Do it again? Investors will be eager to see if industrialists S&P 500 and Dow can repeat Monday’s victories that broke the five-session losing streak. Stock futures widen after consumer prices showed a drop in inflationary pressures.

From video game retailers to a once-forgotten source of energy: Retail investors on Reddit comment forums seem to be interested in uranium, whose prices have risen recently.

Investors may want to move quickly to achieve these gains, our company warns call of the day by Morgan Stanley.

“While coal and natural gas prices are driven by tight market tension, the underlying fundamentals of uranium supply demand have not changed significantly in recent months to justify this price rise. “Commodity strategists Marius van Straaten and Susan Bates told clients. “While the current rally is likely to take longer, we are still not convinced it can be held next year.”

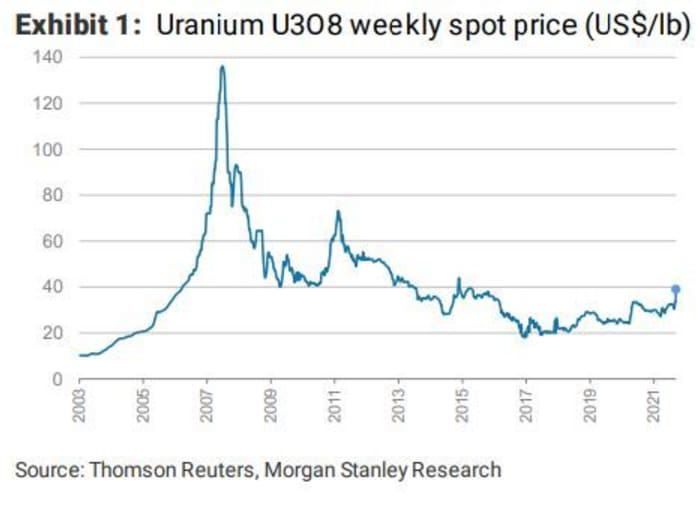

Joining a “broader energy concentration,” the spot price of uranium has risen 20 percent since August to $ 39, the highest since 2015. Strategists acknowledge uranium purchase by of the Sprott Physical Uranium Trust UUT,

– Keep it away from nuclear power plants – has played a key role.

Some believe that Sprott ETF could do for uranium, which the Bitcoin Trust GBTC grayscale,

made for the prices of cryptography when he started buying Bitcoin. The continuation of the purchase from Sprott would add to “an already very active spot market, due to disruptions in the supply of Covid-related mines,” analysts say.

But while the purchase of funds also preceded the upward run of the commodity from 2004 to 2007 that brought it to nearly $ 140, this was against the backdrop of a “nuclear renaissance” that is now not the case. , said. Some bulls argue that prices will not fall even if fund buying slows down due to improved market liquidity that has helped price discovery and revealed the true “spot” price, the couple said .

“On the other hand, better visibility of previously hidden uranium stocks could become an excess for the market, with physical fund outflows also a risk,” they added.

Strategists noted that the World Nuclear Association has recently forecast a balanced market (achieved by reductions in utility inventory and inactive return of mine supply) until 2028. Reductions are expected to play a role. key in the next three years.

“Only when these utility inventories are materially worked out do we believe that the real need for a higher price to encourage the return of idle supply will be more urgent,” they said. This is so, as the discipline of supply can become difficult among producers like Kazatomprom KAP,

and the Canadian Cameco CCJ,

as spot prices keep rising, they point out.

Regardless of the risks, Morgan Stanley is bullish in the medium term for uranium, and expects prices to reach $ 49 a pound in 2024. “That said, the current investor-driven rally could not move smoothly any to a “real” deficit-driven bullish market, and we could see some price weakness in the middle, ”strategists said.

Here come consumer prices and Apple’s big event

Consumer prices in August rose 0.3% compared to forecasts for a gain of 0.4%. Excluding food and energy, prices rose 0.1%.

Read: This was the best-performing asset during eight U.S. inflationary regimes

Apple AAPL,

it is expected to present its iPhone 13 lineup during its fall event which will kick off virtually at 1pm in the East. The tech giant has also struggled to get an emergency security patch for all users.

Boeing BA,

says the aerospace market is recovering in line with its predictions from last year. But the actions slip.

Oracle ORCL Shares,

they have fallen after the software giant’s first-quarter tax revenue fell short of Wall Street forecasts.

Shares of China Evergrande 6666,

fell sharply after the real estate developer said he had appointed financial advisors as he faces a steady decline in property sales and a threat of default. And investors are angry:

Hurricane Nicholas made landfall off the coast of Texas in the early hours of Tuesday and there are predictions of catastrophic flooding.

At the first Met Gala in New York since 2019, with all her fashion emotions, Representative Alexandria Ocasio-Cortez wore a white dress that said “Tax the Rich” on her back, cheering and joking.

She was not the only one wearing a statement dress. Consult Congresswoman Carolyn Maloney (D-NY):

The markets

YM00 futures,

ES00,

NQ00,

increase ahead of inflation data.

SXXP European Shares,

are fighting, and it was mostly a red sea for 000300 Asian markets,

HSI,

The DXY Dollar,

is dropped, oil CL00,

BRN00,

has cut some gains after the International Energy Agency cut its crude oil demand forecast due to the delta variant. Metal industrial palladium PAZ21,

it is being crushed.

Random readings

During the closures, the Scottish government gave the prisoners gifted “intransigible” phones. ”An assumption about what came next.

Note for those looking for selfies: don’t follow the goats off the cliffs.

You need to know it starts early and updates up to the opening bell, but sign up here to receive it once in your email. The email version will be sent around 7:30 am East.

Want more for the next day? Sign up for The Barron’s Daily, a morning investor briefing that includes exclusive comments from Barron’s and MarketWatch writers.