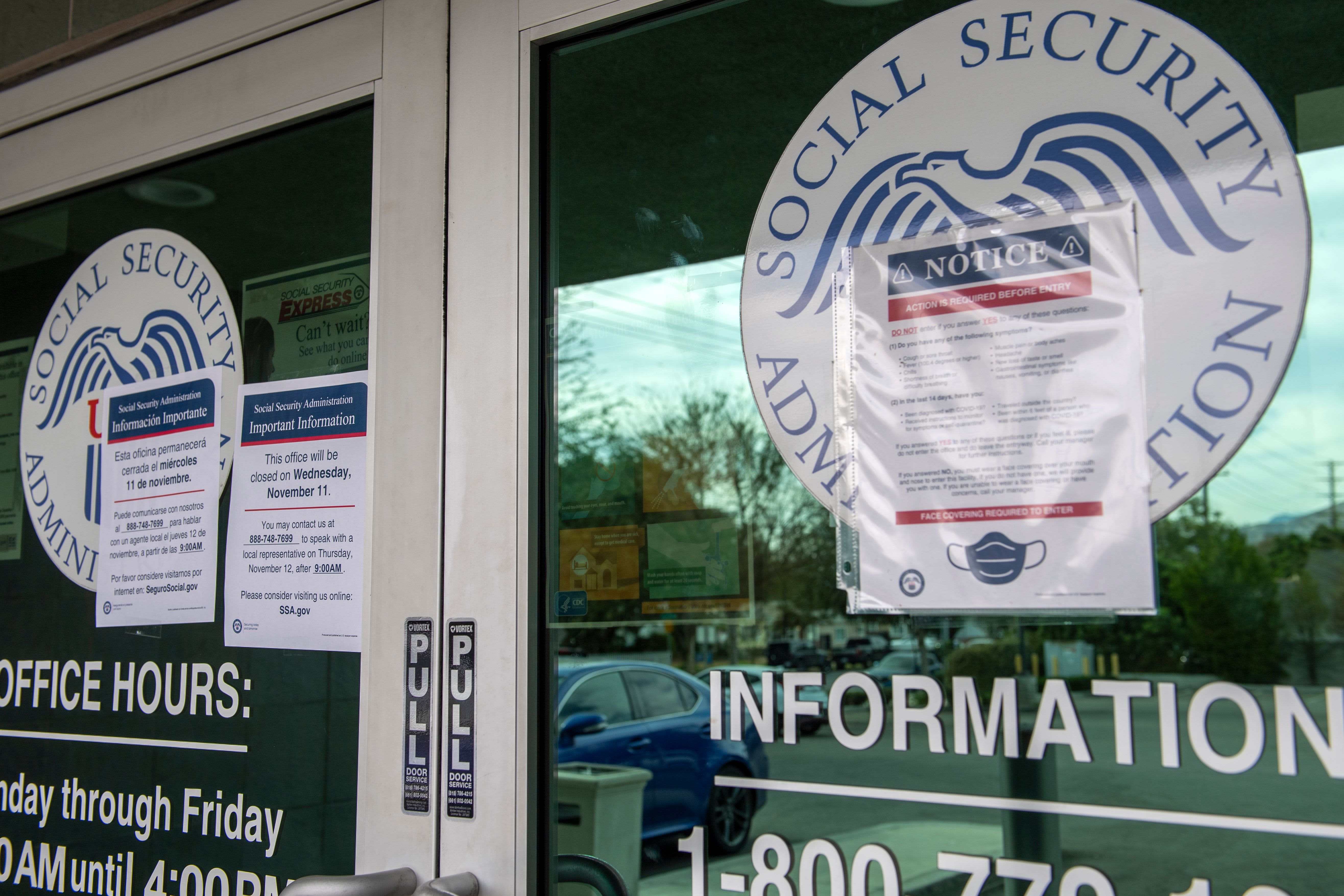

VALERIE MACON | AFP | Getty Images

According to new estimates released this week, Social Security will be able to pay full benefits for another 12 years.

The experts, though. just saying that doesn’t mean you have to drastically change your Social Security claim strategy.

Each year, the Social Security Administration publishes an annual pattern report on the status of the program. This year’s report was the first to show the effects the Covid-19 pandemic has had on the program’s funds, which were already running out.

Estimated dates for when these funds will no longer be able to pay full benefits have been increased. Now, the combined funds used to pay for retirement, survival and disability benefits will be able to continue to pay in full until 2034, a year earlier than planned last year.

It is important to note that the program will still be able to pay 78% of the benefits at this time.

The severity of the program situation depends on who you ask. But both optimistic and pessimistic experts see reason for hope in terms of continued profit availability.

One reason for optimism is that lawmakers have traditionally intervened to balance spending and revenue.

“Recipients can be confident that the pattern will continue,” Paul N. Van De Water, a senior member of the Center for Priority Budgets and Policies, wrote this week.

However, Larry Kotlikoff, a professor of economics at Boston University and president of Economic Security Planning, has a more bleak outlook on the current state of the program.

“This is a time when we need a fundamental, radical tax reform, to take the whole tax system and redesign it so that we get enough income so as not to impoverish our children,” Kotlikoff said.

For most Americans, the big question is: what does this mean for my benefits?

Those who are anxious may be tempted to claim retirement benefits when the requirements are met at age 62.

But by initiating monthly checks that beneficiaries will soon get a 25% to 30% reduction in monthly checks based on their full retirement age, said Scott Thoma, Edward Jones ’investment strategist.

Should people rush to collect Social Security benefits right away? No.

Larry Kotlikoff

professor of economics at Boston University and president of Economic Security Planning

“Don’t apply before just because you have concerns about the program in 12 years,” Thoma said. “You should always make a presentation decision based on your personal financial situation and needs.

“Don’t make a political decision,” he said.

Despite the program’s pessimistic outlook, Kotlikoff also said people should approach their grievance decisions with caution.

“Should people rush to take Social Security benefits immediately? No,” Kotlikoff said.

Because profit cuts would be politically unpopular, changes such as payroll tax increases are likely to occur, Kotlikoff predicts. Even if there was a 25% reduction in benefits within ten years, people would go ahead if they wait.

Other considerations related to your personal situation should be a higher priority, Thoma said.

Key areas to consider are your life expectancy, your ability to continue working, how much money you need, and how your claim decision will affect your spouse.