Stock market valuations are “historically extreme” by almost every measure. And while valuation corrections don’t necessarily lead to market setbacks, the risk of a “hard” correction grows, a Wall Street strategist warned.

“With the current cycle advancing very rapidly, the risk of a hard correction is growing,” Deutsche Bank chief strategist Binky Chadha wrote in a note on Thursday.

The warning comes when Wall Street companies have expressed nervousness as stocks continue to rise, pushing major indices to all-time highs, with no significant setbacks. Including Friday, the S&P 500 has spent 214 trading days without a 5% decline, up more than 33% in this stretch. This is the longest run without a rollback since the 404-day run that ended Feb. 2, 2018, according to Dow Jones Market Data.

You need to know: This Wall Street company is meeting its S&P 500 price target. This explains why it says a correction has been exhausted.

Major indices lost ground during the week of Friday, with the S&P 500 SPX,

and Dow Jones Industrial Average DJIA,

threatening to extend the streak of defeats to five sessions. The S&P 500 is down just 1.7% from the September 2 record and more than doubled from its March 2020 pandemic low.

Chadha noted that while stocks are “very expensive,” this fact alone does not require major market correction. This is because valuations can fall if rising stock prices outweigh profit growth, reducing the price-to-earnings ratio even as stock prices rise.

These types of soft valuation corrections are usually seen in a recovery when profit growth is rapid, he said. However, during this recovery, the “compression” of the multiple benefits has been slow and uneven, Chadha noted.

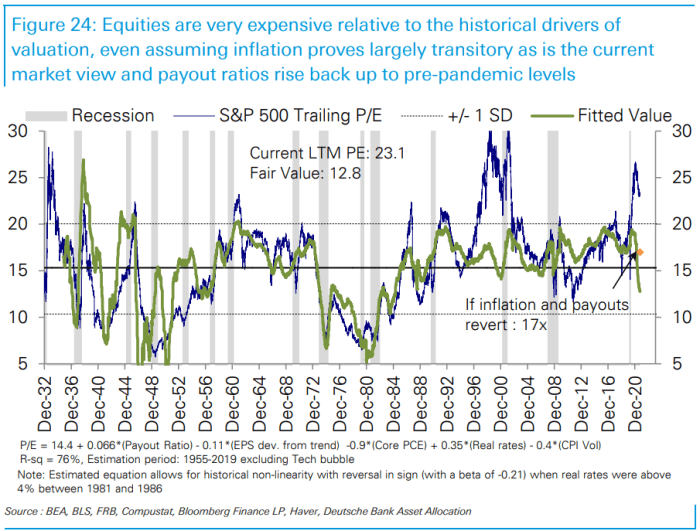

Using the subsequent 12-month gains, the price-earnings ratio, or P / E, of the S&P 500 went from a low of 14 to the depths of the 27th pandemic in early 2021. It has since been reduced to 23, 1, a decrease of 14%, as profits outpaced the rise in prices, but remains 15% above its historical range of 10 to 20, he noted.

Deutsche Bank

Multiples based on term earnings estimates have gone sideways to a high level. Other ratios, such as company value or EV, in relation to EBIT (earnings before interest and taxes) and EV / EBITDA (earnings before interest, taxes, depreciation and amortization) have fallen modestly from the maximums. record but remain above their technology bubble highs, Chadha said, while cash flow-based valuations have continued to rise.

Chadha said a “surprisingly rapid rebound” in earnings is the most likely explanation for the extreme valuations, noting that the S&P 500 gains have exceeded the analyst consensus estimate of low by 15 to 20 percent. unprecedented points for five consecutive quarters. But that dynamic looks set to end, he said, noting that analysts ’consensus seems to have caught up, while the pace of earnings and earnings updates, a key driver of equity growth, is will reduce.

“At a fundamental level, we believe that the main reason why multiples are high is the confusion of the market about where we are in the profit cycle, which partly reflects the speed and surprise with which it has been developed the economic recovery and the great persistent rhythms that this has generated, ”he said. he wrote.

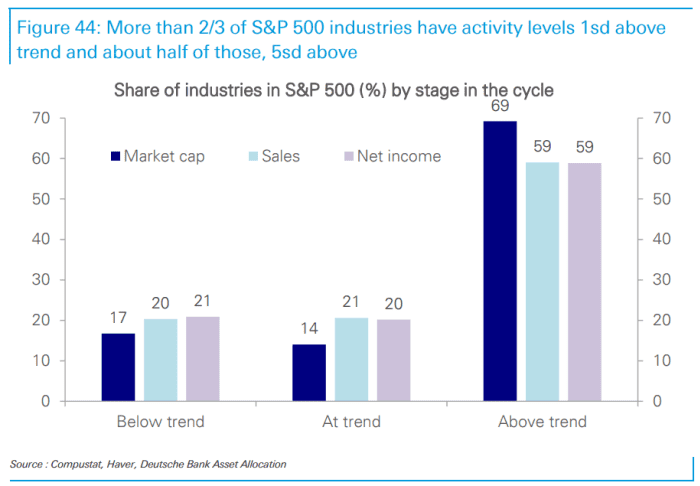

And as gross domestic product is still well below trend, there is a popular opinion that the best of the recovery has not yet arrived, Chadha said. The problem is that the parts of the economy to which S&P 500 companies are most exposed are already significantly above trend, he said, with 2/3 of S&P 500 industry groups showing activity levels that exceed the trend of one or more standard deviations (see chart below).

Deutsche Bank

“So the cycle is much more advanced and the risk is that activity will start to slow down, while the market has a price for most of the recovery that has yet to come and the big paces continue,” he said.