Interest rates have remained persistently low, even as the economy emerges from the pandemic.

The yield on 10-year US Treasury notes TMUBMUSD10Y,

for more than two years it has not exceeded 2%. (Monday yields 1.32%).

As a result, many income-seeking investors have migrated from bonds, considered the safest income investments, to the stock market. But the income from a diversified portfolio of stocks may not be high enough.

There is a way to increase this income, even by reducing the risk.

The following is an income strategy for stocks you may not be familiar with (covered call options), along with examples from Kevin Simpson, founder of Capital Wealth Planning in Naples, Florida, who manages the Amplify CWP Enhanced Dividend Income ETF DIVO,

Morningstar has rated five stars (the highest) with this exchange traded fund. We will also see other ETFs that use covered call options in a different way, but with revenue as their primary goal.

Covered call options

A call option is a contract that allows an investor to buy a security at a specific price (called a strike price) until the option expires. A put option is the opposite, which allows the buyer to sell a security at a specified price until the option expires.

A covered The call option is the one you type when you already have security. The strategy is used by equity investors to increase income and provide some downside protection.

Here’s a current example of a covered call option in the DIVO portfolio, described by Simpson during an interview.

On August 23, the ETF wrote a one-month call for ConocoPhillips COP,

At the time, the shares were trading at about $ 55 per share. The call has a strike price of $ 57.50.

“We collected between 70 cents and 75 cents per share” in that option, Simpson said. Therefore, if we go down, 70 cents per share, we will get a return of 1.27% for just one month. This is not an annualized figure: it shows how much revenue can be earned with the covered call strategy if used over and over again.

If ConocoPhillips shares exceed $ 57.50, they will likely withdraw: Simpson and DIVO will be forced to sell the shares at that price. If this happens, they may regret parting with a stock they like. But along with the 70 cents per share of the option, they will also have enjoyed a 4.6% gain in the share price at the time they wrote the option. And if the option expires without being exercised, they are free to write another option and earn more income.

Meanwhile, ConocoPhillips has a dividend yield of more than 3%, which in itself is attractive compared to Treasury yields.

Still, there is risk. If ConocoPhillips doubles to $ 110 before the option expires, DIVO would have to sell it for $ 57.50. All this rise would be on the table. This is the price you pay for the revenue provided by this strategy.

Simpson also provided two previous examples of values for which he wrote covered calls:

-

DIVO bought shares of Nike Inc. DE,

-2.83%

for between $ 87 and $ 88 per share in May 2020 after the withdrawal of the shares, and then set aside $ 4.50 per share in revenue by drafting repeated covered call options for the shares until December. Simpson finally sold the shares in August after reserving another $ 5 per share in option premiums. -

DIVO earned $ 6.30 per share in covered call premiums from Caterpillar Inc. shares. CAT,

-0.23% ,

which were withdrawn “in late February about $ 215-220,” Simpson said. After that, shares rose to $ 245 in June, showing a rise in gains. Shares of Caterpillar have retreated to about $ 206.

Simpson’s strategy for DIVO is to hold a portfolio of 25 to 30 blue chip shares (paying dividends) and write only a small number of options at any one time, depending on market conditions. This is primarily a long-term growth strategy, with improved revenue from hedged call options.

The fund currently has five hedge positions, including ConocoPhillips. DIVO’s main goal is growth, but it has a monthly distribution that includes dividends, option income, and sometimes a return on capital. The SEC’s 30-day listed return on the fund is only 1.43%, but that only includes the dividend portion of the distribution. The return on distribution, which is what investors actually receive, is 5.03%.

You can see the fund’s top holdings here on the MarketWatch budget page. Here’s a new guide to the budget page, which includes a wealth of information.

DIVO performance

Morningstar’s five-star rating for DIVO is based on the ETF’s performance within the joint venture group “US Fund Derivative Income” of the investment research firm. A comparison of the total performance of the ETF with that of the S&P 500 SPX index,

it can be expected to show lower long-term performance, in line with the revenue approach and the waiver of some upside potential for the actions that are convened as part of the hedged call strategy.

DIVO was established on December 14, 2016. Below is a comparison of NAV-based returns (with reinvested dividends, although the fund may be best for investors in need of income) for the fund and the its Morningstar category, along with S&P 500 yields calculated by FactSet:

| Total yield: 2021 | Total yield – 2020 | Average yield: 3 years | |

|

Amplify DIVO ETFs enhanced by CWP dividends, |

13.8% |

13.2% |

13.9% |

|

Income category derived from the American fund Morningstar |

13.0% |

4.3% |

8.3% |

|

S&P 500 SPX, |

19.9% |

18.4% |

17.8% |

|

Sources: Morningstar, FactSet |

|||

Return on capital

A return on capital may be included as part of a distribution of an ETF, a closed-end capital fund, a real estate investment fund, a business development company or another investment vehicle. This distribution is not taxed because it is already the investor’s money. A fund may return part of the capital to maintain a dividend temporarily or it may return capital instead of making a different type of taxable distribution.

In a previous interview, Amplify ETF CEO Christian Magoon distinguished between “accretive and destructive” capital returns. Accretive means that the fund’s net asset value (the sum of its assets divided by the number of shares) continues to increase, despite the return on capital, while destructive means that the NAV is declining, leading to poor investment over time. and continues.

Covered calls to whole indexes

There are ETFs that take the hedging option strategy to one end, writing options against an entire stock index. An example is the Global X Nasdaq 100 Covered Call QYLD ETF.

which maintains the shares that make up the Nasdaq-100 NDX index,

in the same proportions as the index, while continuously covered call options are written against the entire index. QYLD has a four-star rating from Morningstar.

The ETF pays monthly; its distribution yield after 12 months has been 12.47% and its distribution yields have been consistently higher than 11% since it was established in December 2013.

That means a bit of income. However, QYLD also stresses the importance of understanding that a pure “hedging” strategy in a full stock market index is really an income strategy.

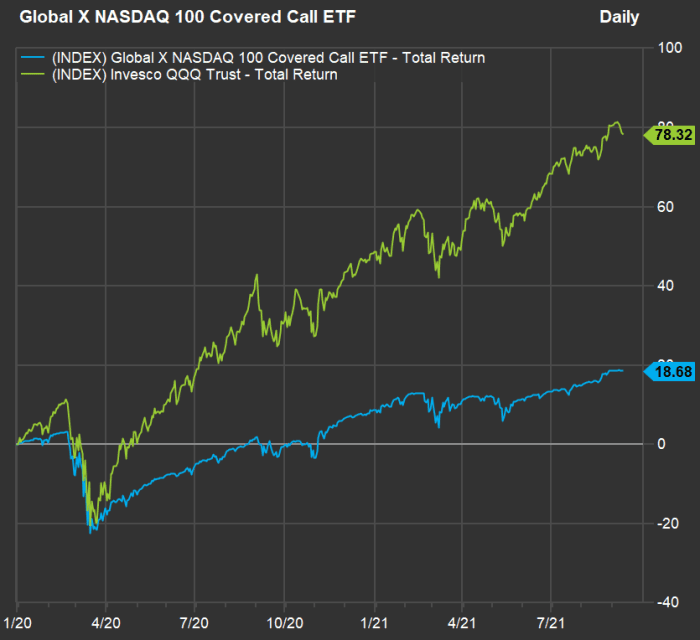

Below is a comparison of the fund’s returns and the Invesco QQQ Trust QQQ,

which has been monitoring the Nasdaq-100 since the end of 2019, which includes the entire COVID-19 pandemic and its effect on the stock market:

FactSet

QYLD made a strong dive during February 2020, as did QQQ. But you can see that QQQ recovered faster and then fired. QYLD continued to pay for its high distributions throughout the pandemic crisis, but was unable to capture most of QQQ’s additional benefits. It is not designed to do that.

Global X has two other funds following hedge call strategies for full revenue ratios:

-

Global X S&P 500 XYLD ETF with hedged hedging,

+ 0.21% -

The Global X Russell 2000 Covered ETF RYLD,

+ 0.14%

Covered call strategies can work especially well for stocks that have attractive dividend yields and some investment advisors use the strategy for individual investors. ETFs offer an easier way to follow the strategy. DIVO uses hedged calls for a growth and revenue strategy, while the three listed Global X funds are more revenue-oriented.

Do not miss: Here is a safer way to invest in bitcoin and blockchain technology