The question that still reverberates in the financial markets is the extent to which the $ 1.9 trillion coronavirus relief will be spent, either immediately or if the virus is far enough away for buyers to go out and fly.

This column previously pointed to surveys on how the initial $ 600 stimulus was used and plans for the $ 1,400 that have reached many households, suggesting that much will not be deployed in the economy.

Another way to look at it is whether families perceive the stimulus as additional income or additional wealth. Studies have shown that the propensity to spend out of wealth is only 5%, while the propensity to spend out of income ranges from 10% to 50%, according to a recent speech by voting member Gertjan Vlieghe of the Monetary Bank of the Bank of England. Policy Committee.

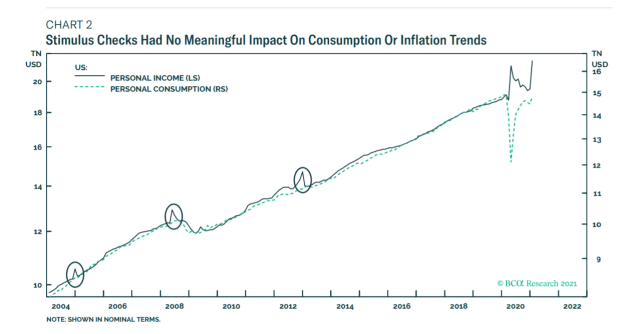

Dhaval Joshi, chief strategist at BCA Research, says the new stimulus is considered wealth or income depending on whether the household receiving it has to start with low or high incomes. But looking at past stimulus controls, there were no significant changes in either consumption or inflation.

Consequently, he believes that market expectations about inflation are being let down. It also says, in a note written before Thursday’s fall in crude oil prices, that inflation expectations are positively correlated with high commodity prices, although real inflation tends to decline when commodity prices fall. raw materials are high.

“Given that the bond market is useless in predicting inflation, it also does not serve to assess real interest rates,” he says. If the bond market exaggerates the future level of inflation, inflation-adjusted bond yields should be even higher. “The important thing right now is that, in any comparison to the actual return on bonds, stocks and other risky assets are even more expensive than they seem.”

Icy conversations in China

Talks between the United States and China began with icy beginnings in Alaska, with public criticism from each side in the initial statements.

FedEx FDX,

may rise after the delivery service said third-quarter tax gains rose more than analysts predicted and led to a stronger-than-expected current quarter.

Nike,

it may slip after the clothing manufacturer saw slower-than-expected sales growth in its third fiscal quarter.

Chubb CB,

has made a $ 65-per-share bid to buy rival insurer Hartford Financial Services Group HIG,

The Bank of Japan eliminated stock exchange-traded fund targets and real estate investment trusts and expanded the band that will allow 10-year bonds to be traded.

The oil recovers, a bit

After the collapse of 7% in crude oil prices on Thursday, the CL.1 futures of light and sweet crude,

they have slowed their fall, but remain below $ 59.80 a barrel. Oil futures traded between $ 64 and $ 65 a barrel earlier this week. UBS analysts say they are focusing on the pace of COVID-19 vaccines, which should help ease restrictions and support oil demand.

The performance of the TMUBMUSD10Y three years from the Treasury,

it fell slightly to 1.69%. Futures of the American stock exchange YM00,

ES00,

NQ00,

were higher, as European stocks fell UKX,

DAX,

PX1,

Asian stocks closed the week in red, with indices in Tokyo NIK,

Hong Kong HSI,

and Shanghai SHCOMP,

falling by about 1.5%.

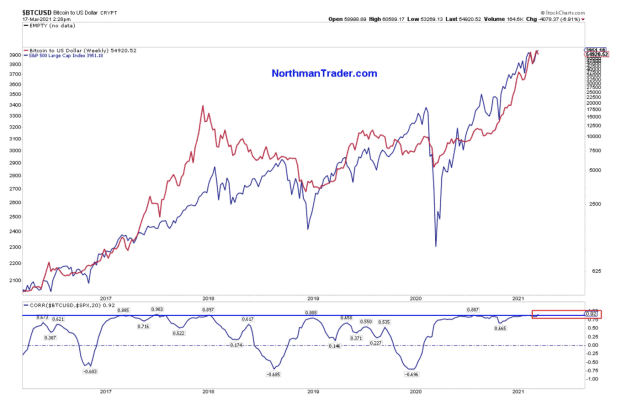

Bitcoin flows mirror value flows

Bitcoin is BTCUSD,

a diversifier? It is a huge debate in the markets that have taken over several major banks in just the last two weeks. Sven Henrich, the technical analyst who runs the Northman Trader website, compiled this chart, which shows that the correlation between weekly bitcoin flows and stocks is at the highest level in history.

Random readings

Financial market analysts often cite the 1600s tulip fashion when discussing speculative obsessions. For lovers of irony, there are non-fungible tulips (i.e. illustrations of tulips sold in the blockchain) on sale.

A winged shark? Scientists baffled fossils found in Mexico.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.