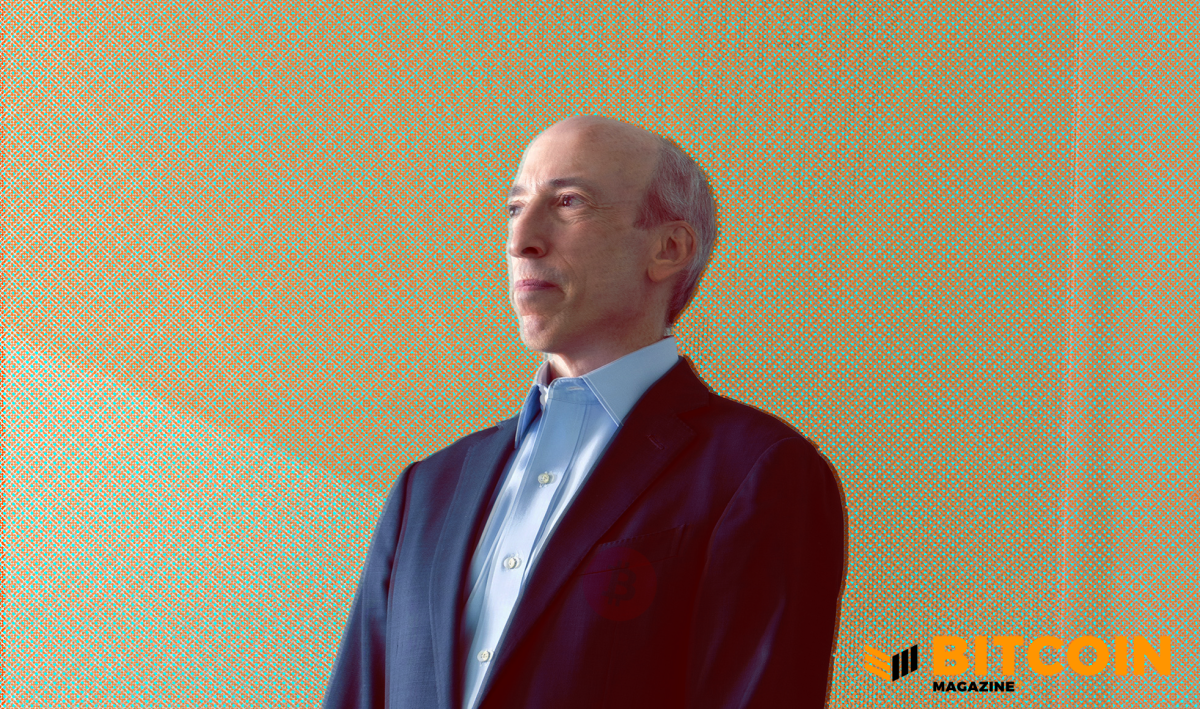

Today, the chairman of the U.S. Securities and Exchange Commission, Gary Gensler, made statements to the European Parliament that equated Bitcoin to the early Internet in terms of global paradigm shift technology.

Speaking virtually, Gensler told the European Parliament’s Committee on Economic and Monetary Affairs that Bitcoin is effectively bringing the European and American markets closer, The blog reported.

“I think the transformation we’re going through now could be as big as the Internet in the 1990s,” Gensler said.

The SEC president also highlighted the fact that Bitcoin has no borders and its markets do not close: “It works 24 hours a day, 7 days a week.”

Gensler’s speech to parliament was a remarkable attempt to connect U.S. Bitcoin and fiduciary regulatory interests to the world’s largest financial markets.

“Our global markets are inextricably linked, with money flowing between them in microseconds. New financial technologies continue to change the face of financing for investors and businesses. I know this committee is interested in this issue, “he said.

Speaking about the emergence of Bitcoin and cryptocurrency, Gensler commented: “This innovation has been and could continue to be a catalyst for change in the fields of finance and money.”

Many of Gensler’s remarks reflect statements he made earlier, including, “I would like to point out that financial innovations throughout history do not thrive long outside the frameworks of public policy.”

The interesting thing about this statement is that Bitcoin itself is agnostic to public policies. In the absence of slowing down the popular exit ramps and exit ramps, there is nothing the government can do to stop it, and Gensler knows this as he has taught courses at MIT on the subject.

In his speech, Gensler highlighted primarily the risk that unregulated cryptographic exchanges pose to the public, as well as the common use of stablecoins as a way to achieve public policy goals. None of these observations seemed directed at Bitcoin.

Referring to the proliferation of unregulated and non-intermediary cryptographic scam exchange sites, he commented: “this class of assets has been full of fraud, scams and abuse in certain applications”.

The president’s speech to the European Parliament comes just a month after he delivered a speech at the Aspen Security Forum in which he issued new comments that drew a dividing line between Bitcoin and its broad field of imitators.

Elsewhere, Gensler issued new comments that shed light on how the SEC can act on the numerous proposals for exchange-traded funds (ETFs) that can now be reviewed by the agency, indicating that those based on futures Bitcoin may have the highest probability of approval. led to the presentation of many Bitcoin Futures ETFs throughout August, including Galaxy Digital, VanEck and Invesco.