Following Jackson Hole’s stubborn message last week from Federal Reserve Chairman Jerome Powell, stocks appear to be at record levels on Monday.

The head of the Fed indicated a gradual reduction in support and the markets will be closely monitoring some important data that will have to arrive this week and that could weigh on the speed or slowness of the central bank procedure. The Institute for Supply Management’s manufacturing report is due to be published in the middle of the week, followed by non-farm payrolls on Friday.

Energy is also in the spotlight for Monday, following one of the largest hurricanes to hit the U.S. mainland.

To ours call of the day, of a billionaire investor who believes investors should not waste money or time on an increasingly popular asset class he considers a “bubble”.

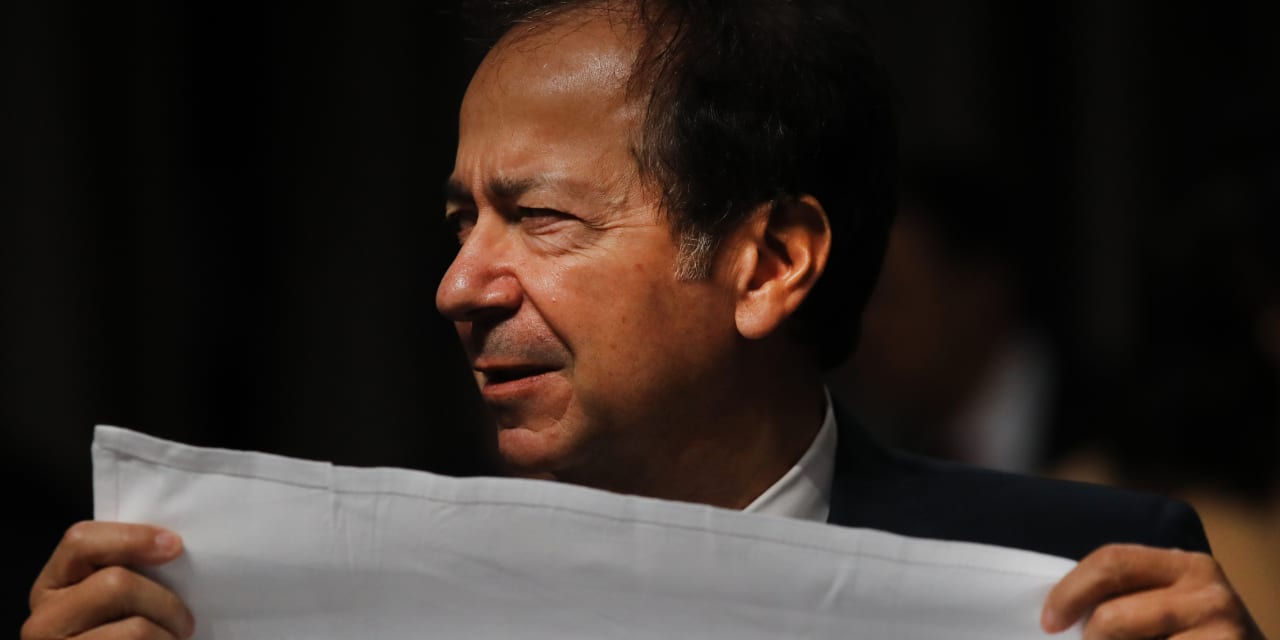

“Cryptocurrencies, no matter where they are traded today, will end up proving useless. When exuberance runs out or liquidity dries up, it will go to zero. I would not recommend anyone investing in cryptocurrencies,” John told Bloomberg Wealth Paulson, president and portfolio manager of US investment firm Paulson & Co., in an interview published Monday.

Paulson said it was not even worth shortening Bitcoin given its extreme volatility, and instead suggested that investors invest money in bullion, due to “a very limited amount of reversible gold.” Paulson sees investors pulling money out of fixed income and cash as inflation rises and heading for the only logical destination, which is gold.

For those unfamiliar with the Paulson name, the former hedge fund manager made a killing bet against the U.S. real estate market before it collapsed.

Bitcoin rose to $ 50,000 early last week, but then struggled to maintain that level, even as Powell’s comments on Friday weighed on the dollar and gave cryptocurrencies a boost. Bitcoin was trading at about $ 47,000 earlier Monday.

Paulson had another tip for those who only have $ 100,000 – use it to buy your own home. Read the full interview here.

Ida breaks to the south

Excavation of one of the worst storms to hit the United States is scheduled to begin. Hurricane Ida cut off power in New Orleans, ripping off rooftops and sending the flow of the Mississippi River in the opposite direction. So far a death has been reported and rescuers have begun searching for the trapped people.

Affirm Holdings shares AFRM,

shoot up after buy-now-pay-later fintech group announced Friday afternoon that it has partnered with Amazon AMZN,

Elsewhere, Baxter International BAX,

is said to be in advanced talks to buy medical equipment manufacturer Hill-Rom Holdings HRC,

for about $ 10 billion.

A Tesla TSLA,

using its autopilot function crashed into a Florida Highway Patrol cruiser on Saturday, nearly losing the driver. The U.S. government opened a formal investigation into the electric vehicle manufacturer’s autonomous navigation system earlier this month.

The European Union may announce on Monday a recommendation to stop non-essential travel from the United States, where the rate of COVID-19 infection is now higher than in the common currency region. Thus, hospitalizations have been over 100,000 and some southern states are running out of oxygen for patients.

Carnival CCL,

meanwhile, it faces a lawsuit alleging that the cruiser was unable to protect those taking its cruises from the coronavirus causing COVID-19.

The markets

ES00 stock futures,

YM00,

NQ00,

they are barely moving, in line with European SXXP shares,

CL00 oil prices,

CLV21,

slip after concentrating ahead of Hurricane Ida, while gasoline costs RBU21,

they are falling. The storm has destroyed 95% of energy production in the Gulf of Mexico.

Read: Whether or not to pause oil production increases is the issue facing OPEC + at its meeting on Wednesday

Random readings

Al Roker is once again firing on the “punks” who say the 67-year-old man of the time is too old to cover live hurricanes on television news.

An antidote to a Monday smile: baby bats babbling

What you need to know is to start early and upgrade to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am, Eastern Time.

Want more for the next day? Sign up for Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.