The shares of General Electric Co. fell on Wednesday, after the industrial conglomerate confirmed a $ 30 billion deal with AerCap Holdings NV, surprisingly proposing a reverse split of 1 by 8.

GE, which hosted a meeting of analysts in early Wednesday, also provided financial guidance for 2021, in which the adjusted profit range was somewhat bearish, but income and cash flow intervals free. they were in line with expectations.

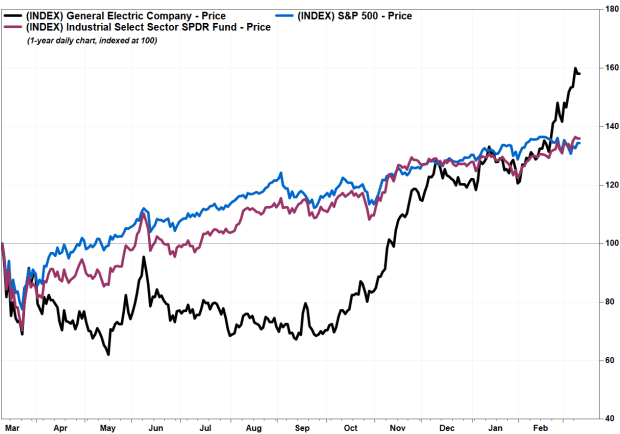

The GE action,

Swing fell 6.0% in morning operations, and was on track to fall one day from September 21, 2020, when it fell 7.7%. The decline comes after stocks rose 11.6% between March and Tuesday, including a three-year close of $ 14.17 on Monday, while the S&P 500 SPX index,

has gained 1.7% at the same time.

The reverse split may surprise investors because they are usually reserved for companies concerned that their share price may, or has fallen below, thresholds that may lead mutual fund investors to shy away from stocks or exchanges. issue termination notices. Read more about inverse fractions of values.

In GE’s case, the company said its board recommended splitting the reserve, which will be voted on by shareholders at its May annual meeting, given the company’s “significant transformation” in recent years.

“Reverse division of shares would decrease the number of outstanding shares to a number more typical of companies with comparable market capitalization,” GE said in a statement.

FactSet, MarketWatch

GE had a market cap of $ 122.75 million at the closing price of shares on Tuesday and had outstanding shares of $ 8.77 billion as of Jan. 31. In comparison, Lowes Companies Inc. LOW,

with a market capitalization of $ 121.33 billion, it has about 734 million shares outstanding, while Starbucks Corp. SBUX,

with a market capitalization of $ 125,444 million, it has 1,188 million shares outstanding.

The reverse division proposed by GE would effectively multiply the share price by eight, reducing the number of outstanding shares to about 1.1 billion. If shareholders approve the spin-off, the spin-off will take effect at GE’s discretion, at any time prior to the first anniversary of the May 4, 2021 annual meeting.

GE confirms AerCap agreement

GE on Wednesday confirmed an agreement to combine GE Capital Aviation Services ’(GECAS) aircraft rental business with AerCap, in an agreement that generates more than $ 30 billion in value for GE shareholders.

The Wall Street Journal had reported earlier this week that a deal was near.

Under the terms of the agreement, GE will receive $ 24 billion in cash and 111.5 million common shares, with a market value of about $ 6 billion and representing a 46% stake in the combined company. .

GE said it plans to use the benefits of the deal to further reduce debt, which would bring the total debt reduction from the end of 2018 to more than $ 70 billion.

The deal is part of a multi-year effort by GE to reduce risk to GE Capital, which is expected to have assets estimated at $ 21 billion after closing the deal, below $ 68 billion at the end of 2020. The agreement is expected to close in nine or twelve months. And once the agreement is closed, these remaining assets will become part of the consolidated industrial balance sheet.

“Today marks the transformation of GE into a more focused, simpler and stronger industrial company,” said Larry Culp, CEO.

“AerCap is the right partner for our exceptional GECAS team,” Culp said. “We are creating an industry-leading aviation lessor with experience, breadth and scope to better serve customers around the world, while GE gains both cash and significant stake in the strongest combined company, with revenue flexibility. as the aerospace industry recovers. ”

GE financial guidance

As part of the analysts ’day, GE provided details on its financial guidance for 2021.

The company expects year-round adjusted earnings per share from 15 cents to 25 cents, compared to the 25-cent FactSet consensus.

In terms of revenue, GE expects growth in the “low-digit” percentage range, while the current FactSet revenue consensus of $ 80.4 billion implies an increase of 1.0%.

Free cash flow is projected to be $ 2.5 billion to $ 4.5 billion this year, surrounding the $ 3.6 billion FactSet consensus.

GE said its guidance is based on the assumption that the aviation market will begin to recover in the second half of the year. GE is taking on the growth of the renewable energy market, an accelerated shift in the electricity business, and sees a healthcare market as “attractive,” with explorations toward pre-COVID levels.

“We are on a positive trajectory in 2021 as the momentum between our businesses increases and we transform into a more focused, simpler and stronger industrial company,” CEO Culp said. “We are excited to shift more towards offense, investing in innovative technologies to meet the needs of our customers and the world, to achieve more sustainable, reliable and affordable energy; more integrated and personalized healthcare; and a smarter flight. ligent and efficient “.

GE shares have now risen 16.2% over the past three months and rose 48.6% over the past 12 months. In comparison, the XLI fund traded by SPDR Industrial Select Sector,

has advanced 36.6% in the last year and the S&P 500 has risen 34.9%.