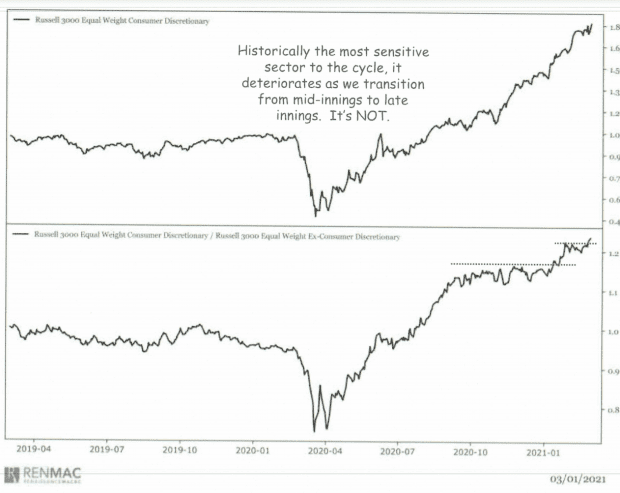

Consumer discretionary values are the most sensitive to the market cycle and right now give no indication that the cycle is about to turn around, according to one of Wall Street’s most followed technical analysts.

“Discretionary names historically deteriorate before the cycle ends,” Jeff deGraaf, founder and president of Renaissance Macro Research, said in a note Wednesday. “This turns them into excellent opposing proxies for the market cycle. With discretionary names to new relative highs, it suggests that the market cycle is still average, even early, but not the latest entries that inflation and growth suggest, ”

He noted the following graphs, tracking the absolute and relative performance of the Russell 3000 consumer discretionary sector, with the same weight, to point it out.

Renaissance Macro Research

The shares had a mixed performance on Wednesday, with the DJIA Dow Jones Industrial Average,

increases 90 points, or 0.3%, while the S&P 500 SPX,

fell 0.3% and the NASdaq Composite COMP

fell 1.1%. Equity faltered last week as fears of rising inflation led to a jump in bond yields. But if discretionary actions are a guide, so far there is little evidence of price pressures.

“We could be wrong, but discretionary names are likely to weaken as sustained inflationary pressure increases and consumer borrowing and energy costs erode their purchasing power (this is not yet happening),” he wrote. deGraaf.