Markets are sinking into the combat chair as it is about to go online another day of the retail-driven food frenzy for short-term stocks.

In case you thought the trading craze was a limited battle between internet day traders and Wall Street hedge funds: video game retailer GameStop was one of the most valued stocks in the U.S. on Wednesday.

Amateur investors, many based on the Reddit group WallStreetBets, are jumping to very short stocks, bringing prices to astronomical levels and forcing hedge funds to sell bigger and safer bets to cover losses.

Selloff is crawling into other investments and being terrified. Major indices fell from 2% to 3% on Wednesday and are expected to continue browsing.

A must read: Did you tend? Diamond hands? Your lingo guide to WallStreetBets, the Reddit forum that fuels Gamestop’s wild rise

Our call of the day comes from Jefferies American equities researchers, led by global equity strategist Sean Darby, with bonus call by Sébastien Galy, Nordea Asset Management strategist.

The Jefferies team is clear that stock price correction has little to do with fundamentals. Rather, what is happening is a reflection of a “change of sentiment within some of the most excessive and speculative parts of the market.”

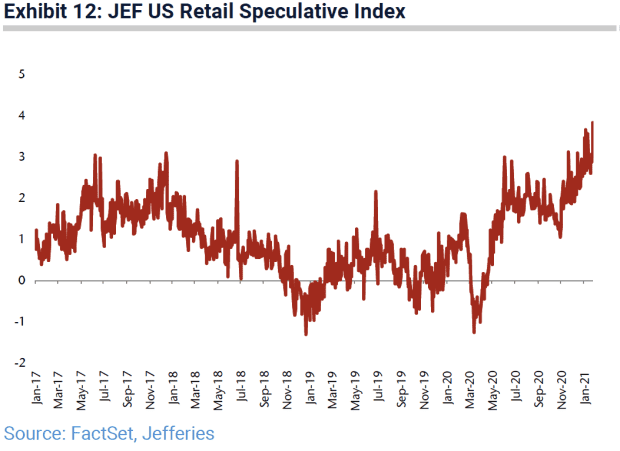

The group’s retail speculative index, which measures the deviation from the trend of assets where the value is difficult to determine, is high at 4 standard deviations. “So there’s a lot of air to get out of the riskiest financial assets,” the team said.

Darby’s team noted that the short-term concern is whether the “emergence” of riskier parts of the market will create a domino effect, as major stocks are liquidated to curb losses.

Galy, of Nordea’s Nordic asset manager, echoes Jefferies ’caution over a wider sale. He also says it’s too early to buy the bathroom, because there are more things to come.

Big moves to cover shorts at a time of great leverage tend to force more leverage, Galy said. This is because the limitation of capital due to the risk of loss of investments increases.

“As a result, the cost of hedging downside risk has risen sharply,” Galy said. “This risk reduction could last for a few days, followed by a strong rebound driven by liquidity in the US and, to a lesser extent, European stocks.”

Galy said even a Federal Reserve meeting on Wednesday could not turn that market upside down, which is another sign it could last.

The buzz

GME GameStop Shares,

it hit the $ 500 level in the market before retiring. The stock was only $ 19 until 2021. The fashion brand Nakd NAKD,

it is another action that makes a big leap into the pre-market, 130% more.

In a presentation this morning by the Securities and Change Commission, the AMC AMC film-theater chain,

revealed that the holders of the company’s convertible bonds have opted to convert the bonds into shares, as the company’s shares have risen around 330% since this Tuesday.

Apple AAPL,

Facebook FB,

and Tesla TSLA,

posted profits after yesterday’s close. Technology giant Apple surpassed $ 100 billion in quarterly revenue for the first time, shattering expectations, as social media company Facebook also exceeded estimates, with sales soaring 156% over “other revenue “, such as virtual reality headsets and video chat devices. Tesla, an electric car maker, reported its sixth consecutive quarter of profits, but lost expectations.

But if you can take your eyes off the stock market, it’s a great day on the economic front. Initial and ongoing claims are due at 8:30 a.m. EST, and some 875,000 people are expected to have filed unemployment last week. Gross domestic product data for the fourth quarter of 2020 will arrive at the same time, before the new home sales figures for December at 10am are announced.

After the Federal Open Market Committee decided yesterday to keep monetary policy stable, Fed Chairman Jerome Powell gave negative signals that the central bank had not finished restoring the health of the economy devastated by the COVID pandemic. -19. “We haven’t won it yet,” he said.

The markets

It looks like another wild day on Wall Street. Yesterday’s commotion caused the Dow Jones Industrial Average DJIA,

more than 630 points fall and the futures of the YM00 stock market,

ES00,

NQ00,

they point down, about to continue selling. Asian markets NIK,

HSI,

HSI,

fell widely and the European SXXP indices,

UKX,

DAX,

PX1,

they are firmly in red.

The graph

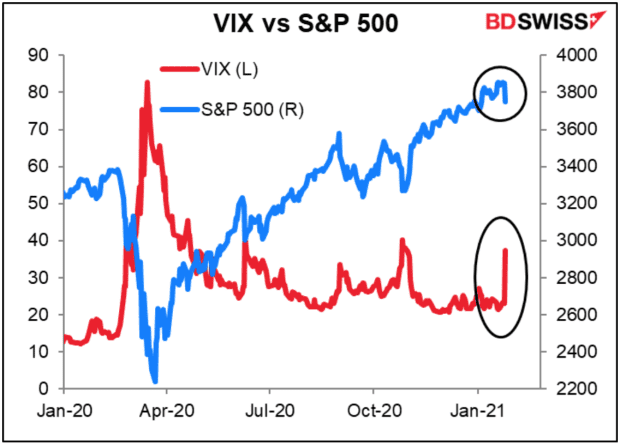

Our chart of the day, from Marshall Gittler to BDSwiss, shows how the S&P 500 SPX,

it was reduced to a minimum since October 2020 and the VIX index of expected volatility recorded its largest increase in a day since the COVID-19 pandemic hit in March 2020.

The tweet

When sharks take root towards the fish. Billionaire businessman and investor Mark Cuban, famed “Shark Tank,” is taking root on Reddit’s WallStreetBets traders.

Random readings

An Oklahoma lawmaker has proposed a “Bigfoot” hunting season with a new bill.

Key West wants to ban people from eating fat, wild, and free-ranging chickens.

Need To Know starts early and updates up to the opening bell, though sign up here to get it delivered once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing, which includes exclusive comments from Barron and MarketWatch writers.