Several U.S. airlines warned investors on Thursday that their third-quarter revenue would be weaker than previously forecast, as the recent rise in COVID-19 cases has reduced people’s travel plans.

The actions of the airlines that issued revenue warnings were a first success, but were changed to operate abruptly after the opening bell, as some airlines even suggested that the worst has already happened. past and that a decline in travel was expected.

Airlines said that after a strong July, the rate of recovery of bookings slowed down and cancellations increased in August, with this weakness continuing in September as cases increased. of COVID-19 and with a small impact from Hurricane Ida.

On average, airlines reduced third-quarter capacity expectations by 2% (12% compared to 2019) and reduced revenue expectations by 4% or 24% compared to 2019, he said. on Thursday Jefferies analyst Sheila Kahyaoglu.

Admission warnings come after the number of new daily cases of COVID-19 began to rise in July and reached levels in August and early September that had not been seen in six months, before falling slightly. last week. Read the MarketWatch “Coronavirus Update” column.

And of course, the daily average of people passing through the Transportation Security Administration’s checkpoints was 2.04 million in July, the highest monthly average for the year, and then fell to 1 , 85 million in August, according to a MarketWatch analysis of TSA data. As of September, the daily average has dropped to 1.72 million.

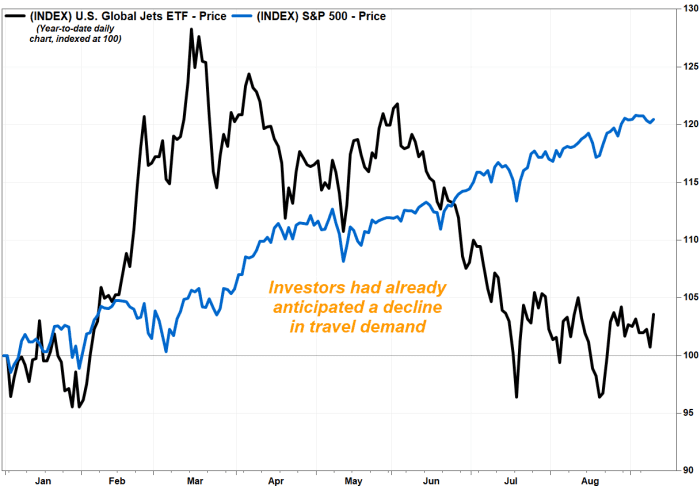

With this data already available, the American fund JETS traded on the JETS stock exchange,

it had been sold since it peaked in mid-March. It fell 9.9% in June and fell another 5.3% in July, then rose 0.4% in August and has gained 0.9% a month so far. It has now lost 12.6% in the last three months, while the S&P 500 SPX index,

has gained 7.3%.

On Thursday, despite all warnings, the Jets ETF rose 2.9%.

FactSet, MarketWatch

Shares of Delta Air Lines Inc. DAL,

they fell to 1.1% ahead of the opening, but reversed course to increase 4.3% in morning operations as the company suggested the weakness was over.

The airline only said it expected third-quarter revenue to be at the “lower end” of its previous target range, but said its total capacity outlook was not “unchanged”.

“While the environment remains turbulent, reserve trends have stabilized over the past 10 days and recovery is expected to pick up as cases decline,” Delta said in a statement.

Delta’s third-quarter orientation “looks mixed,” analyst Stephen Trent told Citi on Thursday.

“From the downside, management sees a bit more of a cost compared to what was previously anticipated, while revenue should now reach the lower end of the previous guide,” he said. “On a slightly more positive note, the Atlanta-based giant should now also see some wind due to lower fuel costs for aircraft.” Trent maintained its purchase rating on Delta shares.

According to a New York Times tracker, the 7-day average of new COVID-19 cases was 148,538 on Wednesday, compared to 166,015 a week ago and 3% below what it was two weeks ago.

AAL Shares of American Airlines Group Inc.,

it sank to 1.5% before the market, but charged 5.6% more in recent operations.

The airline said it now expects third-quarter revenue to drop from 24% to 28% over the same period in 2019, compared to previous indications of a 20% decline. FactSet’s current consensus for third-quarter revenue of $ 9.23 million implies a 22.5% drop from 2019.

The company said the load factor set aside for peak travel periods, including fourth-quarter holiday periods, “remains very strong.”

The American “saw its strong summer of leisure travel continue until July, with the airline turning into profitable ex-special items for the month,” Kahyaoglu said in a note. However, the airline “experienced the smoothness of bookings close to August and cancellations continued until September.”

United Airlines Holdings Inc. share UAL,

it rose 4.3%, after losing to 2.2% before opening.

The company expects third-quarter revenue to drop 33% from 2019, while the $ 8.44 billion consensus on FactSet revenue implies a 26% drop. United also cut its capacity target to a 28% drop from 26%.

But on a good note, United said the current rise in COVID-19 cases “has been significantly less impactful so far than previous rises” and is expected to be “temporary” in nature.

“Based on demand patterns after previous waves of COVID-19, the company expects reserves to begin to recover once the cases arrive,” United said.

United’s revenue cut was the strongest and “probably due to business travel,” although the airline did not specify, Kahyaoglu said.

Among the actions of other airlines that warned, Southwest Airlines Co. LUV,

rose 3.5% and JetBlue Airways Corp. JBLU,

advanced 6.1%.