Welcome to the last commercial week of 2020, a year we can’t see fast enough. Stocks are on the rise after President Donald Trump signed this $ 900 billion stimulus bill, despite 11-hour demands for more relief checks.

With only a handful of business days before the end of the year, ours call of the day says investors need to prepare for a rough start until 2021 if we close the year with stock market records.

It has been an “unprecedented year for financial assets,” with equity markets melting earlier this year due to the COVID-19 pandemic, followed by an impressive rise as authorities pushed the stimulus, notes John Hardy, head of currency strategy, at Saxo Bank.

“Market historians looking back to another incredible year (1999), in which the S&P 500 closed the year with a new all-time high, will recall that in the early days of 2000 a cruel correction occurred. “Yes, the times were different and the focus was on Y2K and the concentrated bubble of the time, but investors need a reminder that even during the major pulls of the bullish market, significant setbacks can be seen,” he said. say Hardy, in a note to clients he posted Monday.

The closing new highs hardly seem like a crazy idea for Monday’s session. On Thursday, the S&P 500 closed just 0.5% of its record close of 3722.48, which was seen on December 17th. Equity futures indicate that the S&P will not open too far from that level.

Others have debated ominous parallels between this market and 1999. The S&P 500 finished 19% higher that year, but fell 10% in 2000. So market bones are still hard to find these days, with an average year-end price target for the S&P. 500 of 4,027.21 among Wall Street’s big forecasts.

The markets

YM00 futures,

ES00,

NQ00,

they are superior. London markets are closed for extended holidays, while European markets SXXP,

have risen, also helped by last week’s post-Brexit trade deal, which is giving GBPUSD sterling,

a big boost. Most Asian markets rose and bitcoin BTCUSD,

around $ 26,000, after surpassing the record $ 28,000 over the Christmas weekend. But is it right for your portfolio?

The buzz

President Trump signed the stimulus bill, but also said Congress would vote to raise individual stimulus payments to what he wanted ($ 2,000) from the agreed $ 600. House Speaker Nancy Pelosi said she would hold another vote Monday, but Republicans blocked that effort last week.

Alibaba BABA,

9988,

increased its share repurchase program from $ 6 billion to $ 10 billion, but the shares of the e-commerce giant fell about 8% in Hong Kong, continuing to suffer an antitrust probe by Chinese regulators. Over the weekend, authorities also demanded the online financing platform Ant Group, of which Alibaba owns a 33% stake, clean up its business and present a plan, after suspending its stock debut on last month.

The EU COVID-19 vaccination campaign kicked off over the weekend. U.S. officials are “very seriously” looking at a new strain of the virus in the UK, according to Drs. Anthony Fauci, government infectious disease expert. He also warned of a possible “uphill climb” after Christmas in the US

Holiday spending in the U.S. rose 3 percent from Oct. 11 to Dec. 24, according to the Mastercard Spending Pulse survey. The biggest jump occurred in furniture and home furnishings, while spending on clothing decreased.

According to investigators, the man responsible for the Nashville Christmas bombing is believed to have died in the blast.

The graph

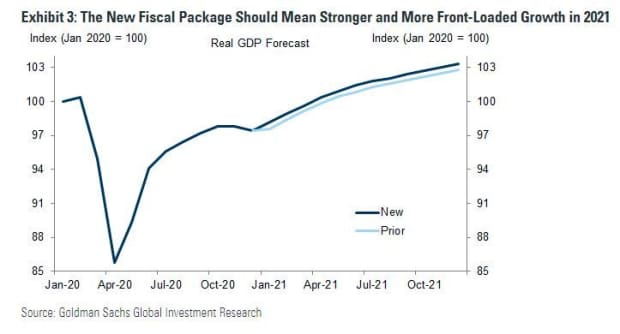

With a “slightly larger” and “earlier” stimulus package approved now, Goldman Sachs has raised its growth forecasts in the US. A team led by chief economist Jan Hatzius, now predicts 5% growth in the first quarter of 2021, up from 3% previously, and “significantly higher production levels in the four quarters.”

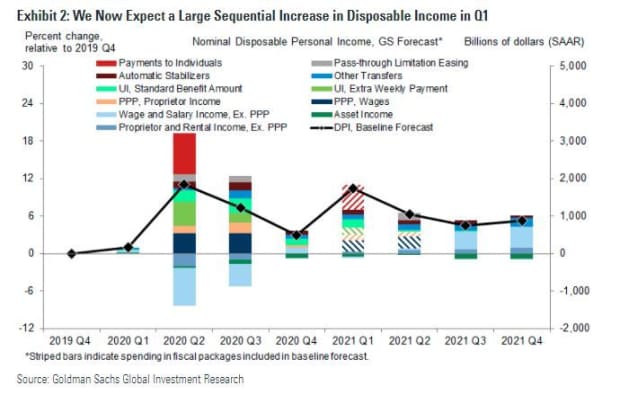

They expect a strong echo of disposable income in the first quarter:

Random readings

The UK government plans to use supermarket checkout lines to combat obesity

Seen in the Indian Ocean, a group of blue whales previously hidden

Italy plans COVID-19 vaccines in flowery pavilions to help recipients catch colds

Need To Know starts early and updates up to the opening bell, though sign up here to get it delivered once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, an morning briefing for investors, featuring exclusive comments from Barron and MarketWatch writers.