The S&P 500 continued into record territory on Monday, nearing the end of August with its best performance in the first eight months of a calendar year since 1997.

History offers no guarantees, analysts said, but it shows that strong performances tend to have continuity.

The uppercase SPX reference point,

rose 0.5% on Monday to record its 53rd record in 2021 and increase its gain to 20.6%. When there was one trading day left in the month, that would be enough for its strongest performance from year to August from a 21.4% increase over the same period in 1997.

The Nasdaq Composite COMP,

also closed on a record Monday, up 0.9%, while the Dow Jones Industrial Average DJIA,

it lagged behind, falling 0.2%, or 55.96 points.

Since 1971, the S&P 500 has experienced an average year-on-year increase of 6.07% through August 31, according to Jefferies.

Before: What the S&P 500 says of 50 record highs in 2021 to stock market historians

While this year’s rally looks impressive, it’s only the sixth strongest performance of that period in five decades, according to Dow Jones Market Data.

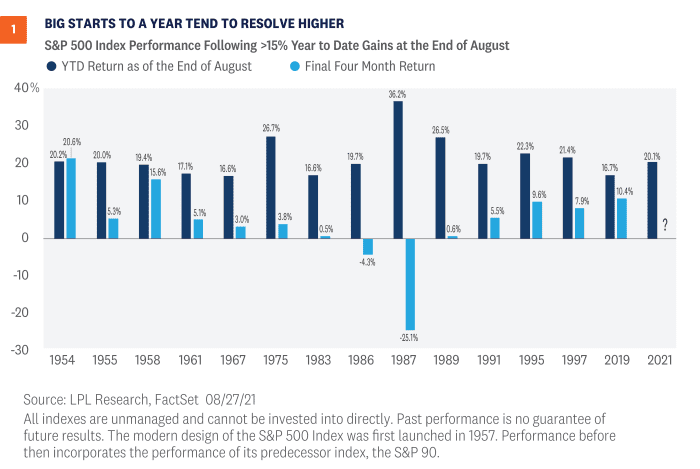

In a note, Ryan Detrick, chief market strategist at LPL Financial, noted the following chart, which dates back to 1954. It shows that the last five times the S&P 500 rose more than 15% by the end of August, stocks saw a positive return over the remaining four months of the year four times.

LPL Financer

“In fact, the average yield of the last four months after a good start to the year is 4.2%, with a very impressive average yield of 5.2%. Both figures are above average and the average annual return over the past four months is 3.6%, Detrick said.

Of course, there were also some setbacks, especially in 1987, when a 36% increase until August gave way to the fall of “Black Monday” on October 19.

Jefferies analysts noted that since 1971, the years in which stocks rose more than 10% through the end of August had a positive performance in the final four-month stretch 83% of the time, compared to 72% of the time during all years.

The previous year’s performance is not the only demonstration of the strength of the index in 2021. Detrick noted that before that year, in 1964 and 1995 alone more than 50 new highs were seen before the end of the year. ‘August. The record for new highs in a year is 77, set in 1995, with this year about to get very close to that record, he said.

“One of the bear’s usual concerns is that stocks go up a lot means stocks will go down a lot,” Detrick wrote. “Fortunately, that’s not true.”

The Tell: Investors compare the 2021 stock market rally to the summer before the 1987 crash, right?

Detrick, in the note, described LPL as “constantly bullish” and backed down against other bearish arguments, but stressed that it did not rule out the potential for a significant retreat on the stock market.

“Corrections are a normal part of the investment and the S&P 500 index has not yet retreated even 5% so far this year, averaging three times a year,” he noted.