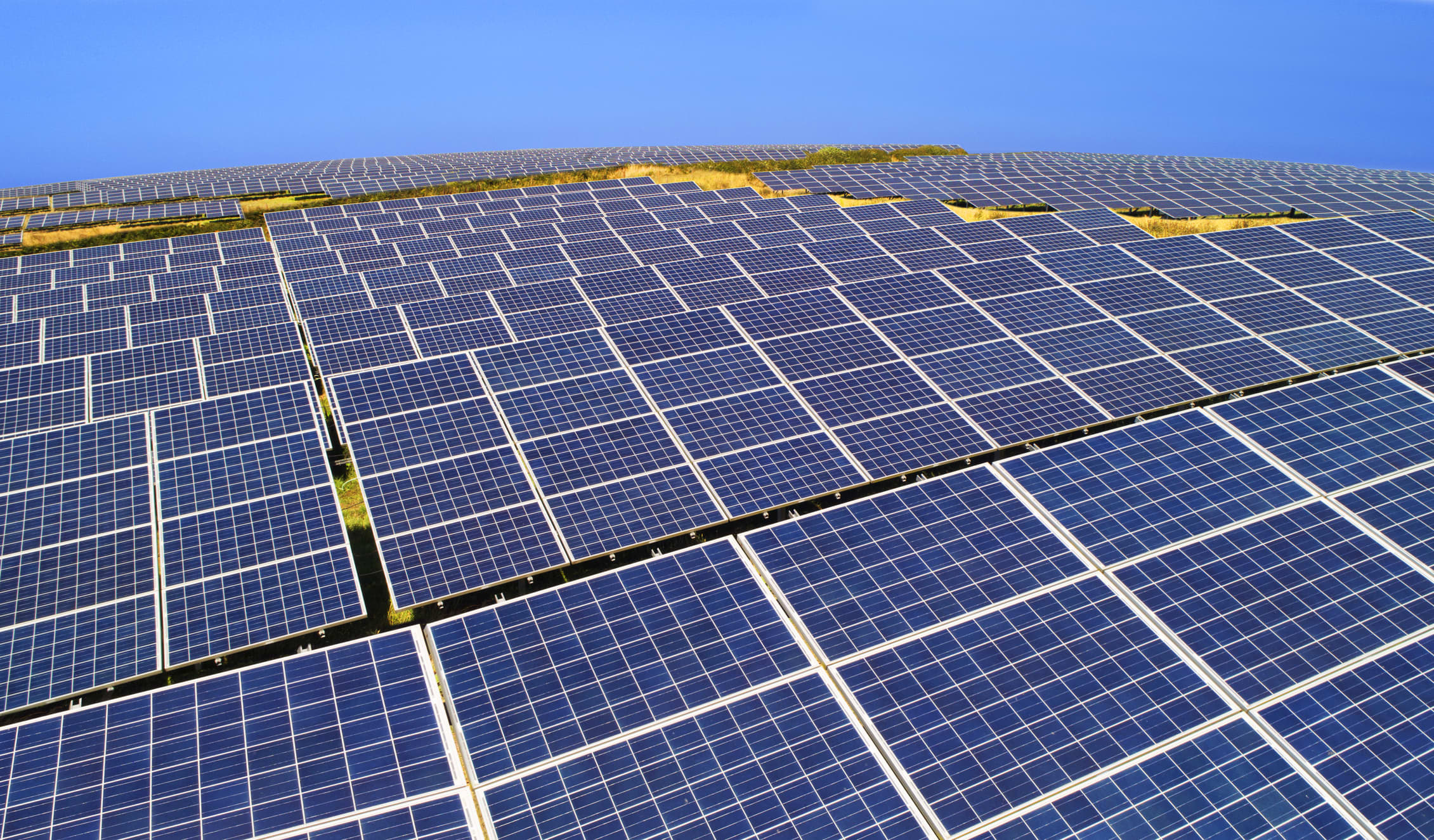

Peter Cade | Pedra | Getty Images

According to a report released Tuesday by the Association of Solar and Wood Mackenzie Industries, the solar industry is among many sectors experiencing some higher prices.

Prices rose quarter-on-quarter and year-on-year in all solar segments during the period. This is the first time that residential, commercial and utility solar costs have risen jointly since the energy consultancy began tracking prices in 2014.

The most important cost pressures came from a jump in commodity prices, including steel and aluminum. High shipping costs also played an important role. Most of these impacts are likely to start showing up in 2022, as many companies have enough inventory to see them by the end of the year, according to the report.

Overall, the United States added 5.7 gigawatts of solar capacity during the period, a record for second-quarter facilities. This also marks a 45% jump from the 2020 level as the pandemic rocked the industry.

“The solar industry continues to show strong quarterly growth and demand is high in all segments,” said Michelle Davis, chief analyst at Wood Mackenzie. “But the industry now faces multiple challenges. … Resolving these challenges will be critical to expanding the industry’s growth and achieving clean energy goals.”

A separate report from Rystad Energy released on Friday said global solar panel prices have risen 16% this year compared to 2020 levels. Overhead costs, which include soft costs such as labor, are up 12%. % in 2021. Rystad said that this could harm the prospects of demand of the next years.

In the United States, the industry also faces regulatory overlaps and political uncertainty. In June, U.S. Customs and Border Protection issued an order to release silica-based products from the Hoshine silicon industry due to forced labor problems in the Xinjiang region of China. Separately, some U.S.-based companies have filed a petition with the Commerce Department to ask for tariffs to be extended on solar products imported into Malaysia, Vietnam and Thailand, according to SEIA.

All of this happens when lawmakers debate the $ 3.5 trillion spending package, which will have significant implications for the solar industry.

“What the industry needs is certainty,” said Abigail Ross Hopper, president and CEO of SEIA. He believes the most important provision is an extension of the tax credit for investment, which has been key to Solar’s growth. The ITC, which was expanded in December 2020, was included in The American Jobs Plan, but did not enter the final iteration of the infrastructure bill.

Hopper said support for domestic manufacturing is another priority for the trading group, noting that incentives around U.S.-based production could ease some of the bottlenecks in the supply chain. currently faces the solar industry.

Rising costs and a lack of clarity for the industry could hurt President Joe Biden’s ambitious climate goals. According to the Department of Energy, solar costs have fallen by more than 70% in the last decade, but they need to fall even further to increase adoption.

The department on Wednesday issued a plan detailing how solar power could go from 3% of current electricity generation to 45% by 2050, but it will be virtually impossible without support policies. The study said the United States installed a record 15 gigawatts of solar power during 2020.

Facilities will have to double every year until 2025, before quadrupling from 2020 levels annually between 2025 and 2030 if U.S. climate goals are to be met.

“This is a critical time for our climate future, but price increases, supply chain disruptions and a number of trade risks threaten our ability to decarbonize the electricity grid,” Hopper said.