“

“It reminded us a lot of 1998 – late 90’s”

”

This is Chris Harvey, head of equity strategy at Wells Fargo Securities WFC,

talking to CNBC about how Tesla’s TSLA,

recent inclusion in the S&P 500 SPX,

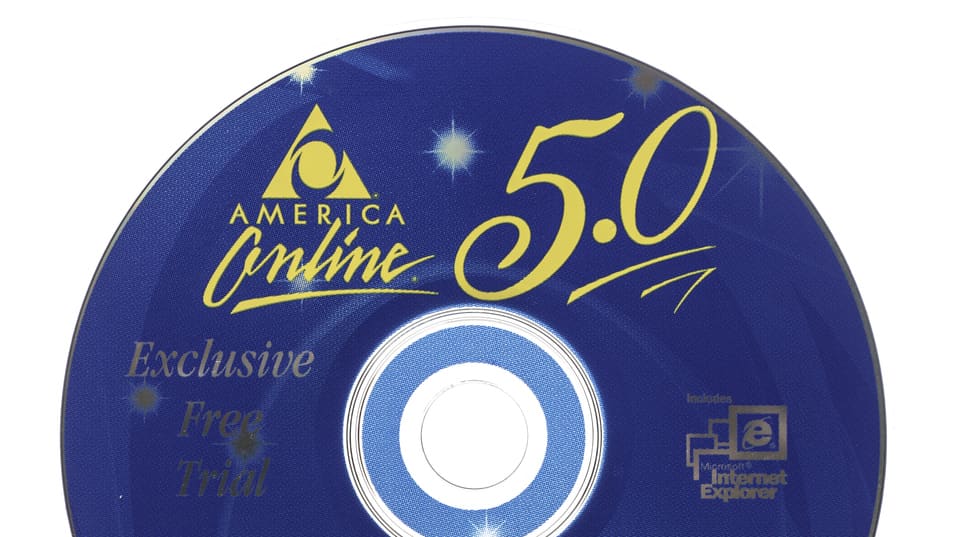

remembers the last days of the dot bubble like. Specifically, Harvey, highlighting Well Fargo’s top 10 predictions for 2021, made a comparison between Elon Musk’s electric car company and AOL, a poster of the Internet frenzy decades ago.

“AOL, similar to Tesla, had game-changing technology, incredible performance … it hit the index at the end of the year in December after an incredible race,” Harvey said. “But it was a pivotal event.”

After its relentless concentration in the late 1990s, AOL, like many causalities of the dot-com bubble, was unable to keep up with the times, posing a risk that Tesla, which has risen almost 700% this year, will also face next year, he explained. “After 99, many technology and growth companies lost 50% to 100% [of value]”We are thinking about 2020, everything is going much faster. So if it took 12 months to start the end, now it will take six months.”

For Harvey, the most attractive places for investors include cyclical names “COVID-beta”. “Old economy, not new economy,” he predicted. Here is the full CNBC summary:

To learn more about Harvey’s thoughts on Tesla and 2021, check out the interview:

Shares of Tesla were down ahead of Monday’s opening bell, while futures on the Dow Jones Industrial Average YM00,

Nasdaq Composite NQ00 of great technological weight,

and S&P 500 ES00,

all signaled a positive start to the week.