Wall Street had Georgia well in the lead on Tuesday night, with equity and bond futures mostly in the spotlight as investors watched the two key Senate seat competitions go down to margins until the first yields.

MarketWatch’s Victor Reklaitis reported that analysts describe Georgia’s races as “as close as possible” and there are expectations that the winners will not be declared until Wednesday morning.

At the last check, the accounts of towns of democratically lean counties were being considered, especially in Dekalb, which could increase the balance sheet.

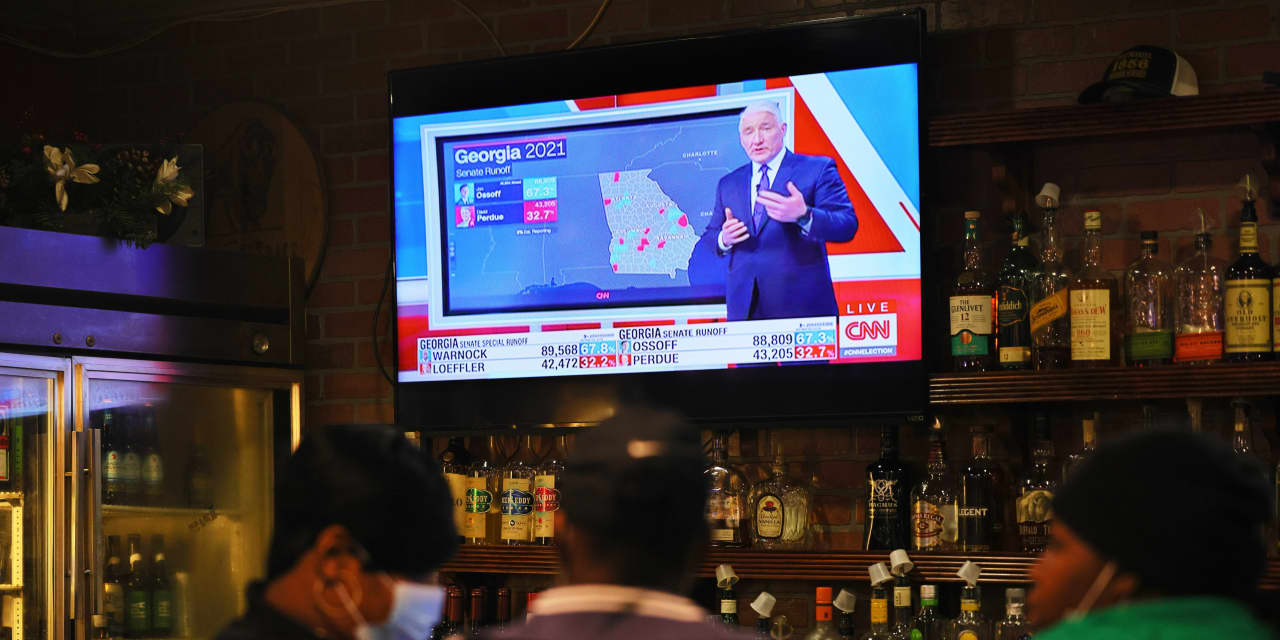

Challenging Democrat Jon Ossoff followed incumbent Republican Sen. David Perdue with more than 90 percent of the vote counted, after enjoying a practical advantage earlier, according to data added by the Associated Press.

In the other round, Democrat Raphael Warnock also lagged slightly behind the current senator for party governor Kelly Loeffler.

The races in the Senate are the qualifiers for the November general election, when none of the candidates reached the 50% threshold required to be declared the winner.

At stake for the markets is the prospect of a narrow Democratic majority in the Senate if candidates can outnumber GOP incumbents.

Senate Republicans, if Loeffler or Perdue win Tuesday night, can be expected to block coronavirus relief legislation and restrict Democratic plans for expansive spending after President-elect Joe Biden takes office, they said. experts.

Once democratic in Georgia, however, it would give this party virtual control of this chamber because elected vice president Kamala Harris would cast unequal votes as president of the chamber.

Futures for the S&P 500 ESH21 index,

ES00,

fell 0.7%, while those of the Dow Jones YMH21 industrial average,

YM00,

were 0.3% lower and the future Nasdaq-100 NQH21,

NQ00,

they were out of 1.3% on Tuesday afternoon

In the regular session, the Dow DJIA,

S&P 500 SPX index,

and the Nasdaq Composite Index COMP,

ended the session much higher ahead of the political clashes.

However, some of the most important movements were those emanating from the bond market, with the 10-year Treasury yield TMUBMUSD10Y,

knocking on the door of 1%, around 0.985%, as prices fell, after rates ended at 0.955%, marking the highest close of 3pm in the east since of Dec. 4, according to Dow Jones Market Data. The 30-year Treasury bond TMUBMUSD30Y,

it also rose nearly 4 basis points and gained 1.744% compared to an afternoon close, with 1.705%, also the highest rate in a month.

For the bond market, democratic victories could add to bearish pressure on treasuries, as analysts say inflation expectations have risen in response, as Congress may be more inclined to pass additional measures. of tax spending with a majority, which would weigh on bond prices, dragging yields up. .

“It looks like a couple of larger Democratic counties haven’t been fully accounted for yet, so I think that can happen to Democrats,” Tom di Galoma, general manager of Treasury trading at Seaport Global Securities, told MarketWatch.

“If that happens, rates will continue to rise over the next few days. We could very well see ten-year yields near 1.2% soon,” he wrote.

It’s almost impossible to guess the outcome Wall Street deems most appropriate to further increase shares in 2021. Last year, market participants bet that a Biden presidential victory, along with Democrats winning a majority in the Senate, would provide the best scenario for additional financial relief measures to help sustain the economic recovery from the Covid-19 pandemic.

However, there was no blue wave and markets rose in the last weeks of 2020 independently.