The month Nathan Greninger received shares of GameStop Corp. free of charge from Robinhood Markets, the shares were trading at about $ 3.70 each.

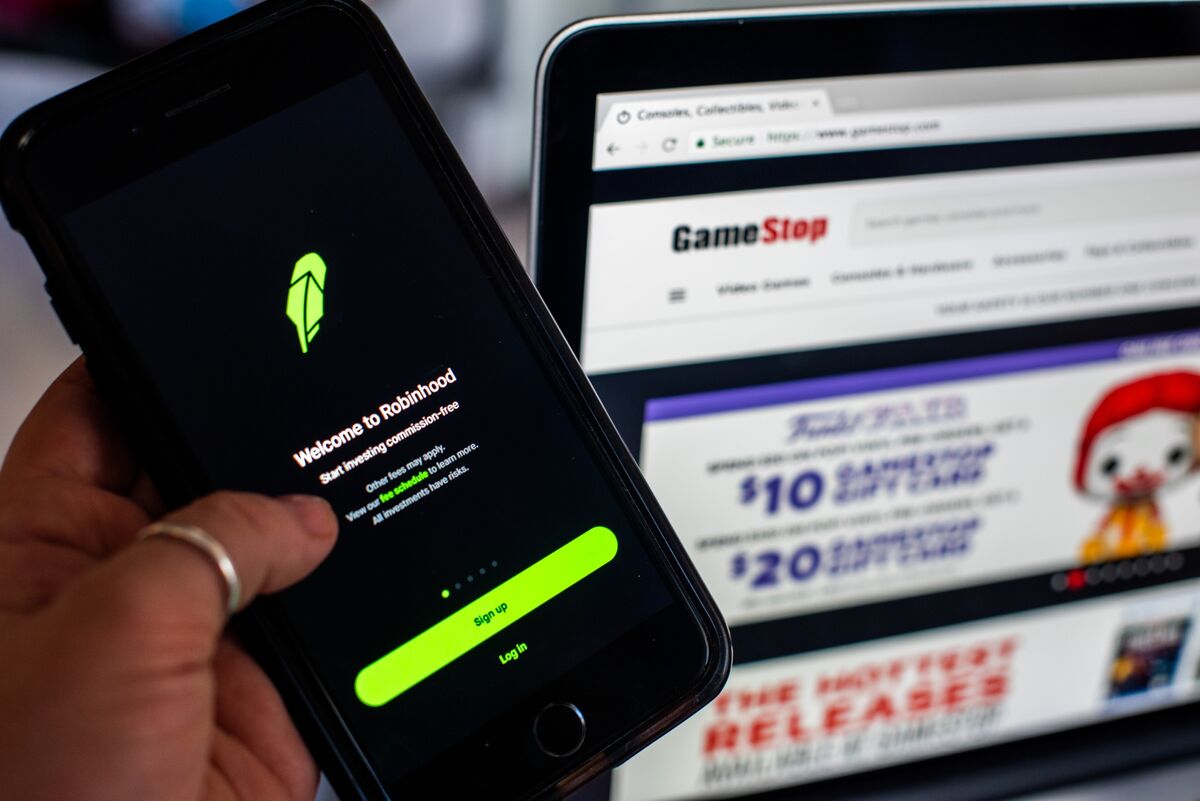

It was last March. Americans were just starting to fall home during the early days of the pandemic blockade, the stock market was closing, Reddit’s WallStreetBets forum was a darkness and GameStop was a much-forgotten mall retailer. Around this same time, Robinhood faced a wave of criticism for a series of interruptions as the market underwent extreme changes. (The company revealed in a stock presentation that is in talks to resolve interruptions investigations and their options trading practices.)

In short, it was a lifetime ago in cultural consciousness.

So 21-year-old Greninger didn’t think twice before selling it in June for $ 4.95. Little did he know then that GameStop would rise to stratospheric heights above $ 400 by the end of January. Although stocks have retreated from these high levels, they continue to trade at more than $ 100.

“I wish I had clung on now,” Greninger said. “I could have used the extra money.”

It’s a feeling that other marketers have echoed around social media, specifically those who have received GameStop, as the free action Robinhood offers customers as an incentive to sign up. Not all new customers receive GameStop, specifically. The company’s terms say that “free stock shares are randomly selected from our liquidated stock inventory”.

Customers can keep the shares or sell them after two days. While 98% of the endowed shares are valued at between $ 2.50 and $ 10, the value could reach $ 225, according to Robinhood. A company spokesman declined to comment.

For Greninger, who works in a retirement community in Tulsa, Oklahoma, the grief has caused even more pain. When the global craze about GameStop was at its peak last month, he said he couldn’t ignore it. He repurchased the shares when he was around $ 380, and lost $ 280 in that trade when he fell again.

“The hype and excitement behind it came to me, and I thought I would win quickly,” Greninger said. “I was investing money that I shouldn’t have. I tried to consider paying for my first investment lesson, but it’s hard not to just think about the money I lost. “

Read also: GameStop Heads Towards the best week of the month amid Reddit Frenzy

Things got better for 23-year-old Cleo Romain, who didn’t even realize she owned GameStop until recently. He received it for free after enrolling in Robinhood in March. Romain, who was already investing through Fidelity, created an account but did not end up using it. He almost forgot that there was something sitting on his account.

Romain didn’t think about signing up until last month, when the GameStop frenzy was in full swing. When she logged in, she was stunned to see that the shares she received when she was about $ 4 were now worth $ 373, a gain of more than 9,000%.

“I was a little bit up to date on the news of that time, even before I knew I had stocks, I was interested and when I started the session, it was like I really have that,” Romain said. . “I mean, I invested $ 0 in it.”

Naturally, Romain decided to share a screenshot of his good fortune on TikTok. His video received more than 500,000 views, with comments from stunned users asking for more tests and others saying they had also received GameStop action for free. Romain decided not to sell and still holds the shares.