For analysts, the annual resort stay for central bankers represents an opportunity to get a real idea of where the Fed is headed: when will the central bank reduce its monthly stock purchase? When will interest rates rise?

It is essential if you are a serious investor, especially because the symposium comes at a time when Covid cases are increasing due to the more infectious Delta variant and the softening of economic data.

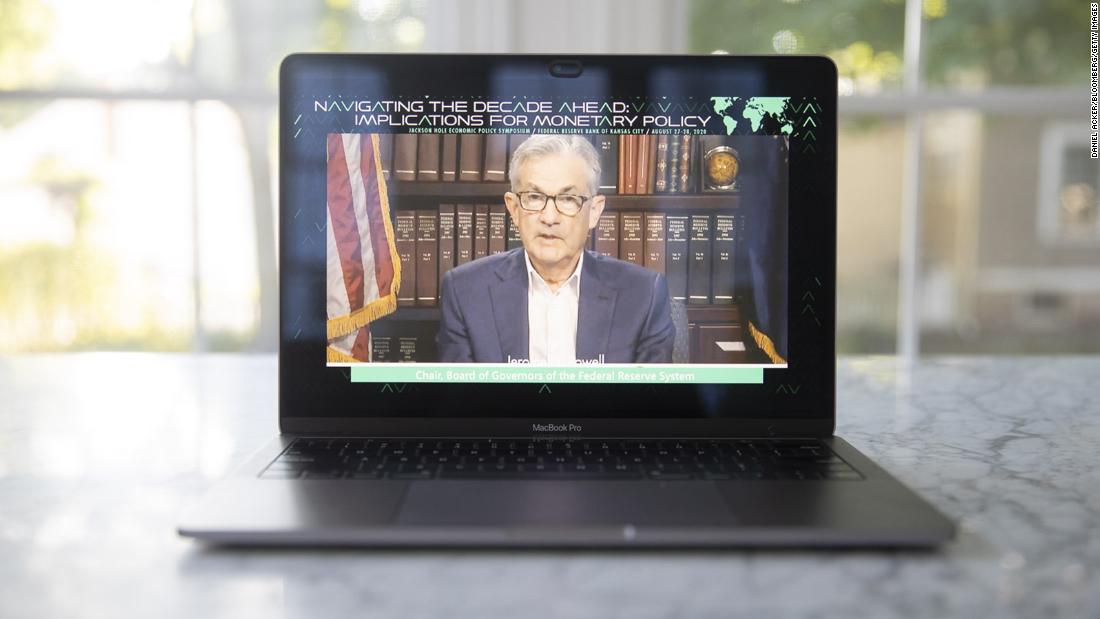

The event will focus primarily on Fed Chairman Jerome Powell’s economic outlook speech on Friday at 10 a.m. ET.

All about the taper

The narrow question: when will the Fed relieve the economic stimulus gas pedal? has been on the minds of investors for months.

Faster-than-expected inflation during the first half of the year sparked concerns for the Fed that it would recover monthly asset purchases of about $ 120 billion sooner than expected. The minutes of last month’s policy meeting added fuel to the fire, causing the market to take on a tizzy sales phase early last week, before recovering this week.

“Several participants commented that economic and financial conditions are likely to justify a reduction in the coming months. Several others indicated, however, that a reduction in the pace of asset purchases is more likely to be appropriate in early next year, “states in the minutes of the central bank It was said the meeting from 27 to 28 July.

Goldman Sachs (GS) has shifted its prediction of when the Fed will begin to shrink in November from December at the end of those minutes, and expects a $ 15 billion cut per meeting, from a formal announcement in November.

While all investors under the sun will hear any reduced conversation at the end of the week, those expecting innovative revelations may end up disappointed.

“We expect the September FOMC meeting to be the main event in which Powell will more substantially establish the predicate on volume reduction, not Jackson Hole,” RSM chief economist Joe Brusuelas said.

For the Fed, waiting at least next month has its advantages, including another look at the job market with next week’s job report. Another strong report could bolster the case for the speed reduction to be implemented.

Is inflation here to stay?

But even if Powell doesn’t set a firm date for weight loss on Friday, there are still many things he could clarify.

When inflation started to jump, the Fed introduced its favorite word to the market: transitory. This means that prices are rising largely due to temporary factors as the economy reopens and the world faces supply chain problems.

While the Fed remains largely on the transient train, the minutes of the July meeting noted that several officials believe worse-than-expected supply chain disruptions could keep up pressure on prices next year. .

So what is it? Transient or not really? Wall Street investors expect Powell and other Fed officials to shed some light on the issues Friday.

Low performance world

Monthly purchases of Fed assets have, for the most part, kept bond yields low. Buying Treasury values worth $ 80 billion each month will do just that.

Even as yields on ten-year Treasury bonds rose sharply since the previous pandemic earlier this year, driven by concerns about an overheating economy and higher inflation, yields were still strong. low.

So what can happen when the Fed scales its monthly purchases?

“With fewer central bank purchases, bond yields are likely to increase globally, but not too much,” said John Vail, chief global strategist at Nikko Asset Management.

From a stock market point of view, it could be a reason for cyclical and financial stocks to perform well, Vail added.

For the market as a whole, a more hawkish Fed would likely weigh in on the rally that pushed stocks to record highs once again this week.