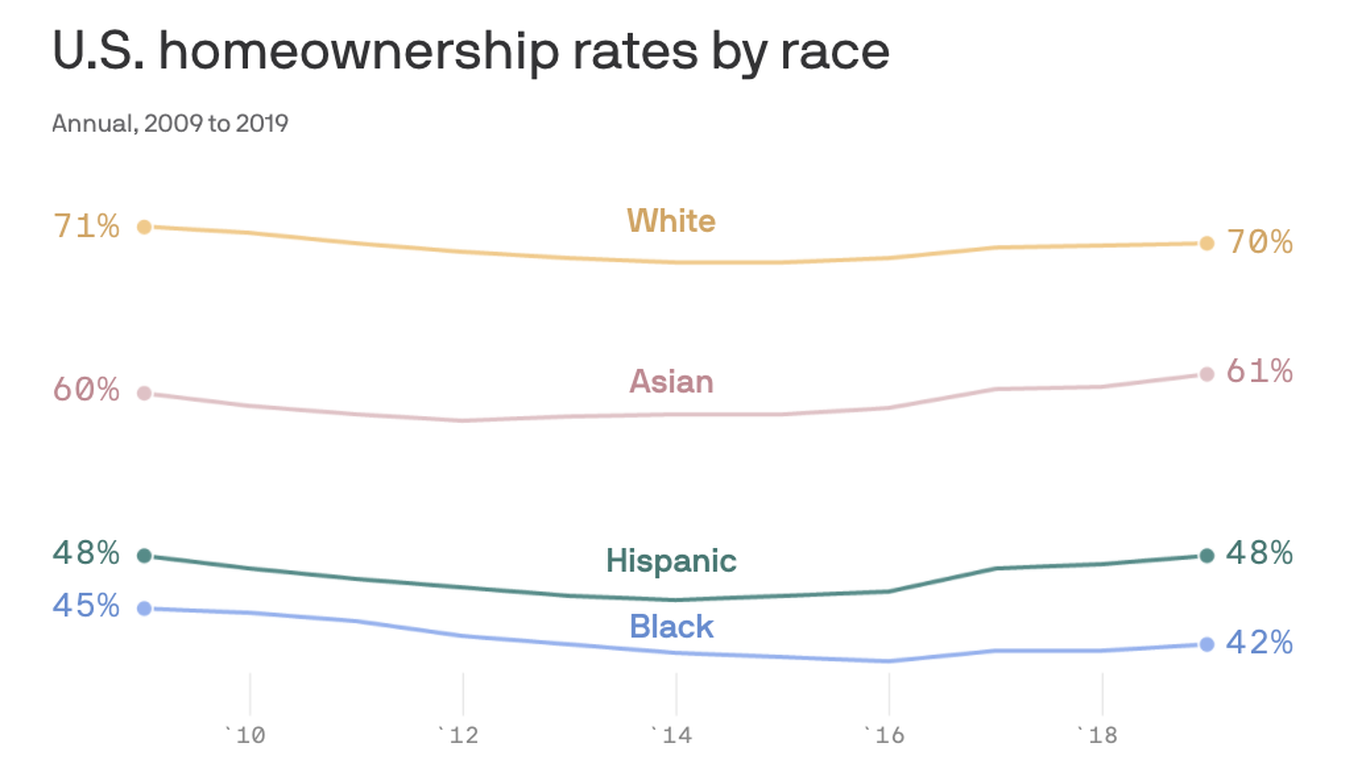

The ownership rate of black families is nearly 30 percentage points lower than that of white families, according to a new data analysis from the National Association of Realtors, which examined trends between racial groups from 2009 to 2019.

Why it’s important: The report comes when President Biden has signed an executive order on racial inequality, ordering his administration to take steps to eliminate “racial bias and other forms of discrimination at all stages of buying and renting homes.” .

By numbers: The home ownership rate of black Americans is 42%, compared to whites, Asians, and Hispanic Americans who own homes at a rate of 69.8%, 60.7%, and 48, 1%, respectively.

- According to the study, only 43% of black households can afford to buy the typical house compared to 63% of white households.

- Black Americans were the only group to see declining home ownership rates from 2009 to 2019 and were “the group most affected by declining homeownership rates before, during and after the Great Recession, ”the report says.

Leading the news: Black applicants were rejected for mortgages 2.5 times more than white applicants. The report highlights the debt-to-income ratio, as the most common reason lenders refused to approve loans to black applicants.

- Black applicants are twice as likely to be surrounded by student debt as white applicants, and black households have an average student loan debt of $ 40,000, compared to $ 30,000 for white households.

- Low credit scores, unverified income, low cash on reserves, and insufficient down payments are also listed as reasons why lenders turned down home loans to black applicants.

- Black and Hispanic applicants were three and two times more respective, respectively, than white and Asian Americans taking advantage of their 401 (k) or pensions as a down payment for a home.