Photographer: Tiffany Hagler-Geard / Bloomberg

Photographer: Tiffany Hagler-Geard / Bloomberg

The Reddit trading crowd that traded daily made the first quarter of 2021 one of the wildest periods of stock market mania in modern history. The (plural) books will no doubt be devoted to the subject in the coming years.

But after these small speculators came together to increase dozens of obscure stocks by hundreds or even thousands per cent – and in the process a few hedge fund barons were burned betting on the declines – the movement seems to be spreading. An index that tracks 37 of the most popular meme stocks (37 of the 50 that Robinhood Markets banned customers from trading during the huge frenzy) is essentially unchanged over the past two months after nearly firing. 150% in January.

Talk to Wall Street veterans and they will tell you that this flat siding is the beginning of what will be an inexorable downward movement in these stocks.

It’s not so much about the poor foundations of companies. At least not in the short term. Fans of daily trading have shown an amazing ability to ignore these facts. What’s more, as the pandemic slowly ends and the economy begins to open up, many of them will leave their homes and start returning to offices, going out to restaurants, and embarking on trips near and far. And, as they do, they can stop obsessing over their Robinhood accounts.

In other words, their collective influence on the meme-stock universe will diminish.

“People will do other things,” said Matt Maley, chief market strategist at Miller Tabak + Co. There will be a “big calculation” at some point, he said. “I have no doubt in my mind.”

Of course, the Wall Street set, broadly speaking, has been misread by Reddit people for weeks before this quarter, and the analysis may be wrong again. However, preliminary data suggest that they are right.

Recent reports suggest vaccinated Americans are planning a long-awaited vacation with searches for “Google Flights ”is reaching a maximum popularity score of 100 this week, according to a Google Trends crawler. The opposite is seen for terms like “securities trading ”and“invest ”that has rushed, Google Trends shows.

“The impact of stimulus testing on retail is declining,” said Edward Moya, a senior market analyst at Oanda. “Many Americans want to attend sporting events, travel around the country, vacation, visit family and friends, and renovate closets before going out to restaurants, pubs, and back to the office.”

Read more: Americans Indicate They Will Spend Stimulus on Travel, Not GameStop

Gamestop Juggernaut

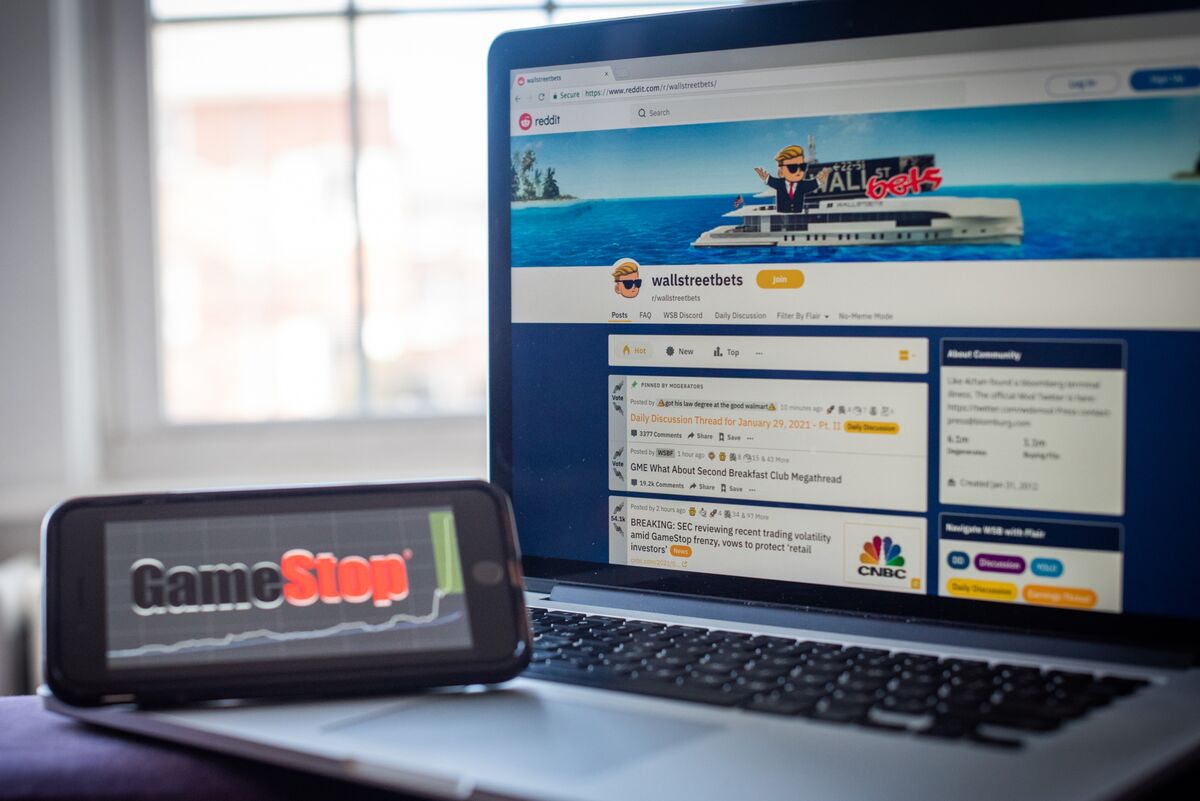

Video Game Distributor GameStop Corp. he became the son of the poster of retailers who wanted to rage against the elite of hedge funds. However, the actions 2,460% roller coasters alongside other favorites promoted on Reddit’s WallStreetBets thread caused both pain and joy.

The rise of more than 900% in shares this year has caught the attention of Wall Street analysts following it. The 12-month average price target means that shares will lose more than three-quarters of their value over current levels. Only Jefferies has a target price near the close of $ 191.45 on Thursday and that call came with the warning that stocks are “subject to volatility beyond fundamentals.”

But any sense of GameStop trading on fundamentals has been ignored since it captivated Wall Street and Reddit users in mid-January. The Bulls are more than happy to promote their bets on the forums as a measure of adhering to short sellers as they buy a renaissance of the company delivered by activist investor Ryan Cohen.

Read more: GameStop adds another Amazon executive to the team

Donat The position of AMC Entertainment Holdings Inc. as a cinema that many Americans attended at some point, it’s no complete surprise why Reddit users rushed to the company’s collaborator. #SaveAMC had a trend on Twitter and amateur investors seemed more than happy to fight Wall Street skeptics even though most movie theaters were closed due to the ongoing pandemic.

The chain’s latest rally came amid plans to continue reopening cinemas, but Wall Street is skeptical. None of the nine analysts tracking the company value their purchase and the average price target implies that the stock will lose 63% of its value next year.

Read more: AMC plans to reopen almost completely on Friday after Covid Hiatus

Retail euphoria seeped into a wider range of stocks from cult favorites like Bitcoin, Tesla Inc. and the ARK Innovation ETF to smaller companies such as the clothing retailer Express Inc. Chinese technology company The9 Limited is one of the best artists in the group this year with an 860% increase.

The company’s rally has been fueled by recent moves to drive the Bitcoin wave alongside peers like Future FinTech Group Inc. and Ault Global Holdings Inc.

Zomedica Corp., a small-cap healthcare company, has become a cult favorite among retail investors pursuing stocks with low stock prices. The Ann Arbor, Michigan-based company started the year with less than a quarter of the value, but had risen to $ 2.91.

The company’s trading volume has accelerated this year with an average of 174 million shares changing hands per session, more than four times the average over 2020. A mention of Carole Baskin of Tiger King helped. the to go viral in mid-January.