“I think in the end, if he really succeeds, they will kill him. And they will try to kill him. And I think they will kill him because they have ways to kill him. But that doesn’t mean it doesn’t have a place, a value, and so on.”

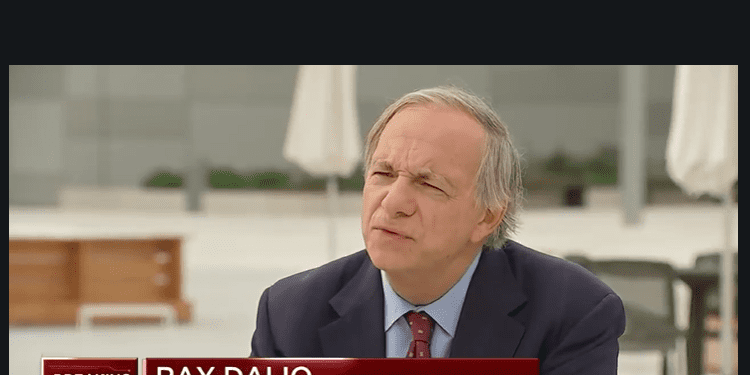

Ray Dalio, billionaire investor and founder of Bridgewater Associates, the world’s largest hedge fund, said the more successful bitcoin is, the more likely governments and regulators to support traditional monetary systems will neutralize it.

In an interview with CNBC on Wednesday, Dalio reiterated comments he made in the past, reiterating that governments have the power to slow the growth of the nascent cryptocurrency market, including bitcoin BTCUSD,

and Ether ETHUSD,

on the Ethereum blockchain, which can pose a threat to conventional finance and global central banks.

Dalio said bitcoin may not have “intrinsic value,” but said it could still be useful in a diversified portfolio. The hedge fund manager said he believes it is worth considering all alternatives to cash and all alternatives to some of the financial assets.

“I’m no expert on it … I think diversification is important,” he said. “Bitcoin has some merit,” he said.

“The real question is how much [does an investor] it has in gold versus how much it has in bitcoin, ”he noted.

For his part, Dalio explained that he holds “a certain amount of money in bitcoin … it’s a small percentage of what I have in gold, which is a small percentage of what I have in my other assets.”

Dalio’s comments come as traditional markets struggle to rise, with the DJIA Dow Jones Industrial Average,

the S&P 500 SPX index,

and the Nasdaq Composite COMP,

with the aim of breaking a recent downward trend in trading.

Dalio, a prominent figure in the world of finance, has a net worth of $ 20 billion, according to Forbes.

In the past, Dalio, founder of the world’s largest hedge fund firm, Bridgewater Associates, has said he is “very bullish” about cryptography as a digital clearing mechanism, perhaps, referring to decentralized finance or DeFi.