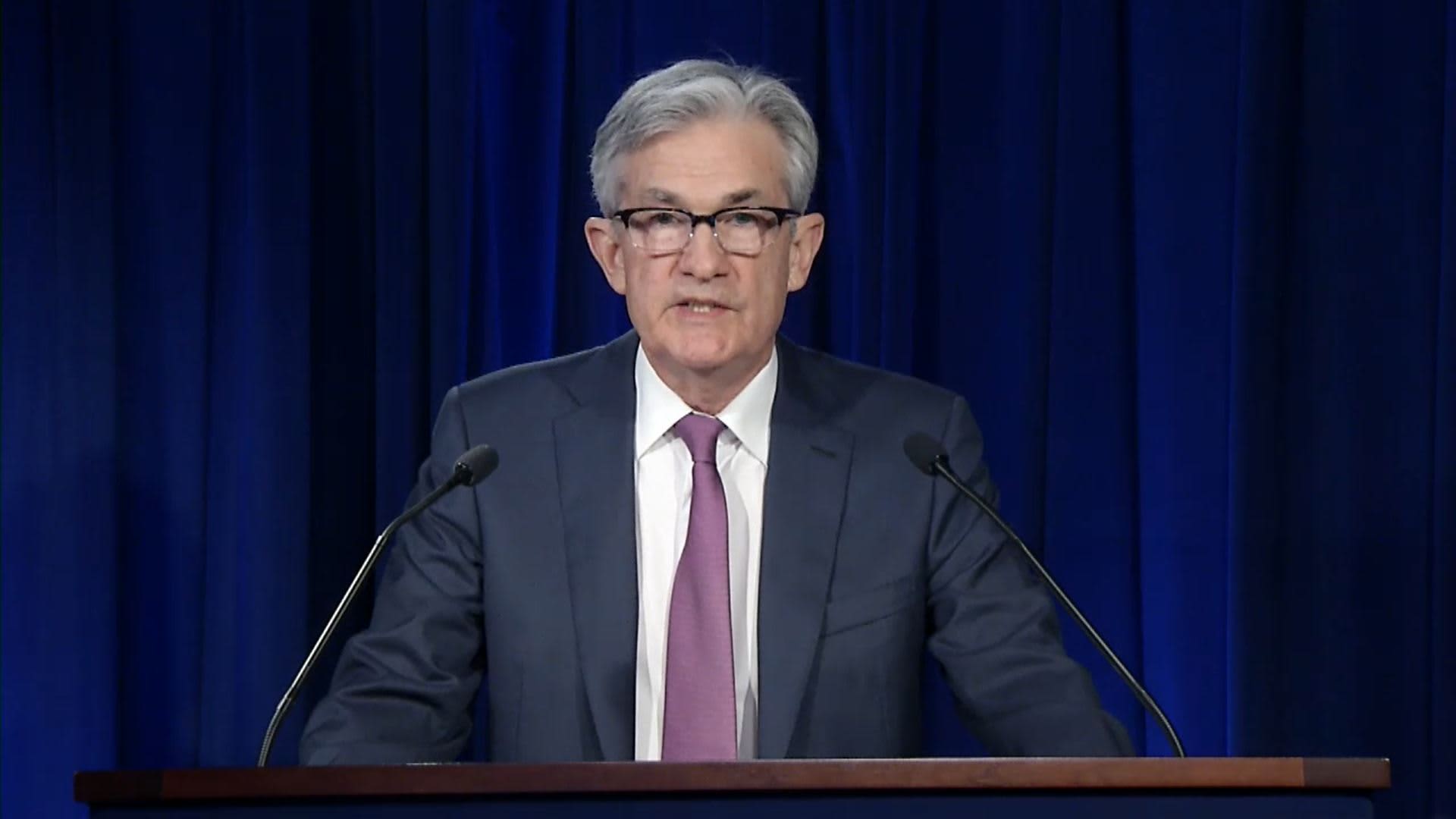

The ten-year U.S. Treasury yield topped 1.64% early Wednesday, reaching a new high of 13 months, ahead of a press conference with Federal Reserve Chairman Jerome Powell , after the two-day political meeting of the central bank.

The yield on the 10-year reference cash note rose to 1.644% at 6 a.m. ET. The yield on the 30-year Treasury bond rose to 2.395%. Yields are reversed to prices.

The two-day political meeting of the Federal Open Markets Committee will conclude at 2 p.m. ET, followed by a press conference with Powell.

The Fed will release new economic and interest rate forecasts, which could indicate that Fed officials expect to raise rates before or even before 2023. The central bank is expected to recognize stronger growth, which should put easy Fed policies in the spotlight, especially given the new $ 1.9 trillion in federal stimulus spending.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, told CNBC’s “Squawk Box Europe” on Wednesday morning that he would be “surprised” if the Fed indicated it would step in to dampen yields on rising bonds at those levels.

Ten-year Treasury yields have risen rapidly recently amid concerns about potential inflation growth as economies reopen and recover from the coronavirus pandemic. Ten-year yields have jumped more than half a percent since late January, reaching 1.6% in recent weeks.

Still, Shepherdson stressed that this “was still close to zero in real terms.”

Shepherdson believed that while Powell would once again push some of the market’s inflation fears, he suggested the Fed chairman would not talk about downsizing his bond-buying program at Wednesday’s press conference.

He explained that this is due to the fact that “as soon as the Fed starts talking about volume reduction, yields will skyrocket immediately because that’s what the markets do: the markets are engaged in an inch and take a garden, especially in the treasures of the moment “.

“So I think the Fed wants this talk to soften as much as they can until they can’t,” he added.

Shepherdson noted that this lack of guidance from the Fed on when policy changes would occur was “justifiable because this recovery is still a forecast.”

Meanwhile, data on the number of licensed building permits and new housing construction projects started in February will be released Wednesday at 8:30 a.m. ET.

A $ 35 billion auction on 119-day bills will be held on Wednesday.

– CNG’s Maggie Fitzgerald contributed to this report.