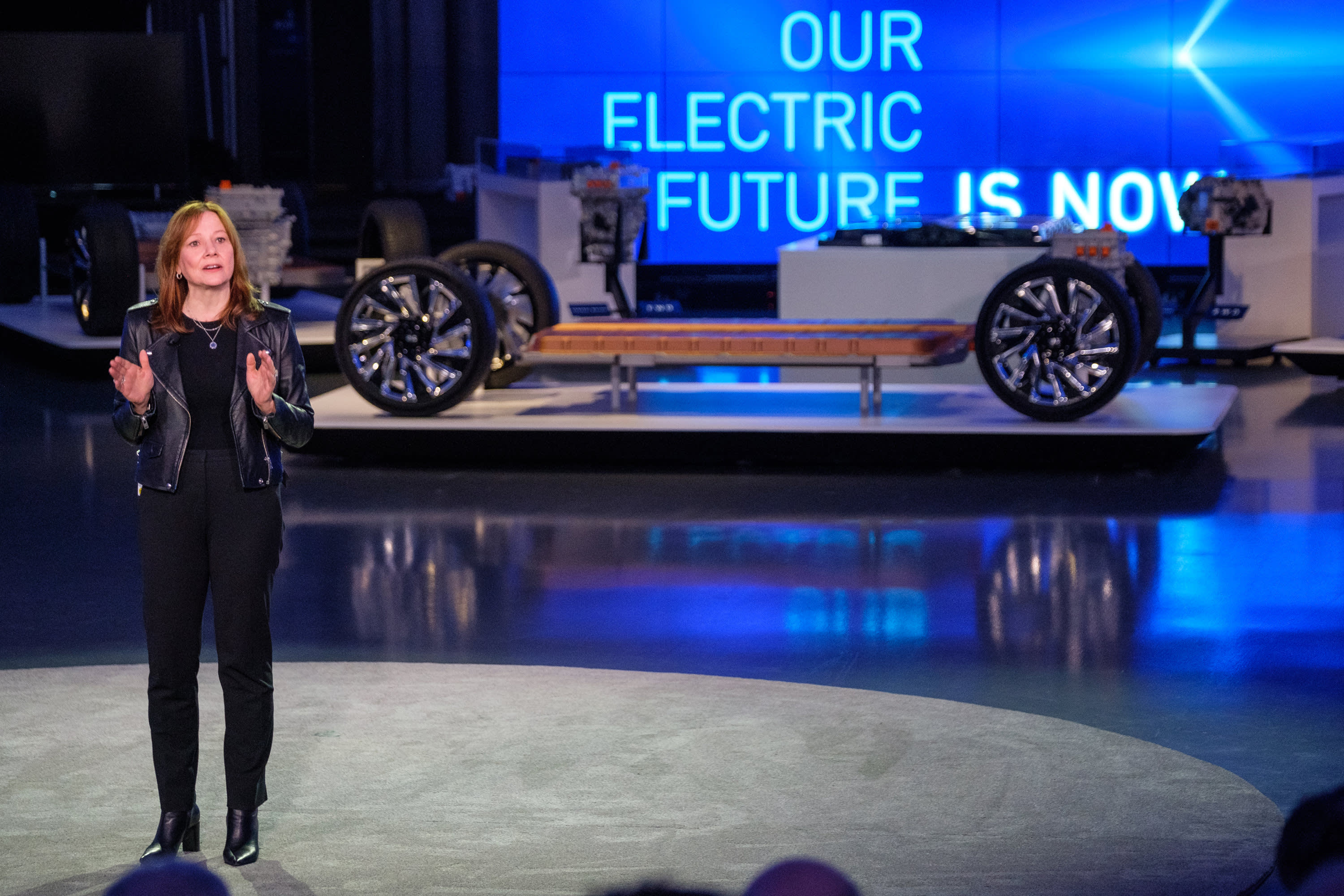

Mary Barra, president and president of GM, speaks during an “EV Day” on March 4, 2020 at the company’s technology and design campus in Warren, Michigan, a Detroit suburb

GM

General Motors will have to report its fourth-quarter earnings before the bell on Wednesday. This is what Wall Street expects, based on average analyst estimates compiled by Refinitiv.

- Adjusted EPS: $ 1.64

- Revenue: $ 36.12 billion

This would be in line with the unofficial orientation of the company. In November, John Stapleton, GM’s interim chief financial officer at the time, told Wall Street analysts that GM expected its pre-tax adjusted revenue to be around $ 8.5 billion and $ 9 billion for the second half of the year.

The automaker reported pre-tax adjusted earnings of $ 5.3 billion ($ 2.83 per share) during the third quarter, though it said the fourth quarter would be weaker due to seasonality .

GM reported a pre-tax adjusted profit of $ 105 million in the fourth quarter of 2019 due to a 40-day labor strike that affected vehicle production. Revenue was $ 30.8 billion during this quarter.

Wall Street is also looking for CEO Mary Barra and other executives for information on other issues, from the 2021 guidance and the possible reinstatement of dividends to updates on the company’s all-electric, autonomous vehicle plans.

Wall Street analysts will also want to know how the global shortage of semiconductor chips is expected to affect the automaker in 2021. GM’s rival, Ford Motor, last week said the shortage could reduce its profits in $ 1 billion to $ 2.5 billion this year.

Barclays analyst Brian Johnson, in a note to investors, said the firm expects GM to provide “a prudent outlook for 2021” due to the shortage of semiconductor chips.

GM shares have risen more than 30% so far this year, led by optimism about its all-electric vehicle plans and new technologies.

This story is unfolding. Please check for updates again.