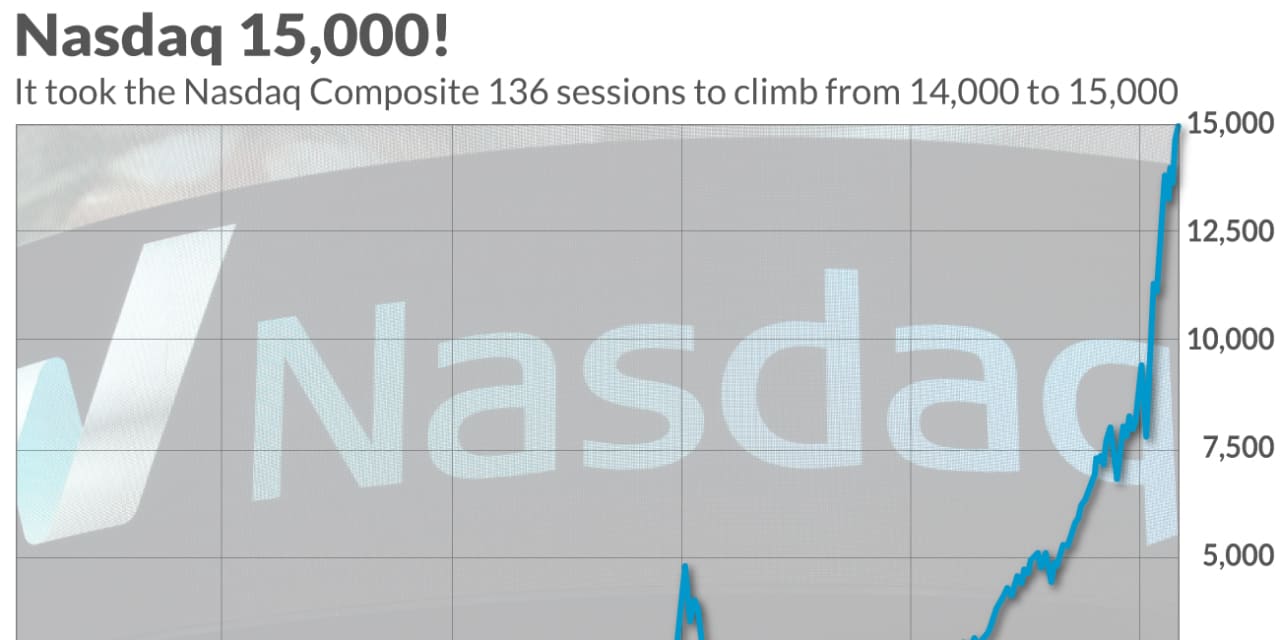

They are 15,000 and count for the Nasdaq Composite Index.

The popular index that was launched in 1971 has been considered a decisive factor for the information technology sector, the future of the American economy, and this Tuesday is becoming a remarkable milestone that goes get the Dow Jones Industrial Average DJIA,

more than half a century more to achieve: 15,000.

The Nasdaq Composite COMP,

it took 136 days from its last milestone at 14,000 to closing at 15,019.80, marking the longest stretch before reaching a milestone of 335 sessions from 8,000 to 9,000 in 2018-19, according to Dow Jones Market Data.

Dow Jones Market Data

It is true that, despite the complicated move of the Nasdaq Composite to 15,000, anyone with a passive familiarity with arithmetic would notice that these successes become less impressive as markets move forward. The move from 8,000 to 9,000 meant a 12.5% increase for the Nasdaq Composite, compared to the 7.1% increase to 15,000, this time.

But is it still worth taking off a 15,000 hat and a banner and blowing up the bubble?

Art Hogan, chief market strategist at National Securities Corp. in New York, he told Tuesday in MarketWatch that there is something to say about the psychological impact that the achievement of a round number has on the psyche of American market movements of average observation and sentiment for investors.

“Round numbers are always important because they bring the history of the market to people who don’t see it every day,” said Hogan, who noted that news of stock index successes is most eagerly announced on these occasions.

“It may be one of the only stories Aunt Joan will read tomorrow,” the National Securities Corp. strategist explained.

That said, this milestone, also the 29th highest Nasdaq Composite closing record in 2021, includes the added record advantage for the broader market index. The S&P 500 SPX Index,

marks its 50th all-time high at 4,486.23.

What Tuesday’s trade tells us “is that it reaffirms that while there are many concerns … about the missing stimulus, about the delta variant … companies are growing their revenue and their revenue.” Hogan pointed out.

It is a great opportunity to remind the bones and people who do not keep track of the markets to make a living that the market is progressing very well.

Technology stocks, in particular, have been affected in recent weeks and months, as concerns about the delta variant and rising Treasury yields have led to a steady and uneven rotation of investments that were expected to work. well during the pandemic, to actions that could do better as the economy. reopens.

Financial conditions, so far, have been favorable to the increase in asset values, with the forecast that the Federal Reserve will move slowly when it comes to reducing the adjustments to its monetary policy and the expected interest rates that they will remain between 0% and 0.25% at least until the end of 2022.

The delta variant of the coronavirus, however, has raised some questions about the fluidity of the U.S. economy in the transition to any resemblance to normalcy.

It’s not an apple-to-apple comparison, but the Nasdaq Composite took 50 years to reach 15,000, while the Dow took 117 years to reach 15,000 in 2013.

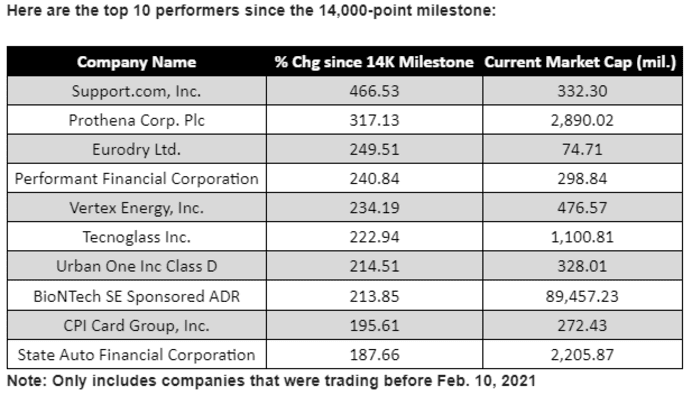

Among the best results of the Nasdaq Composite in its rise to 15,000 is Support.com Inc. SPRT,

466%, Prothena Corp. PLC PRTA,

, increasing by approximately 317%, and Eurodry Ltd. EDRY,

advancing 250%. US-listed shares of BioNTech also top the list, up 214%.

Dow Jones Market Data