Massachusetts regulators filed a lawsuit against Robinhood Wednesday, accusing the popular commercial app of not acting in the best interests of its users.

The complaint cites Robinhood’s “aggressive tactics for attracting inexperienced investors, its use of gamification strategies to manipulate customers, and its failure to avoid interruptions and frequent disruptions to its trading platform.”

The complaint is the first application of the Massachusetts Trust Rule, which Commonwealth Secretary William Galvin began enforcing in September.

“Robinhood, which derives revenue from transactions executed by its clients, gave clients with no investment experience the ability to make a potentially unlimited number of transactions, without properly examining them to approve them for options trading.” , issued a statement along with the complaint reads. According to the regulator, 68% of Massachusetts-based Robinhood customers were approved for options trading after reporting limited or no investment experience.

“Treating it like a game and attracting young, inexperienced customers to do more and more business is not only unethical, but it’s also well below the standards we demand in Massachusetts,” Galvin said in a statement.

“We have not seen the complaint, but we are working closely and cooperating with all of our regulators,” a Robinhood spokesman said in a statement to CNBC. “Robinhood has opened up financial markets to a new generation of people who were previously excluded. We are committed to operating with integrity, transparency and complying with all applicable laws and regulations.“

The Massachusetts complaint, first reported by the Wall Street Journal, follows an investigation by the Securities and Exchange Commission in September.

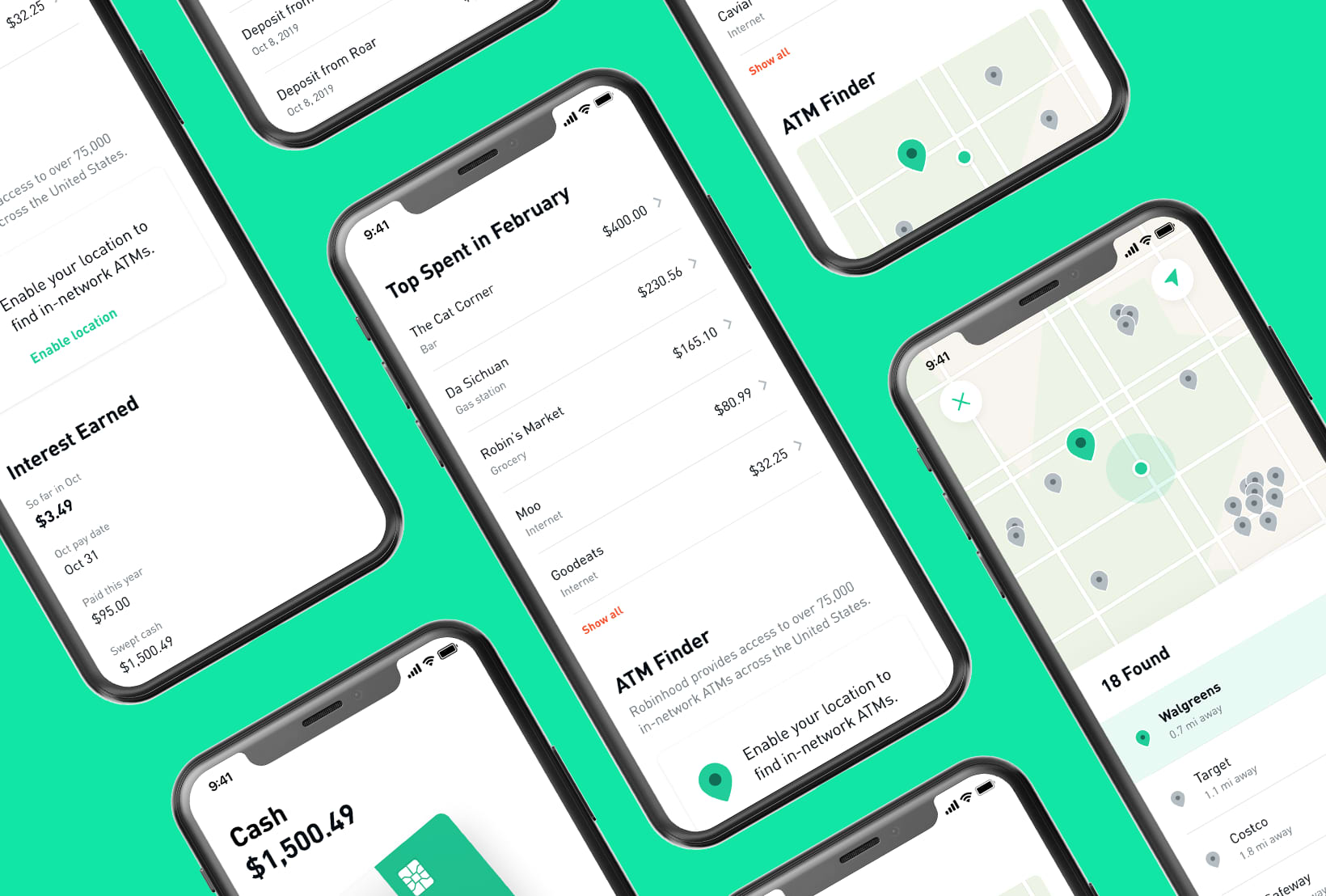

Robinhood has been a pioneer in the commission-free trading model since its founding in 2013 and has seen its user base explode amid the Covid pandemic. During the first four months of the year, the company said it recorded a record 3 million new customers as the shares entered a bear market. The app has caught a lot of attention on Wall Street and since then the stock changes of popular names like Tesla have been attributed to these new market investors.

Robinhood said it recorded 4.3 million daily average revenue transactions in June, surpassing all listed stockbrokers. Robinhood said its DARTs doubled more than in the second quarter of the previous three months.

This year’s success has also caused growing pains. Robinhood has experienced several outages, including a multi-day outage in March, leaving some customers unable to negotiate for a historic day through the markets.

In August, the company announced a $ 200 million G-Series funding round, raising its valuation to $ 11.2 billion. Robinhood, which is expected to be made public in 2021, has hired Goldman Sachs to direct its IPO preparations, according to Reuters, citing sources.

– CNBC’s Kate Rooney contributed to the reports.

Subscribe to CNBC PRO for exclusive information and analysis and live scheduling of weekdays from around the world.