It’s been a pretty impressive 12 months for the world’s top miners.

The FTSE 350 mining index 156995,

– which includes diversified mining giants Rio Tinto RIO,

BHP Group BHP,

Anglo American AAL,

and Glencore GLEN,

– has returned 46% to shareholders over the past year, according to FactSet, compared to the 7% drop in the broader FTSE 350.

The sector benefits from an increase in the value of the metals they discover. Copper HG00 of the first month,

futures have jumped 62% in the last twelve months, SI00 silver,

has gained 51% and platinum PL00,

has added 32%.

And there are two big trends that should further boost the sector.

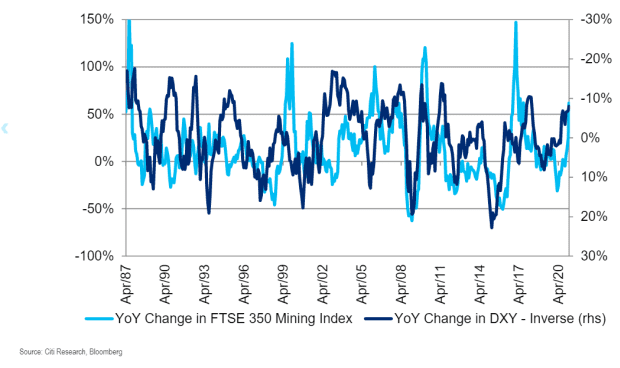

The first is the decline of the DXY dollar,

A weak dollar environment increases the purchasing power of major commodity-consuming markets, especially China, says Ephrem Ravi, a Citigroup analyst. A lower dollar also helps to loosen global monetary conditions, as much of the world’s corporate debt is denominated in the green dollar.

As the graph shows, there is usually a strong correlation between mining sector stocks and the dollar exchange rate.

Another boost comes from the rise of copper versus gold. The copper-gold ratio has been declining over the past year, implying optimism about global growth, says Citi’s Ravi. Copper is needed for manufacturing and construction, while gold is often used as a safe haven in bonds of financial coercion.

Jeffrey Gundlach, chief executive of DoubleLine Capital and the so-called king of bonds, has said the copper and gold ratio closely tracks U.S. government bond yields, which tend to increase as the bond improves. economy.

According to Ned Davis Research, which cites data dating back to 1995, the European metal and mining industry has outperformed the market with an average annual gain of 9.7% when the economic outlook improves, but with a lower yield at 7.4% annually when the economic outlook deteriorates.

Mark Phillips, a European equity analyst at Ned Davis Research, says it makes sense for miners to suffer booms and bursts. “A boom will begin when an increase in demand for commodities raises prices, while short-term supply remains relatively fixed. As high prices persist, this encourages companies to invest in new projects that were previously uneconomical, ”says Phillips.

“However, long delivery times often mean that many companies invest in new projects at the same time, which causes cost pressures and a lack of supply, which can come at a time when demand is starting to decline. This translates into a fall in prices and mining and metal companies raise the cost curve to stop working, ”he adds.

Supercycle talk

Behind the gains there is also talk of some of the commodity supercycles. This basically means a cycle that lasts for decades and moves commodities as a whole. “The commitment of many nations to be carbon neutral and less energy-efficient by 2050-2060 requires significant investment in infrastructure that will require commodities. Structural models of commodity prices have shown that at every important stage of economic development : agricultural, industrial and service, the use of raw materials may change, increasing the likelihood of a supercycle in the early stages of development “, says Daniel Jerrett, investment director of Stategy Capital, which started a fund global macro last month.

In the market there is talk of inflation, driven by lax monetary policy and aggressive fiscal spending. Analysts at Variant Perception, a research firm, have said that rising inflation risks, the need to cover them and “generationally economical” prices will lead to a commodity supercycle. Among the major banks, JPMorgan has also supported the commodity supercycle vision.

At the moment it is a solitary bet against the miners. According to daily updates from the Financial Conduct Authority, there is no short position against large miners large enough to be reported.

But there are a few with dissenting opinions. Ben Davis, an analyst at Liberum Capital, has a sales rating on Rio Tinto and a stake in BHP. He acknowledges, the weakness of the dollar may help continue the concentration, “but it feels great in price.” And Davis doesn’t believe commodities are in a supercycle.

But Davis predicts a slowdown in Chinese credit, which will soon have an impact. Loan growth has gradually slowed, from 13.2% year-on-year in June to 12.7% in January.

“The reduction in Chinese credit will begin to be felt in demand for commodities, and while replenishment in the rest of the world is a very powerful force, it is unlikely to last beyond the middle of the year. The first and most The main beneficiary of this cycle has been iron ore and, for this reason, BHP and Rio Tinto have the most short-term disadvantage in our opinion, ”he says.