While stocks appear to hit new highs in September, the feeling of fear on Wall Street is palpable.

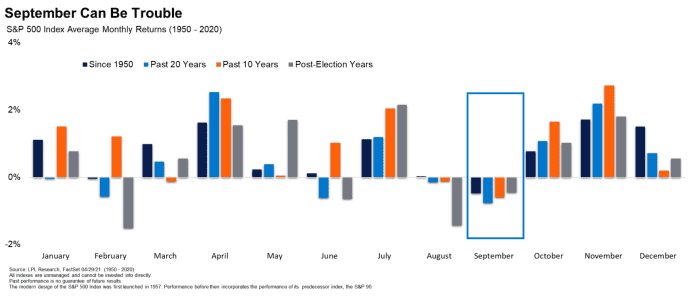

Strategists (and the media) have been relentlessly delving into seasonal trends that place September as one of the worst months of the year for equity benchmarks.

through LPL Financial

Even last year, when stocks had an almost incessant run to records, the S&P 500 SPX,

he took a September pen that saw him finish with almost 10% value at one point before resuming the bullish rally.

Ultimately, September 2020 saw a 3.9% decline for the S&P 500, after five consecutive months of strong gains following the COVID-19 pandemic that brought the financial markets and the general public to a dead center.

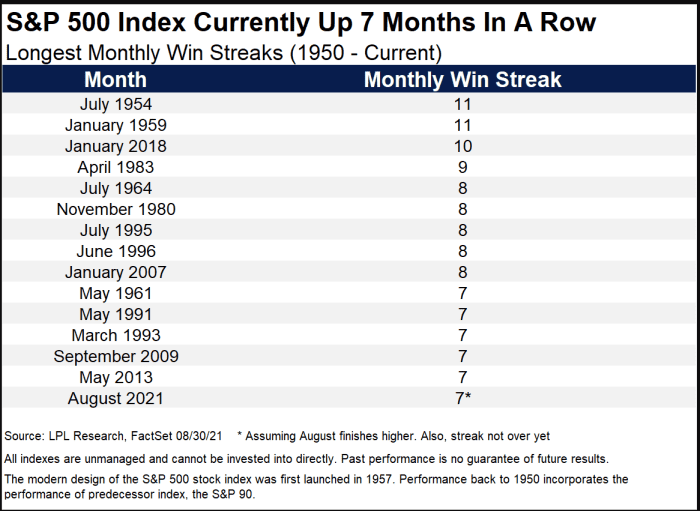

This time, investors are worried that the markets are in a similar misfortune, with seven consecutive months (and counting) of gains for the broad market benchmark, and the feeling grows that valuations are rich and money easy to the Federal Reserve. the punchbowl will be removed soon.

Seven months of consecutive earnings is an impressive account:

through LPL Financial

Ryan Detrick, in a research note this Tuesday, chanted the usual warning for this time of year.

“While this bullish market has laughed at almost every sign of concern in 2021, let’s not forget that September is historically the worst month of the year for stocks,” wrote LPL’s chief market strategist Financial.

There is little doubt about the narrative surrounding the reason for the discomfort:

-

The job report Friday

-

Valuations are rich for stocks, depending on your measurement

-

The delta variant of coronavirus is spreading as schools open

-

Inflation worries

-

The Fed meeting from September 21-22

-

The debt ceiling

-

Quadruple witchcraft options and stock expiration

-

Gravity

Sahak Manuelian, head of equities trading at Wedbush Securities in Los Angeles, told Joy Wiltermuth at MarketWatch in an interview that volatility could be a major factor this month.

“I think September and the volatility you usually have in September can come into play again,” the trader said.

That said, MarketWatch columnist Mark Hulbert said that despite statistics showing that September (and October, which is arguably worse) is a terrible month for stocks, investors should not be swayed. simply by loose correlations.

“The stock market tradition is full of statistically significant correlations but of no importance in the real world,” Hulbert wrote.

Paul Schatz, president of Heritage Capital, offered some similar advice in a blog post, noting that September’s negative data also depends on how the statistics around the month’s performance look.

“As the calendar changes, many experts have been arguing that September is historically the worst month of the year for stocks. That’s really right. Depending on which year you choose the start date,” Schatz writes .

“September has a negative return of -1.10% since 1928. However, the devil is really in the details,” he said.

He argues that the August performance, which was strong this year (and also strong last year), has a major factor in the September figures.

“If we look at times when the stock market starts in September in an upward trend, the negative return becomes positive by about 0.5%,” he wrote. “In turn, this also tells us that when the stock market starts the month already in decline, the average is almost -3%.”

Either way, investors can cut it, the market is likely to be forced to consider itself stung, given that nothing is going straight up forever and the S&P 500 has yet to post a reduction (a setback since its most recent peak) of 5% or worse this year.

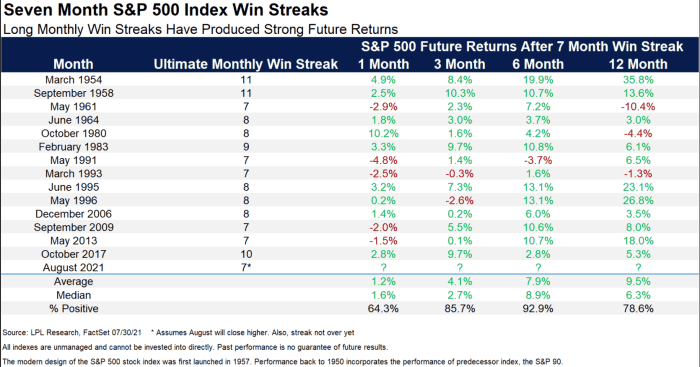

Detrick said persistent monthly market gains so far may offer a better indicator of market performance over the next three, six and 12-month periods, with average gains of 4.1%, nearly 8% and 9, respectively. 5%, respectively. , in those periods when the S&P 500 produced earnings of at least seven months.

through LPL Financial

On Wednesday, markets started quite strongly in September. The Nasdaq Composite COMP,

reached its 33rd record in 2021, and the S&P 500 nearly lost its 54th all-time high, with earnings declining. The RUT Russell 2000 small-cap index,

increased by about 0.6%.

However, the DIA Jones Industrial Average DJIA,

recorded a loss of 0.1% to start the month.

Wall Street will soon see how September looms.