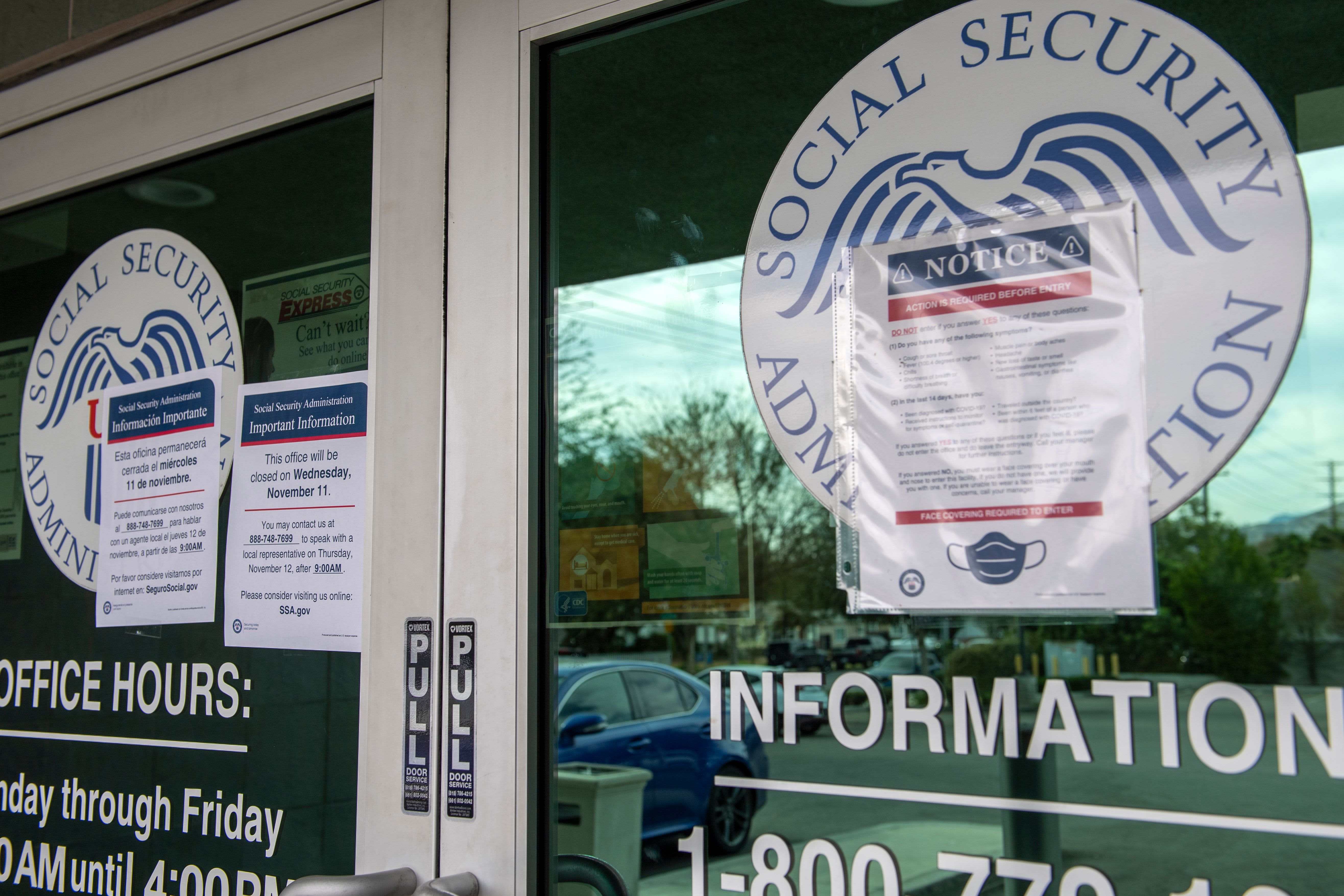

VALERIE MACON | AFP | Getty Images

According to an annual government report released Tuesday, the Social Security trust fund that most Americans trust for their retirement will run out of money in 12 years, a year ahead of schedule.

The outlook, exacerbated by the Covid pandemic, also threatens to reduce retirement payments and raise health care costs for older Americans.

The Treasury Department oversees two Social Security funds: old-age and survival insurance and disability insurance trust funds. These programs are designed to provide a source of income, respectively, for former workers who have retired at the end of their professional career or those who are unable to work due to a disability.

Officials said the Old Age and Survivors trust fund can now pay the benefits scheduled until 2033, a year earlier than reported last year. It is estimated that the Disability Insurance Fund will be adequately funded until 2057, eight years earlier than in the 2020 report.

Although the two funds are separated by law, the Treasury Department said the hypothetical combined funds could pay the benefits scheduled on time until 2034.

Senior administration officials said at a news conference Tuesday afternoon that an increase in deaths among Americans of retirement age in 2020 helped keep program costs lower than expected. They added that the definitive long-term impact of the coronavirus is less clear as costs and revenues return to their expanded forecasts.

The Treasury Department said it estimates the level of productivity of workers and therefore it is assumed that GDP will be permanently reduced by 1%, even as they are expected to resume their pre-pandemic trajectories.

However, the financial outlook for Social Security and Medicare, two of the country’s most important safety net programs, has deteriorated over the past year as Covid accelerated retirements and caused a contraction in the size of the American workforce.

There was no change from last year’s projection that the Medicare hospital insurance fund would run out in 2026. At that time, doctors, hospitals, and nursing homes would not receive full compensation. Medicare and patients would likely take responsibility for any coverage cuts.

In their entirety, the funds act as pillars that sustain the retirement plans of tens of millions of Americans, current and future. For decades, Americans have assumed that the programs they spent years contributing to payroll taxes would provide them in turn.

Programs have become so popular that they are often called the “third railroad” of American politics, simply too dangerous to play. Treasury Secretary Janet Yellen set the tone in a statement issued Tuesday.

“Having strong Social Security and Medicare programs is essential to ensuring a safe retirement for all Americans, especially for our most vulnerable populations,” he said in a press release. “The Biden-Harris Administration is committed to safeguarding these programs and ensuring that they continue to provide economic security and health care to older Americans.”

But the future of this model is now in the midst of a slow crisis: in the past two years, the program has begun withdrawing its assets to pay all the benefits promised to retirees.

In other words, Social Security costs in the form of monthly payments to retirees now exceed the income received by U.S. workers. It is expected to run consistently in black soon, the program’s reserve fund will run out by 2033.

If Congress doesn’t act right now, Social Security law would cut retiree benefit checks by about 20 percent overall. For a demographic population that has anticipated these payments and generally has few other avenues of income, a 20% reduction could be disastrous and threaten to throw many Americans into poverty.

Social Security has long known that it faces a simple math problem: with thousands of baby boomers retiring every day, there are an insufficient number of young people entering the workforce to offset the cost.

To make matters worse, the life expectancy of Americans increases and the birth rate decreases.

According to Social Security estimates, the number of Americans age 65 and older will increase to more than 79 million by 2035, from the current 54 million by census data. Meanwhile, the number of births in the United States fell last year by 4% from 2019, double the average annual rate of decline of 2% since 2014, the CDC said in May.

The U.S. birth rate is now so low that the nation is “below replacement levels,” meaning more people die every day than are born, the CDC said.