Robinhood online trading app has imposed trading limits on 50 shares, including GameStop (GME) – Get the report, amid the continuing volatility of shares promoted in social media chat rooms, including the WallStreetBets subreddit.

The move expands on a list of 13 limited Robinhood shares Thursday. This move, along with the limits imposed by online brokerages, sparked a clamor among social media groups and elected officials alleging a Wall Street effort to protect itself against newly empowered populist investors.

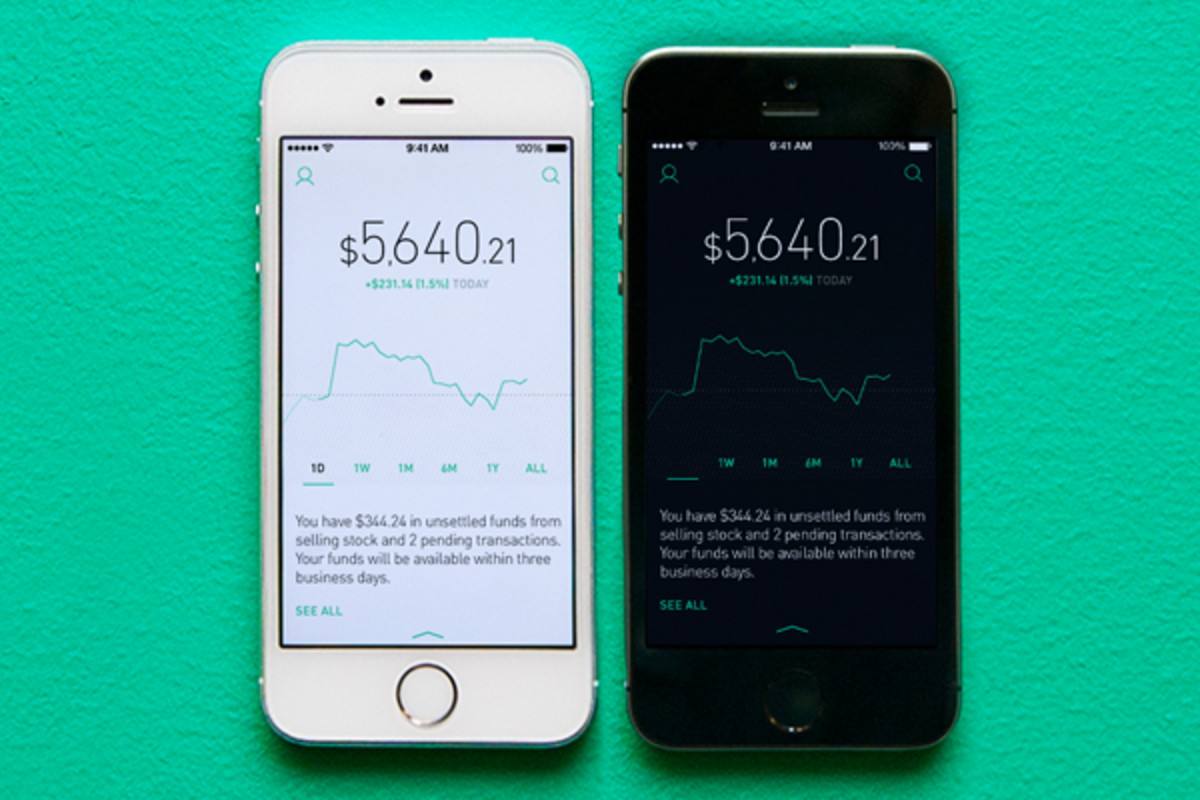

Robinhood has said it had to limit stock trading due to the huge costs associated with settling the massive number of transactions.

The company has received a $ 1 billion private equity infusion and has established a $ 500 million line of credit to help meet its needs, Bloomberg reported.

GameStop shares soared in January as small investors turned to very short stocks to create a reduction. The concerted action helped force actions of up to $ 482 this week.

The Reddit effect has also expanded to other very short values, including Bed Bath & Beyond (BBBY) – Get the report, American Airlines (AAL) – Get the report, Kohl’s (KSS) – Get the report And others. Alternative investments, including Dodgecoin silver and cryptocurrency, have also seen an increase.

Robinhood said account holders can only open 1-share new positions in the 50 shares to which it has imposed limits. It also limited the number of option contracts that can be purchased.

Shares of GameStop rose 70% on Friday, on a downward day for markets that saw Dow industrialists lose 620 points. In after-hours stock, shares fell to $ 317.00, down $ 8 (2.5%).