Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

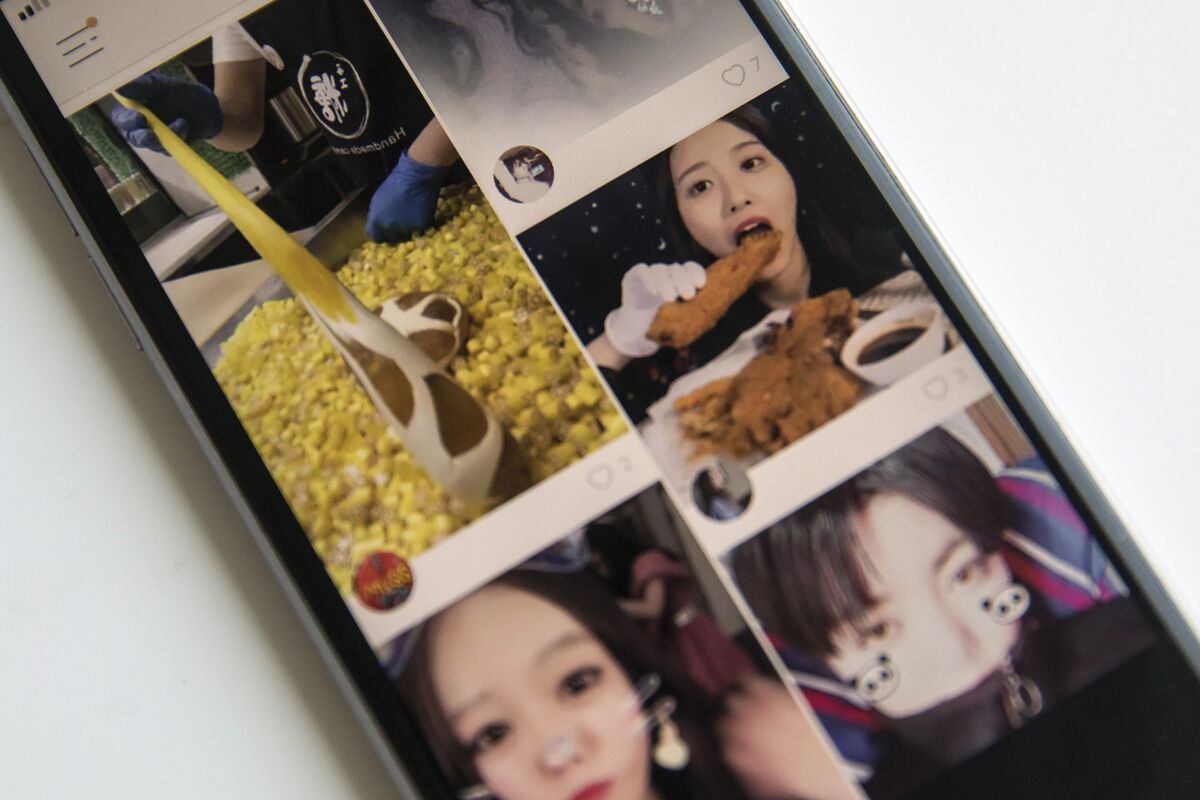

Kuaishou Technology, the main rival of ByteDance Ltd., in China, seeks to raise up to $ 5.4 billion in Hong Kong in what would be the world’s largest initial Internet public offering since Uber Technologies Inc.

The short start of video, supported by Tencent Holdings Ltd., sells 365 million shares for between HK $ 105 and $ 115 each, under the terms of the agreement reached by Bloomberg News. The company will start receiving orders from investors from Monday to January 29 and is scheduled to appear on February 5.

Kuaishou is attempting the largest IPO in the world since the sale of Uber shares to US $ 8.1 billion in May 2019, according to data collected by Bloomberg. The Chinese startup’s IPO will also give another boost to Hong Kong’s already active capital market and could become the largest in Asia since Budweiser Brewing Co.’s $ 5.8 billion fleet.

Kuaishou, which means “fast hand” in Chinese, is one of China’s biggest Internet success stories of the past decade, being part of a generation of startups that thrived with Tencent support. Together with ByteDance, the father of TikTok, the ensemble co-created by Su Hua in 2013 pioneered the live streaming and small-format video format that has since been adopted worldwide by people. the size of Facebook Inc. Kuaishou’s upcoming debut could test the appetite of the biggest rival investors, which was last valued at $ 180 billion.

Kuaishou’s bid has attracted 10 cornerstone investors, who agreed to subscribe for $ 2.45 billion worth of shares, based on the midpoint of the traded range. Training includes The Capital Group, Temasek Holdings Pte, GIC Pte, BlackRock Inc. and Abu Dhabi Investment Authority, according to the terms, confirm a previous Bloomberg News report. The cornerstone investors have agreed to hold shares for six months in exchange for an early and guaranteed allotment.

Kuaishou’s valuation could more than double after its IPO in Hong Kong. A high-end price will value the Chinese company at $ 60.9 billion, up from the $ 28.6 billion it achieved in a round of financing last year, according to Pitchbook. Even in the low end, Kuaishou will still be valued at $ 55.6 billion.

ByteDance has long been a rumored IPO candidate, but last year was caught up in the fight against the US ban on TikTok after the video service was dubbed threat to national security. The social media giant was in talks to raise $ 2 billion before listing some of its businesses in Hong Kong, Bloomberg News reported in November.

According to his report, Kuaishou had an average of 262 million daily active users in September prospectus. That’s still less than half of Douyin’s 600 million, the Chinese version of TikTok. That said, Kuaishou’s revenue rose 49 percent to 40.7 billion yuan ($ 6.3 billion) in the first nine months of last year, after it intensified monetization efforts through advertising and e-commerce. . While offering free access to its main platform, the launch follows the advice users give to their favorite live broadcasters who perform viral challenges, lip sync with the latest pop songs, and play video games.

Tencent holds approximately 21.6% stake in Kuaishou, and other sponsors include venture capital firms DCM, DST Global and Sequoia Capital China, the brochure shows. Shares of Tencent jumped 6.4% to an all-time high early Monday in Hong Kong.

Morgan Stanley, Bank of America Corp. and China Renaissance Holdings Ltd. they are joint sponsors of the agreement.

– With the assistance of Dominic Lau and Zheping Huang

(Add Kuaishou’s assessment to the sixth paragraph.)