Dallas Federal Reserve Chairman Robert Kaplan would like the central bank to announce next month that it will begin tightening the reins of its policy.

Among his reasons is the general belief that the economy can withstand a little less Fed aid. But Kaplan also said he is concerned about inflation and excessive risk-taking that have caused “distortions” in financial markets, especially bonds.

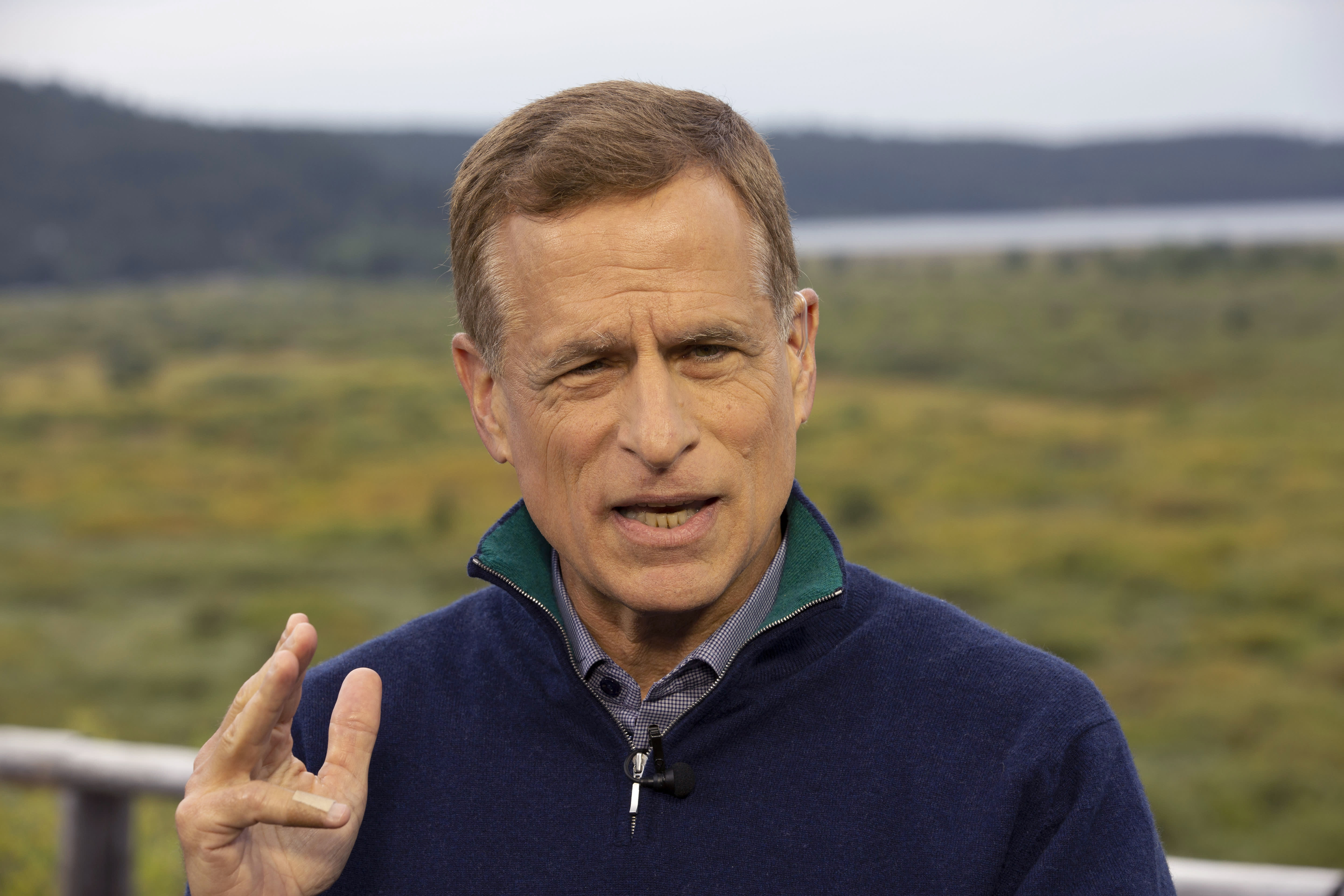

“Based on everything I’ve seen, I don’t see anything right now that makes me materially change my perspective,” Kaplan told CNBC’s Steve Liesman. “I would still feel that when we get to the September meeting, it would be good for us to announce a plan to adjust purchases and start running that plan in October or soon after.”

Kaplan spoke of the Fed’s “reduced” critical issue: when will it be appropriate to start withdrawing the $ 120 billion a month in bond purchases in which it has been involved since the early days of the Covid-19 pandemic. His remarks come a day before a very attentive speech by Fed Chairman Jerome Powell, who will speak as part of the Jackson Hole virtual symposium.

Earlier in the day, CNBC aired an interview with Kansas City Fed Chairman Esther George, who expressed similar sentiments to seeing the taper start soon. The Fed Chairman of St. Louis, James Bullard, was even more brazen in statements to CNBC.

They both said that while the rising Covid cases, and their delta variant, are worrying, they don’t seem to have a big impact on the economy in a broad sense.

“What we’re seeing is that businesses and consumers are learning to adapt and get on with their lives, and they’re realizing that this isn’t going to be clean and tidy or be a straight line,” Kaplan said. “It’s going to stop and start, and they adjust to that reality.”

However, he is concerned about the impact that the Fed’s ultra-light policy has on the economy.

Inflation has been around the highs of several decades in 2021 and Kaplan said rising gas and housing prices are affecting the lowest-income communities in his district.

“What we’re seeing in these communities is that inflation disproportionately affects them,” he said. “I think in the Fed we have to take it very seriously.”

Kaplan cited the effects that high house prices are having on rents.

He also said he is seeing high levels of risk-taking, particularly at the high-end end of fixed income markets.

For both reasons, he believes it’s time for the Fed to return its housing.

“I think we will be much healthier if we could soon wean off purchases and that will put us in a much better position in the future,” he said.

Become a smarter investor with CNBC Pro.

Get stock selections, analyst calls, exclusive interviews, and access to CNBC TV.

Sign up to start a free trial today.