- AUD / USD exchanges pressing against a key support area before the RBA.

- Australia’s interest rate may be revised in the money markets, while foreign exchange traders will prepare for a possible mini-taper boom.

- It is a currency exchange if the RBA will refuse to decrease or increase the purchase of assets at today’s meeting.

The Reserve Bank of Australia will meet today and decide on its monetary policy in the foreseeable future.

While traders are confident that interest rates are on hold, the prospects for risk reduction are risk.

This makes the Australian vulnerable to a strong bid and paints a bullish backdrop that will enter the event today.

That said, something to the contrary could be catastrophic for the currency as markets look for performance.

Cyclical currencies, such as AUD, could already be under pressure this week if the delta variant is considered to eliminate short-term growth prospects in APAC nations.

The U.S. dollar shows signs of strength earlier this week, despite sad non-farm payroll data coming in on Friday.

Investors believe that if the US sneezes, the rest of the world will also cool down.

While the Federal Reserve is unlikely to shrink as soon as markets would have expected during the course of very strong employment over the last quarter, it is unlikely to fall too far behind.

Other central banks that have already started or are about to shrink, such as the BoC and the RBA, could slow it all down.

The RBA was due to start shrinking, albeit very cautiously, in September.

However, given the recent outbreak of the highly contagious Delta variant of the coronavirus, the blockages mean no.

“We believe the RBA Board of Directors will decide to delay the reduction of the AUD 5 per week bond to AUD4 B scheduled for September, but the decision is likely to be very close and could go either way,” the ANZ Bank analysts.

In this scenario, traders could continue to favor the currencies of nations that are not seen to be worse in terms of viruses and blockages.

As a result, an exodus of Australians could be seen plummeting against the greenback.

“We fully expect the reduced commitment to be deferred,” Westpac analysts said.

“But an even better response would be to raise purchases from AUD5 B to AUD6 B with a review at the November Board meeting, when the risks of reopening economies and spreading the virus will be much clearer,” he said. analysts analyze. he argued.

This move was expected to really affect Australians.

” The RBA has always been prepared to contribute to policy efforts to help deal with economic shocks. This brutal contraction in the economy should not be an exception, “Westpac analysts said.

However, it is not an agreement made and traders should be prepared to get a result in both directions, as it has been known that the RBA is engaged in current events and remains bullish in the future and post-blockade prospects. .

“We expect the RBA to adhere to its narrow decision at the Sept. 7 board meeting,” TD Securities analysts analyzed.

” Despite the worsening situation of COVID-19, the silver line is the best implementation of vaccination, while a broad fiscal stimulus seems more appropriate to support the economy at this juncture than the stimulus monetary. That should give the RBA room a chance to justify its decision to continue with its taper until its next review in November. ”

Technical analysis of the US dollar

Meanwhile, as measured by the DXY index, the green dollar is trying to regain support in the 92.20 / 92.30 area:

This is crucial for the commodity complex for which it is priced in USD.

The AUD is trading as a commodity substitute and if we see a significant resurgence of the US dollar, perhaps to test the 61.8% ratio close to 92.50, Australians are expected to be subject to a strong selling pressure.

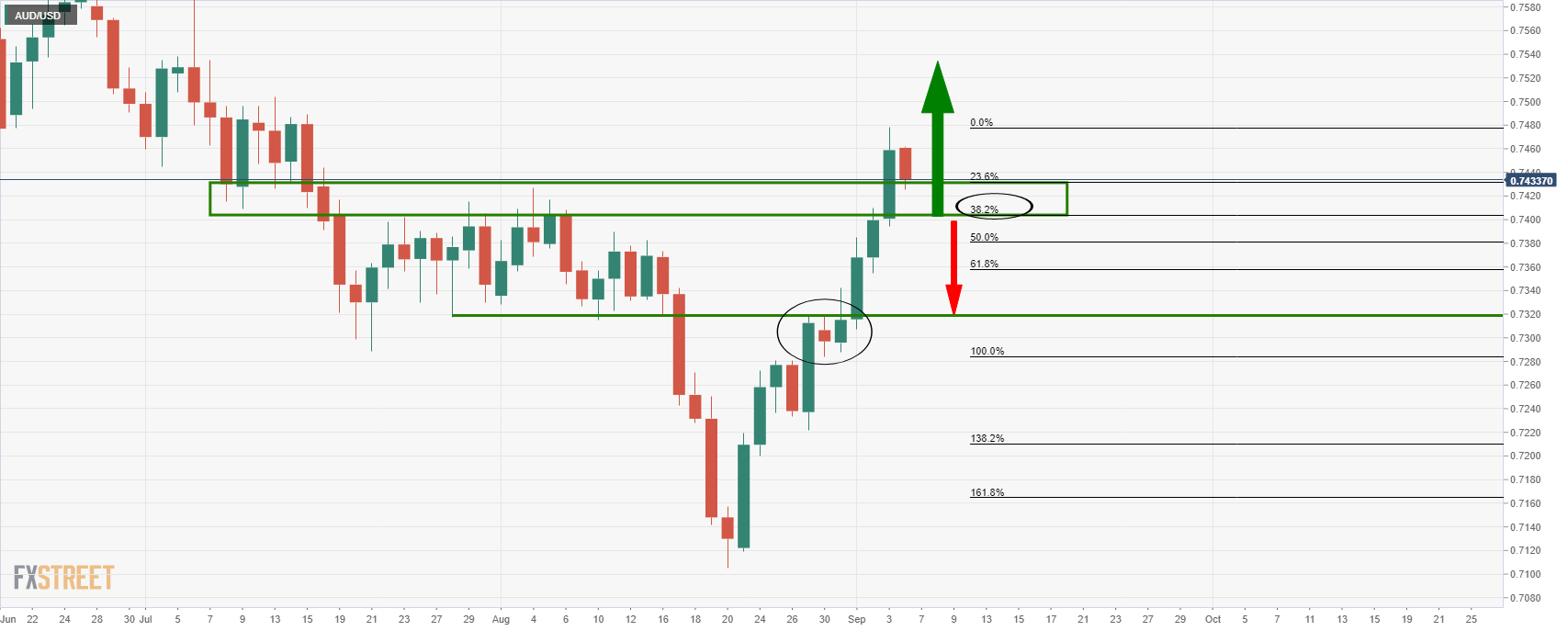

AUD / USD technical analysis

The price is up for a remaining 38.2% or possible 50% ratios if the bulls don’t commit at the moment.

In its absence, there is total support beyond the 61.8% ratio near the August 30 structure, between 0.73 the figure and 0.7320.

On the plus side, the bulls can commit and watch them take on 0.7480 and then 0.75. The 0.7650 marks the weekly minimum sprints held in April 2021.