The big discussion not only in the markets, but also in politics, is whether the new round of stimulus will reheat the economy.

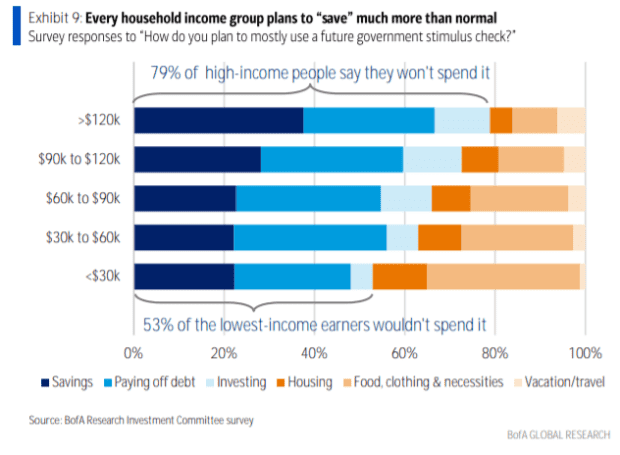

The Bank of America’s research investment committee says it won’t and provides some new data. First, he cited census Census data showing that of households that received a $ 600 stimulus check in the first fortnight of February, 73% saved or paid off debt. Consumer credit also fell unexpectedly in January.

Bank of America also surveyed more than 3,000 people to ask them how they would spend the new stimulus control. Even in the lowest income category, 53% say they plan to save, pay off debts or invest.

So what does this mean for investors? Bank of America says it expects nothing more than a temporary rise in inflation. Supply disruptions will be reduced as labor returns to work, in addition to advances in artificial intelligence and automation could mean fewer industrial jobs. If wage growth accelerates, companies can afford to accelerate research and development.

The research investment committee recommends what it calls prudent performance for bond allocation: high-yield corporate and municipal bonds, leveraged loans, preferred stock, and convertible bonds have outpaced the global bond market. For equities, he says he buys small capitalization growth when it falls and the Nasdaq Composite COMP,

at 11,600 (12% below Tuesday’s close).

The financial sector is your preferred sector as you can earn anyway. If Bank of America’s analysis of inflation is wrong, banks would benefit from a stronger yield curve and higher real estate and lending activity. If correct, banks would be attractive, given the redemptions of stocks and attractive returns.

The buzz

The House of Representatives will have to vote on the $ 1.9 trillion stimulus plan already approved by the U.S. Senate, at which point it will head to the White House for President Joe Biden’s signature. The Congressional Budget Office estimates that $ 1.1 trillion will be spent in 2021.

U.S. consumer price data in February will be the center of a market suddenly obsessed with the prospect of inflation outbursts.

Maryland becomes the last state to relax many of its COVID-19 restrictions.

The United States and China are discussing sending their top diplomats to Alaska to try to re-establish relations for the Biden administration, according to the South China Morning Post.

Pfizer PFE,

and BioNTech BNTX,

agreed to provide an additional 4 million doses of coroanvirus vaccine to the European Union.

Roblox Corp. it fetched a reference price of $ 45 per share from the New York Stock Exchange as the interpolation-focused gaming platform prepares to go public via a direct listing on Wednesday.

Luxury home builder Toll Brothers TOL,

reported a 70% jump in first quarter profits.

The market

After Tuesday’s big rise in stocks and technology bonds, the first few days looked calmer. US ES00 stock futures,

NQ00,

slightly decreased and the performance of the TMUBMUSD10Y to three years of the Treasury,

bordered up to 1.56%.

Bitcoin BTC.1 futures,

rose more than $ 55,000.

The graph

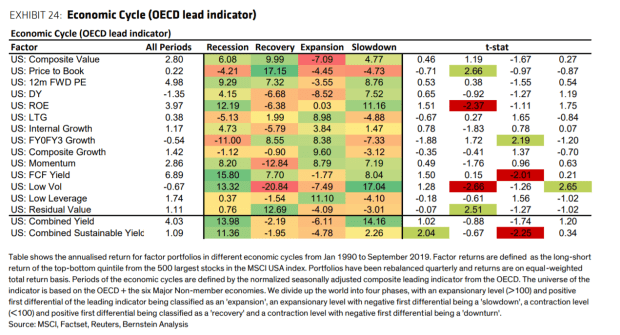

Bernstein Research’s portfolio strategists divided the business cycle into four different parts and checked how well the different investment style factors work. Equity stocks performed best in the current part of the “recovery” of the economic cycle.

Related story: This is what the 2016 value rally says about how far the current advance can go

Random readings

Issuer John Oliver’s 2018 warning to Meghan Markle before her wedding to Prince Harry proved the money.

The abandoned books of Dr. Seuss sells for thousands of dollars in Canada.

There will be a Hollywood movie made from the true story that a bear used cocaine for a wool bag. For any reader of urine in this newsletter, it didn’t end well.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.