According to Jefferies analysts, stock market skeptics, who fear the escape of all-time highs to end a tumultuous 2020, are fueled by an unwarranted round of investor euphoria.

Skepticism is understandable, they acknowledged, in a note on Saturday, that they observed that market performance towards the end of 2020 is “almost the polar opposite” of the double-digit falls observed in the fourth quarter of 2018 despite that comments and news feeds carry one with a similar bad tone ”.

You need to know: As 2021 approaches, watch out for a Y2K-style stock market correction, says strategist

The S&P 500 SPX,

fell 14% in the last quarter of 2018, a deficit triggered by fears that the Federal Reserve’s overly tight monetary policy would stifle the economy. The benchmark index has risen more than 10% so far in the last quarter of 2020, despite increasing cases of coronavirus threatening to derail the economic recovery, even as vaccines are developed in the States. United and much of the world.

News about the coronavirus: The United States has more than 19 million cases of COVID-19 and Fauci is worried about a post-holiday wave

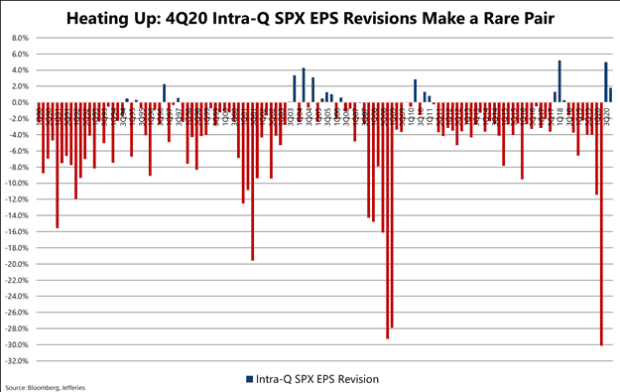

The most important thing is that the actions relate to future profits. And the “notable difference” in the last three months of 2020 is that earnings reviews for the period have been positive almost every week of the quarter, analysts wrote.

“We would argue that this is one of the most important tailwinds of stocks, as profit reviews are rarely positive,” they said.

Earnings revisions refer to changes in analysts ’estimates of corporate earnings in a quarter, in this case, for companies that make up the S&P 500. Normally, expectations are revised lower over a quarter, reducing effectively the bar when the profit season kicks off.

As the chart below shows, upward revisions have become a rare occurrence. But history shows that stocks tend to move forward when they occur, analysts noted.

Jefferies

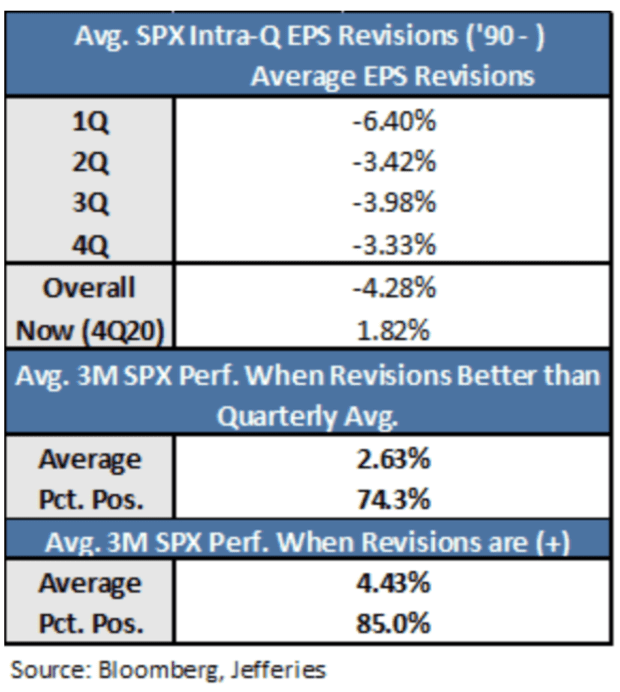

How much tail wind? Analysts said the three-month average overcoming the S&P 500 as a result of positive reviews is nearly 450 basis points, or 4.5 percentage points, “which bodes well” for the S&P 500 in the first quarter of 2021 (see following table).

Jefferies

And as vaccines are just beginning to roll out, the potential for additional positive reviews remains during the first half of next year, they said.

Related: Stock market professionals have a hard time imagining a fall in the S&P 500 in 2021

As shown in the table above, even smaller-than-average negative revisions tend to lead to a solid performance by the S&P 500. In fact, it’s not until revisions begin to be significantly surpassed because the performance tends to slow, analysts found.

So much ahead in 2021? Not too fast.

Analysts said the scope of strong market gains in December, which have seen the S&P 500 increase more than 3% during the month so far, while the DIA Jones Industrial Average DJIA,

has advanced about 2.8% and the Nasdaq Composite COMP,

has gained more than 5.5%, could set the stage for a brief January setback.

See: Santa’s rally has begun, why few 7-session tranches are so positive for the stock market

“Current performance in December is around 50 basis points above average since the 90s, and when that happens, January’s performance is only positive about half the time,” they noted. However, in these cases, first quarter performance has been stronger than typical, with an S&P 500 rising more than 80% of the time.

“So while [near-term] yields can be poor, it could also be a good time to increase exposure, ”they said.