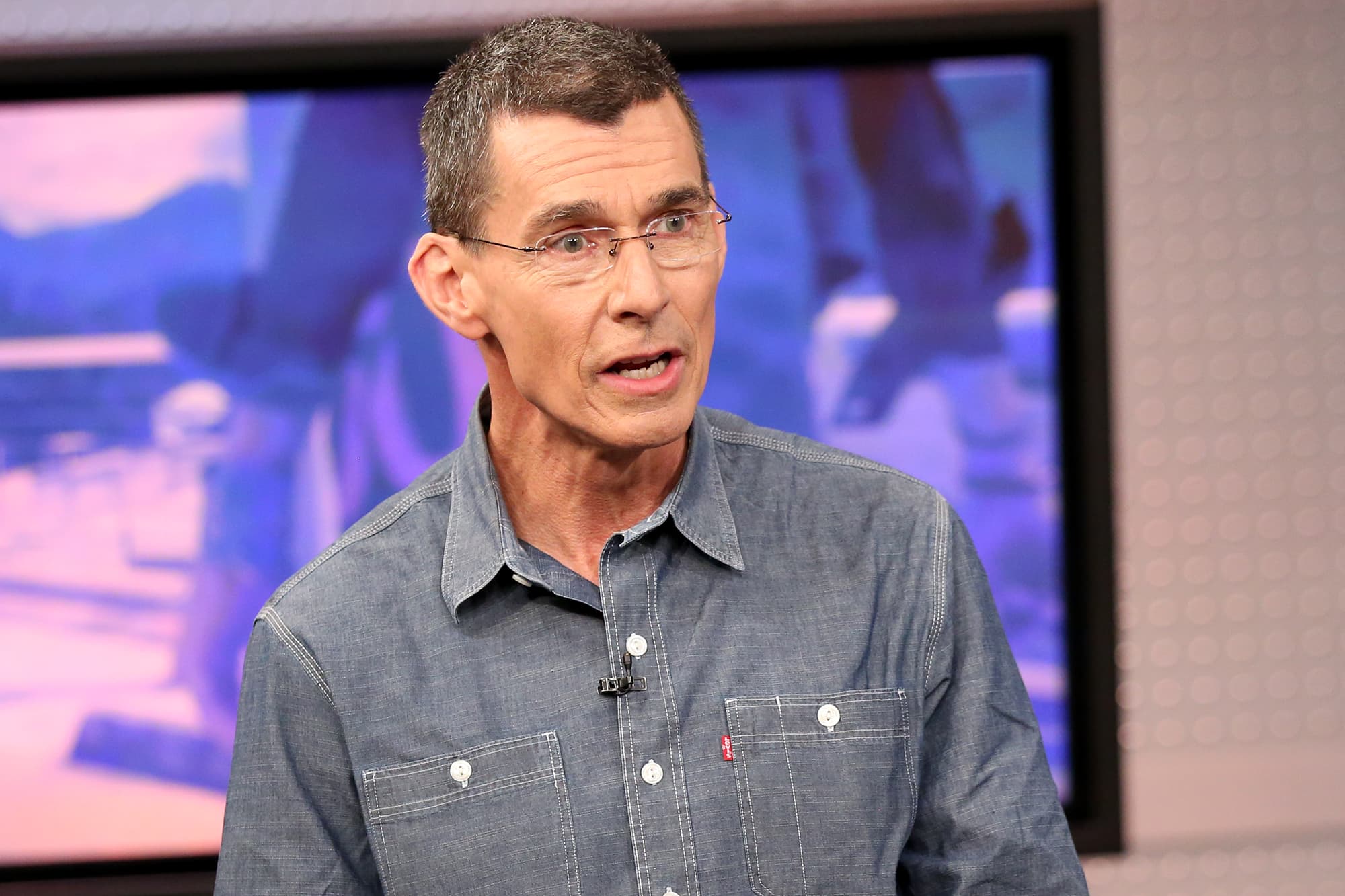

Levi Strauss CEO Chip Bergh said Thursday that the jeans maker buys more space as commercial rental plazas run out.

The San Francisco-based company wants to add to its 40 stores and 200 outlets in the U.S. to increase its direct operations to customers, the executive said.

“This represents a great opportunity, especially with the commercial real estate tsunami that is happening right now,” Bergh told CNBC’s Jim Cramer in an interview with “Mad Money.” Vacancy rates in regional malls rose to a record 11.4% in the first quarter, from 10.5% in the fourth quarter, according to data from Moody’s Analytics.

“It gives us the opportunity to secure large locations with large leases and we are capitalizing on that,” he said.

Direct consumer sales accounted for about 40 percent of Levi’s total revenue last year, the company said in February. For this year, Levi wants these sales to account for 60% of total revenue.

Part of its new store launch is what the company calls NextGen Stores. They’re designed to be smaller, just 2,500 square feet, and equipped with machine learning to help inventory, Bergh said.

“These really represent important opportunities and we have stated that we will be led by DTC,” he said. “It’s really critical for us, the gross margin goes up and we succeed in that.”

Levi’s direct consumer strategy includes its main stores and outlets, online operations and department stores with which it collaborates. Sales in the category fell 26% last quarter, losses that blamed less foot traffic on their stores.