A new month has started bullish, or so it seems, as stock futures rise after Friday’s 916,000 gain, better than expected, in March jobs, supporting the investor who expects a strong post-rebound -COVID-19.

As for the data, there’s a lot to like, according to Tim Duy, chief economist at U.S. SGH Macro Advisors.

“Assuming the pandemic is only controlled more this year, I suspect a substantial impediment limiting the pace of employment growth this year will be the rate at which companies can hire employees. Dismissing is easier than hiring and now employers are struggling to add workers, “Duy told customers in a note.

So watch those stories about “we can’t hire workers,” he says.

To ours call of the day of founder Thomasstr Lee, founder of Fundstrat Global Advisors, who says the rally he predicted recently shows no signs of relaxation. And there’s a reason for $ 4.5 trillion to believe the gains will hold in April, he told customers.

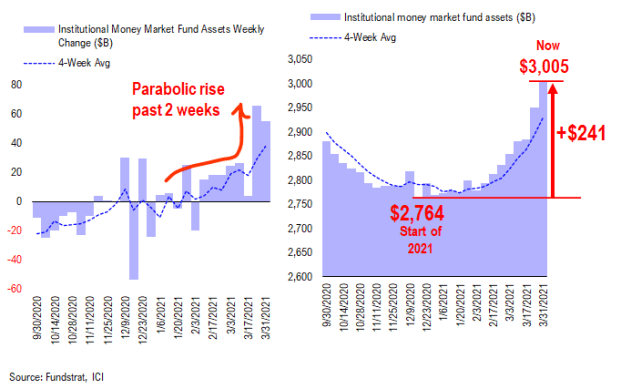

Aside from the positive aspects that already exist for this market (a strong economy and vaccine deployment), Lee points to a stack of institutional money on the sidelines, with dollar cash balances, the highest since June 2020. This is up against $ 2.764 trillion in early 2021, a “dramatic” gain of 9% or $ 241 billion, Lee said.

A cautious attitude on the part of institutions that were “parabolic” in the last fortnight of March adds to the $ 1.5 trillion cash in the retail money market.

“Total cash on the margin is $ 4.5 trillion = tons and tons of firepower on the margin. That predicts April equity gains,” Lee said.

Lee expects small-cap, energy and cyclical capitalization stocks, geared toward economic recovery, to continue to lead the second quarter.

“Remember that cycles are only 33% of the S&P 500 SPX,

global weight and more than 60% of the Russell 2000 RUT index,

So if Cyclicals, aka Epicenter, works, small-cap stocks will outperform, ”he said.

Look at this graph

Adam Kobeissi, founder and editor-in-chief of The Kobeissi Letter, expects the jobs bullish report to send the S&P 500 to 4,035 to 4,050 in the short term, but from there he would like to see it fall back to 3,950 to 4,000 , to set another higher minimum before moving to 4,100.

Kobeissi’s letter

“So we will stay on the sidelines to start this week, as stepping on such a strong market is not a stance we want to take and we will maintain a bullish outlook in the medium term with the intention of returning to our bullish positions following a fall of the market, ”Kobeissi told subscribers.

In the open, the Dow Jones Industrial Average YM00,

futures increase 200 points and the S&P 500 ES00,

and futures NQ00 of Nasdaq-100,

they increased by 0.5% and 0.4%, respectively. European markets are closed for an extended Easter holiday, and most of Asia also closed. The performance of the TMUBMUSD10Y at 10 years,

the note remained stable at 1.72%. The following data includes the March Institute of Supply Management Services index and February factory orders.

CL00 oil prices,

they fall after last week’s decision by the Organization of the Petroleum Exporting Countries and its allies to increase production, and after Saudi Arabia has raised prices for Asian customers.

Shares of electric car manufacturer Tesla TSLA,

they have increased by 6% in the premarket. Tesla said Friday that first-quarter deliveries were 185,000 cars, beating Wall Street forecasts. Wedbush upgraded Tesla to exceed its neutral level and set a new target price of $ 1,000, up from the previous $ 950.

GameStop GME,

shares have fallen 10% after the gaming retailer and one of the popular memes of the year sold up to 3.5 million in common shares.

The South Korean electronics giant LG 066570,

comes out of the smartphone market.

Delta Air Lines DAL,

had to cancel 100 flights on Sunday due to staff shortages and will open medium seats earlier than expected.

The UK government plans to offer all countries in the country two free virus tests a week. Shares in India IN: 1 fell 2% when daily cases of COVID-19 reached 100,000, the second country to see this level of cases after the US

A bitcoin revolution is underway and MarketWatch is gathering a cast of cryptography experts to explain what it all means. Sign up! Bitcoin BTCUSD,

in this regard, it remains stable at $ 57,422

Random readings

Redditors unleash the trends we hate

Soviet-era television version of “The Lord of the Rings”, rediscovered after 30 years: “The Lord of the Rings”.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers