We are almost two days into what has historically been a disaster for stock investors. Given the list of concerns that pile up, and include Friday’s job data and the shadow of last September’s nasty 10% slide, “the market is likely to be forced to take bites,” of any way, as Mark DeCambre of MarketWatch points out.

However, there are investors who can blame them, as there are not many alternatives. In a new letter, former bond king Bill Gross said Treasuries has joined the “waste” stack of cash, with the performance of the ten-year TMUBMUSD10Y note,

destined to climb. And he warned that stocks could join this club, preventing the growth of “double-digit gains”.

Towards our fear call of the day of JPMorgan strategies that say that until retail investors stop charging in stocks, markets probably shouldn’t worry too much.

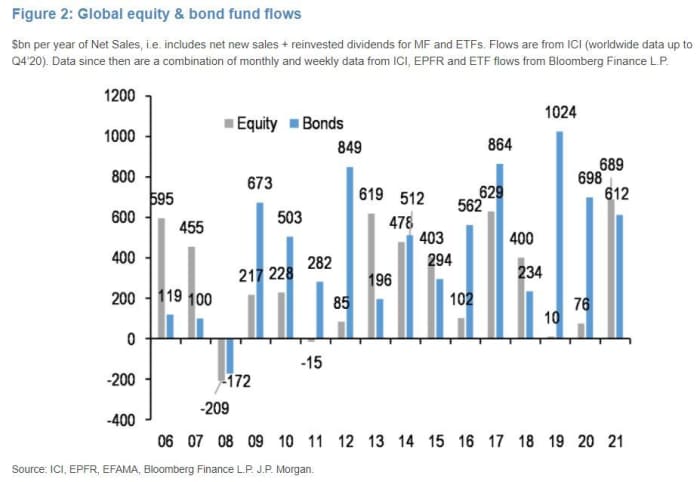

“What could cause a correction in the equity market? It is true that this question is difficult to answer. So far this year, retail investors have been buying stocks and equity funds at such a steady and strong pace that it makes equity correction seem quite unlikely, ”wrote Nikolaos Panigirtzoglou and a team of strategists in a note last Wednesday.

Strategists point to equity fund flows of about $ 700 million annually, or more than $ 1 trillion annually, well above the previous record high of 2017 of $ 629 million. These flows have not only increased stocks, but have forced other investors into stocks, explains Panigirtzoglou and the team. And we’re not talking about any retail investors. Hello, Robinhood HOOD,

merchants.

Read: The meme-stock moment turns 1 year, unofficially, and welcomes a class of second-year tickers

“Because certain retail investors, probably the youngest cohorts, aggressively buy stocks and equity funds, they are strongly pushing the equity market, making“ other ”retail investors, i.e., the older cohorts , they want more overweight actions unintentionally, ”he said. And the latter group has been buying bond funds to try to rebalance, which has brought those flows closer to a previous record high seen in 2019, the bank said.

But Panigirtzoglou and the team are closely monitoring a particular chart: “the most holistic of our equity position indicators, the implicit allocation of equity from non-bank investors globally. It indicates an implicit equity allocation of 46% today, which is just below the post-Lehman crisis of 47.6% in 2018.

“It remains to be seen whether the Fed’s upcoming policy change will change the attitude of retail investors toward equities. Monitoring this retail flow on a daily and weekly basis in the future is key to the equity market outlook we have in the mind, ”the strategists said.

Unemployment claims and deadly flooding in New York City

The remnants of Hurricane Ida flooded streets and the subway and disrupted travel to New York, placing it in a state of emergency and killing eight people so far, while parts of New Jersey were hit by tornadoes. This is how a Pennsylvania dam has problems and Louisiana suffers.

With one day to go before the end of non-farm payrolls, the data showed that weekly unemployment claims fell to a pre-pandemic low of 340,000 even amid rising delta variant. Second-quarter productivity data was revised downward and the U.S. trade deficit narrowed, with factory orders for July still ahead.

Modern MRNA,

has asked the Food and Drug Administration to evaluate its reinforcement candidate COVID-19, which the pharmaceutical company says “shows robust antibody responses against the delta variant.” This is how a new study shows that double vaccines almost halve the risk of long-term COVID.

Citing concerns about the attendance of moviegoers amid the ongoing pandemic, ViacomCBS VIAC,

Paramount ownership has pushed back the release dates of “Top Gun: Maverick” from this November to the following May, while another Tom Cruise movie “Mission: Impossible 7” moved to the autumn of 2022.

A divided Supreme Court refused to block a restrictive abortion law in Texas that went into effect Wednesday. But they suggested that other challenges could still be posed.

Those hoping to reclaim Tesla’s TSLA,

The revamped Roadster will have to wait until 2023, due to “supply chain madness shortages,” an electric vehicle maker Elon Musk tweeted on Wednesday. And that date doesn’t depend on any “mega drama” in 2022, he added.

Shares of Immune Bio INMB,

they are rising after the clinical phase immunology company announced positive results from a study on Alzheimer’s treatment.

Alibaba BABA,

is going up afterwards a report that the Chinese tech giant will donate $ 15.5 billion in 2025 for the country’s “common prosperity”. This can only keep the country’s regulators at bay.

The markets

DJIA shares,

SPX,

COMP,

publication data have increased, while elsewhere SXXP European shares,

mix and oil CL00,

and GC00,

they are recording modest losses.

The graph

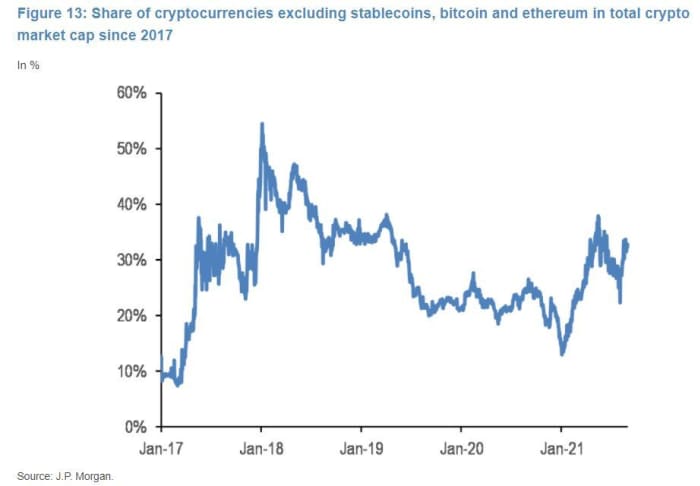

Retail investors also fueled the August revival in cryptocurrencies, but also made them look “sparkling” again, warns our company chart of the day, also from strategist Panigirtzoglou and the JP Morgan team.

“The previous phase of the” mania “of retail investors in the cryptocurrency markets was between early January and mid-May, when the share of” altcoins “had increased from 13% to 37.6%. Although it is far of the record high of 55% seen in January 2018, with 32.6%, the share of altcoins seems quite high by historical standards and, in our opinion, is more likely to be a reflection of the “mania “of sparkling investors and retailers. that the reflection of a structural upward trend,” the team said.

Meanwhile, note that the bitcoin share BTCUSD,

it looks “uncomfortably low,” with 42%.

Read: Ether “is on track to break the $ 4,000 resistance level” soon, says analyst

Random readings

“The Great Big Corrupt Company” and 800 more people rejected corporate names.

This year’s Comedy Wildife Photo Awards finalists include a laughing stamp and some dancing bears.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am, Eastern Time.

Want more for the next day? Sign up for Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.