Stock market investors poured a record amount of money into U.S. mutual funds and publicly traded funds last week as the Dow Jones Industrial Average surpassed another milestone and the S&P 500 index also hit a record.

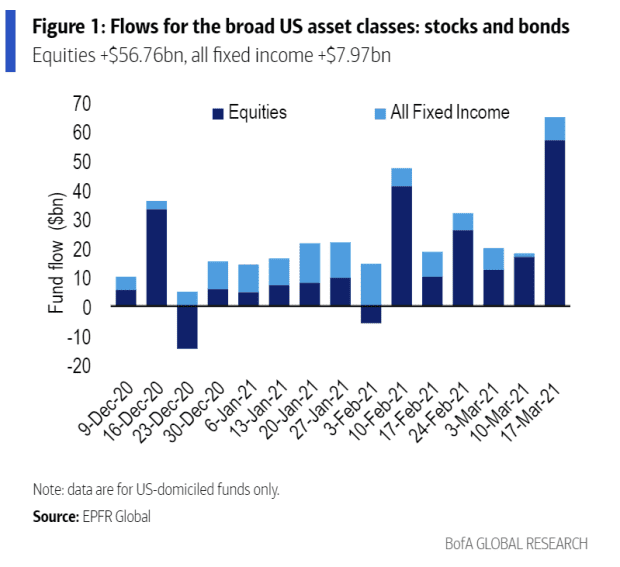

On Friday, BofA Global Research said U.S. equity inflows reached a weekly record of $ 56.76 billion in the week ending March 17, up sharply from the previous week’s $ 16.83 million . The Dow DJIA,

on March 17 it closed above 33,000 for the first time, while the S&P 500 SPX,

it also ended with a record high.

Read: Dow achieves the fastest 1,000-point move in history, surpassing 33,000 facts; that is what has driven him

BOFA Global Research

Meanwhile, Goldman Sachs estimated that net flows to global equity funds reached a record high of $ 68 billion in the week ended March 17, which, when scaled to the level of equity assets, went be the largest since December 2014.

The increase was largely due to higher net inflows into the U.S. market, which coincided with the initial distribution of stimulus controls of up to $ 1,400 for qualified U.S. citizens as part of the $ 1.9 trillion COVID-19 relief package previously signed by President Joe Biden. this month, Goldman Sachs analysts said in a note on Friday.

As of March 17, the Treasury had distributed $ 242 billion in stimulus checks, or about 60 percent of the total expected.

“These payments may be going into mutual funds and ETFs, as well as other assets,” Goldman analysts wrote. “All categories in the sector recorded positive net entries during the week; the largest net purchases in share of [asssets under management] they were industrial and telecommunications.

Surveys have attempted to assess how many stimulus controls would likely hit the market, including individual stock purchases and the purchase of other assets, including bitcoin.

See: Americans willing to invest $ 40 billion in bitcoins and stock exchanges as stimulus controls arrive: poll

Both the S&P 500 and the Dow withdrew from records on Wednesday as continued selling in the Treasury market boosted the performance of the U.S. 10-year Treasury note TMUBMUSD10Y,

at a 14-month high above 1.75% on Thursday.

BofA said government bond fund inflows weakened to $ 60 million from $ 1.188 billion the previous week amid high rate volatility, while municipalities and mortgages they saw $ 1.09 million and $ 300 million in revenue, not far from the $ 990 and $ 470 million seen, respectively. a week before.