It is a level of high risk, high risk and reward investment. And he put Wood fans on a journey with the white knuckles in 2021.

But this year has not been as kind to Wood as the previous one. The Innovation ETF fell 2.5% by the end of August, although there was a hot technology market with the Nasdaq more than 18% so far in 2021.

“I don’t think we’re in a bubble, which is what I think a lot of bears think we are,” Wood told CNBC. “Right now we have nothing like it. In fact, you see a lot of OPIs or SPACs coming out and falling to Earth. We couldn’t be further from a bubble.”

How Wood developed his strategy

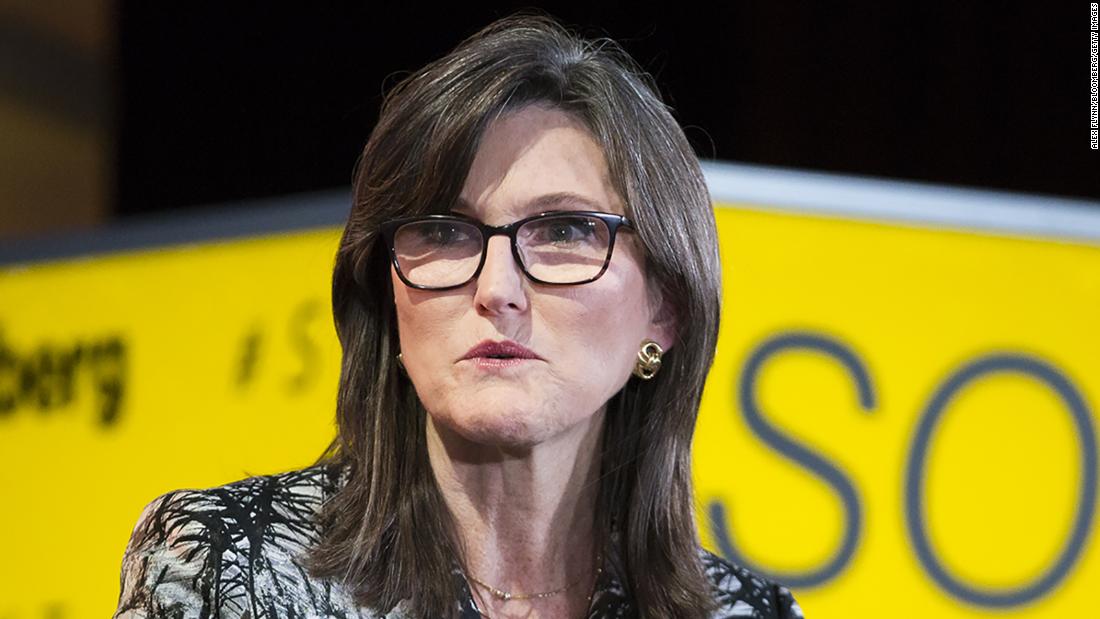

Wood speaks from experience. She’s not a millennial or Generation Z investor for whom the technology implosion of 2000 is just a war story told by folder traders. Wood, 65, experienced the last major technology crash, as well as the infamous 1987 Black Monday.

He worked for 18 years at Prudential-owned money manager Jennison Associates during the 1980s and 1990s, and then spent a dozen years at AllianceBernstein before leaving in 2013.

But then AllianceBernstein conveyed its idea of launching a set of actively managed exchange-traded funds. So she attacked on her own and started Ark in 2014.

This focus on disruption means Wood links the fortunes of his ETF with visionary but mercurial leaders.

Wood is also fine with companies like Tesla issuing more shares to raise money to fund futuristic projects like autonomous vehicles. Some investors distrust this strategy because the new shares reduce the value of existing investor holdings, but he believes it is a short argument, particularly from Tesla bones.

“We’re not afraid of dilution … if we think they do it for the right reason,” he told CNBC. “We wanted them to scale as fast as possible because we believe that if we’re right in autonomy … Tesla could get most of that market, certainly in the United States.”

“With each passing day, especially as we learn more about their experience in AI and how they actually drive the space … we think they have the pole position,” he said, noting that Ark analysts were “impressed” by Musk’s presentation.

Growth at all costs

Wood recognizes that his way of investing at all costs is not for everyone.

Wood added that he believes investors should also put a small percentage of their money in bitcoin, another risky bet. And he stressed that investors should overlook the inevitable short-term outbursts that any asset entails. Wood is essential to maintaining long-term convictions and investing for future growth.

“Many companies cater to short – term investors who wanted profits now [have] “He invested more in stock rewards and dividends on innovation,” he said. “That puts them in danger.”

A fellow professional describes Wood’s approach at home as a model for the new way of investing. There are too many fund managers who are afraid to look too far into the future when judging a company’s merits, rather than focusing myopic on previous and subsequent quarterly earnings reports.

Wood reviews

But a growing heart of skeptics believes Wood’s funds could end up collapsing. Michael Burry, one of the super bass investors who became famous in “The Great Short Film,” recently set a short position in the Ark Innovation ETF, basically betting that it will fall sharply.

Some tech stock veterans also wonder if Wood is just an investor flavor of the month, comparing it to popular portfolio managers like Kevin Landis of Firsthand Funds, Alberto Vilar of Amerindo and Garrett Van Wagoner, who ran a popular fund of emerging growth in the late 1990s.

Is wood destined for a similar ignominy?

“Our investment approach is similar to Ark, as we focus on technology. But we are different in avoiding concentration,” Jeremie Capron, head of research at ROBO Global, told CNN Business in March.

For now, Wood gets the last laugh.

Yes, its fund returns may be volatile year-on-year (the Ark Innovation ETF fell close to 25% in 2018 before recovering 30% in 2019), but it has tended to soften. The average five-year annualized return on the Ark Innovation ETF through mid-2021 was 48.6%, compared to 17.7% for the S&P 500.

As long as this trend continues in the long run, Ark’s acolytes may forgive a year down as Wood continues to sway through the fences.