this year so difficult, “says CEO Pablo Isla in the results report.” The digital transformation strategy launched in 2012 through the integrated platform of online stores has been shown to be the right one, ”he added, concluding that Inditex is today“ an even stronger company than two years ago, with a unique business model and a flexible and efficient global trading platform, which puts us in an excellent position to facing the future “.

Dividend payment

What does raise the textile is the dividend. Inditex returns to its policy of dedicating 60% of the profit to shareholder remuneration and will distribute 0.70 cents per share charged to the 2020 financial year. This is double what it distributed last year. when he kept the dividend up in the air until the summer shareholders’ meeting in the face of the uncertainty unleashed by the coronavirus. In this case it is an ordinary dividend of 0.22 euros and an extraordinary one of 0.48 euros, which will be paid in equal payments of 0.35 euros in May and November.

However, it postpones the payment of the remaining 0.30 euros for the 1 euro dividend committed for the years 2019, 2020 and 2021-2022, as reported.

In terms of other financial variables, Inditex closed the year with a gross margin of 11.39 billion, or 55.8% on sales, one tenth less than the previous year, and with a fall in ebitda of 41% to 4,552 million.

All these indicators, as well as the figure of sales and profit, are below the forecasts collected by Bloomberg in recent days, which calculated a net result of between 1.3 billion and 1.4 billion euros for at the end of the year, and total revenues for the year 2020 of about 21 billion. According to analysts ’calculations, Inditex will not return to the 28,292,000 it billed in 2019 until 2023.

Beginning of the year

In addition to the 2020 balance sheet, Inditex has also given the first clues about the start in February of its fiscal year 2021. It explains that the spring-summer collections “have been very well received by our customers”, and that during the last month an average of 21% of its stores remained closed. By March 8 this percentage had dropped to 15%.

In-store and online sales in the first week of this month saw a 4% drop. Excluding the top five markets with the most stores closed, Germany, Brazil, Greece, Portugal and the United Kingdom, sales grew 2%, according to the company. Inditex estimates that on April 12 “virtually” 100% of its stores will be open.