The shares of Affirm Holdings Inc. raise their best all-day high Monday after a partnership deal with Amazon.com Inc. demonstrated a great vote of confidence in the company’s business model.

Affirm AFRM,

announced Friday that it would select Amazon AMZN,

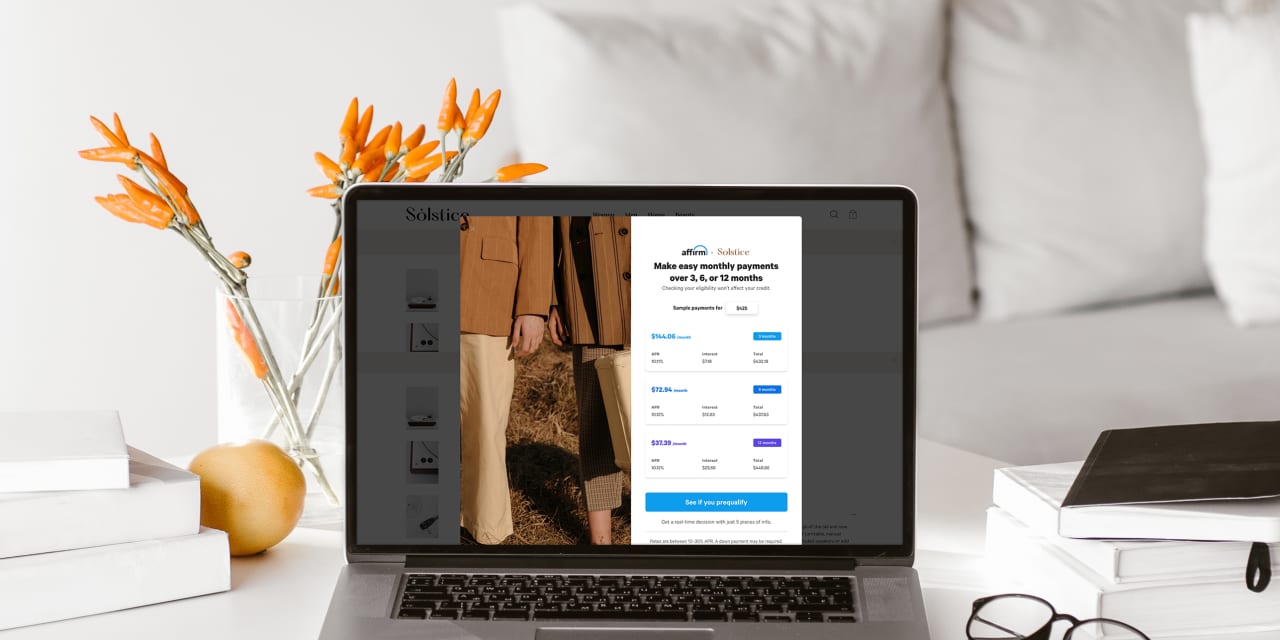

customers have access to Affirm’s installment payment services, with plans for a larger deployment over the coming months. The partnership will allow Amazon buyers to split the cost of purchases into chunks and Affirm says it will not charge hidden commissions or service delays.

“While many had thought Affirm was losing the competitive battle in the BNPL arena, it is clear in this Amazon partnership, along with Shopify, that Affirm is back in the driver’s seat,” the RBC Capital analyst wrote Markets, Daniel Perlin, on a note to customers.

Shares of Affirm, which went public on Jan. 13, rose 43.3% in the afternoon trading. On February 8, the largest one-day increase was 18.7%.

The BNPL trend has been gaining strength in the United States and there has been no related evolution in recent months. Affirm’s shares came under pressure in mid-July amid concerns about plans that Apple reported to join the BNPL game, which then rose in early August after Apple was said to be would work with Affirm on a split option for the Canadian market. Rival Afterpay Ltd. is in full acquisition by Square Inc. in a combination of $ 29 billion.

The timing of Amazon’s announcement “couldn’t have been better,” RBC’s Perlin wrote, given Affirm Peloton Interactive Inc.’s main customer. PTON,

he recently issued a disappointing prospect, which may have contained negative rereadings for Affirm.

“We believe that the combination of Shopify and Amazon as partners in the Affirm platform has quickly changed the conversation with investors, with the argument of the claim that AFRM is a financial services company and has been valued accordingly. , being quickly overcome by the great opportunity of growth that these two associations allow ”, continued.

Perlin values the shares to outperform and raised its price target from $ 87 to $ 124.

Barclays analyst Ramsey El-Assal called the deal a “game changer” for Affirm, arguing that it not only offers opportunities for financial growth, but also serves as broader validation of the model. Affirm business.

“While the details of the deal are scarce beyond what was provided in Affirm’s press release, we would assume that Amazon’s process included an intensely competitive RFP [request for proposal], which Affirm probably didn’t win just for the price, ”he wrote.“ For example, we see that Affirm’s competitive advantage is related in part to the company’s ability to subscribe to AOV in the longer term. [average order value] loans against competitors, which we believe would be important for Amazon given the wide range of products sold on the site ”.

While there are a multitude of players in the BNPL field, Affirm is known for its ability to conduct risk assessments on high value purchases and the company offers a combination of interest-free and simple-interest options.

In terms of financial potential, El-Assal estimated that the deal could lead to a 33% rise in the agreed estimates for Afirm’s fiscal year 2023 at the midpoint of its analysis. It has an overweight rating on the stock and raised its price target from $ 115 to $ 115.

Although Truist analyst Andrew Jeffrey noted that there are still some unknowns about the Amazon deal, such as whether it is exclusive, he agreed that the association sends a positive signal about Affirm’s position. in the market.

“While BNPL has relatively low entry barriers, in our view, and can be marketed quickly, recent companies are gaining on Shopify (exclusive) and now Amazon (unknown exclusivity) highlight Affirm’s competitive advantage,” he said. write, maintaining a purchase rating and raising its target price to $ 120 from $ 82.

Mizuho analyst Dan Dolev indicated that there could be strong interest in a BNPL option on the Amazon platform, as his recent survey of more than 200 Amazon buyers found that it is likely that almost half of them use the offer. Only 18% of respondents were already Affirm customers, suggesting the fintech company the opportunity to grow its customer base.

“We believe the big headline of the collaboration with the No. 1 electronic communications retailer in the United States could launch Affirm into a higher orbit, leading to fears of Apple Pay competition earlier this summer it looks like a forgotten nightmare, ”he wrote.

Dolev has a stock purchase rating and raised its target price to $ 110 from $ 76.

Affirmation shares have risen 59% in the last three months, as the S&P 500 SPX,

has risen 8%.