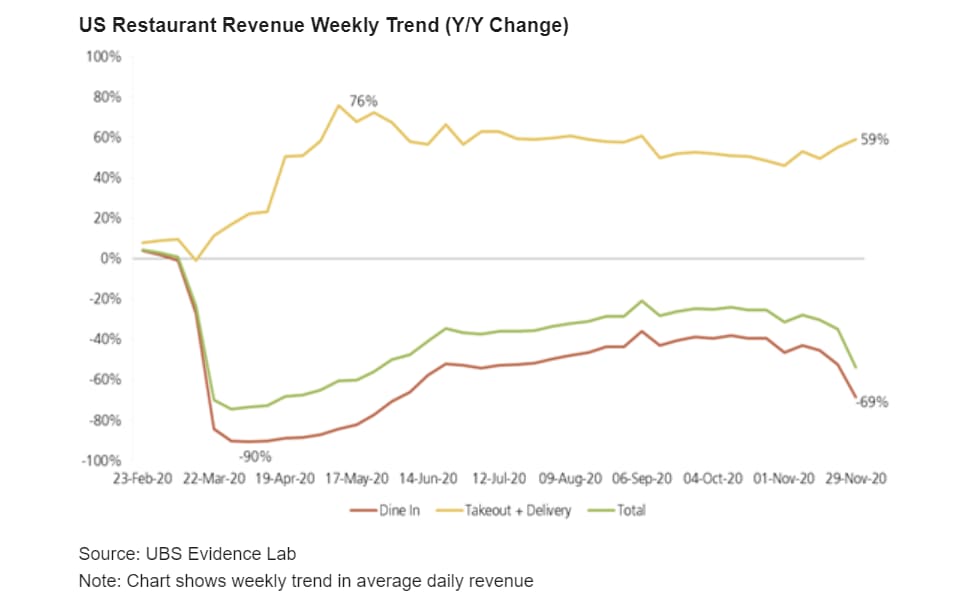

The graph shows weekly U.S. restaurants

Source: UBS Evidence Lab

U.S. restaurant revenue is declining, as delivery and delivery orders do not offset the loss of dinner sales.

UBS Evidence Lab found that food restaurant sales fell 69% in the week ended Nov. 29. In the same week, food and takeaway sales increased by 59%. But total restaurant revenues remained in the red.

Industry experts predicted that winter would further aggravate restaurant problems during the coronavirus pandemic. Cold temperatures mean fewer guests are willing to eat outside, even if the property has heat lamps and blankets.

The winter weather has also led to an increase in new cases of Covid-19, making consumers more cautious when eating out and governors and mayors imposing another round of restrictions on restaurants. New York City has once again banned indoor food, while Los Angeles has stopped all face-to-face meals.

The pandemic has no doubt accelerated the shift toward food delivery, with eMarketer predicting that third-party digital sales overall will double this year to $ 44.94 million.

Investors have been closely following the growth of third-party delivery companies. Shares of DoorDash, which debuted publicly in early December, are up 55%. Its market value of $ 50.3 billion exceeds that of Chipotle Mexican Grill, the owner of Taco Bell, Yum Brands and Domino’s Pizza.

However, pending delivery and sales will not be enough to save some restaurants if these revenue trends continue. The National Restaurant Association estimates that 110,000 establishments have already closed due to the pandemic. Covid’s new congressional assistance bill passed by Congress Monday afternoon means restaurants will be able to apply for funding from the Payment Check Protection Program, but business groups expect more specific relief when President-elect Joe Biden assume office.