Another round of stimulus checks could provide a shot in the arm for stocks and especially bitcoin, according to a poll released Monday by Mizuho Securities.

The survey of 235 individuals hoping to receive checks courtesy of the latest round of COVID-19 relief signed into law by President Joe Biden found that two out of five recipients plan to invest at least a portion of their revenue in bitcoins and stocks . Based on the answers, about 10% of total gross payments, or about $ 40 billion of the $ 380 billion in direct checks, could be allocated to purchases of the world’s most popular digital assets and stocks.

Read: “$ 1.9 trillion seems fake, but $ 7,000 seems to change lives”: 3 Americans tell MarketWatch how they will spend their stimulus checks

This is in line with the findings of other surveys and a report that accompanied an increase in the activity of individual investors throughout the COVID-19 pandemic. Analysts and economists have speculated that the boredom induced by the blockades, along with payments for previous incentives and the lack of activities to spend them, have led to an increase in the opening of online brokerage accounts, as well as the interest in so-called meme actions like GameStop Corp. GME,

and AMC Entertainment Holdings Inc. AMC,

See: Individual investors have returned: this is what it means for the stock market

When it comes to the current round of payments, a Deutsche Bank survey late last month also found investors willing to use the money to trade. In fact, that survey showed that investors were even more willing to invest money in the market, estimating approximately $ 170 billion in potential stock market inflows of $ 465 billion in direct payments.

Take a look at: A new wave of fearless retail investors could be ready to invest $ 170 billion in shares, according to Deutsche Bank

At the extreme, the Mizuho survey found about 20% of check recipients expected to allocate up to 20% of their checks to bitcoins and / or stocks, while 13% expected to allocate 20% to 80 % and 2% expected to put 80% or more on the markets.

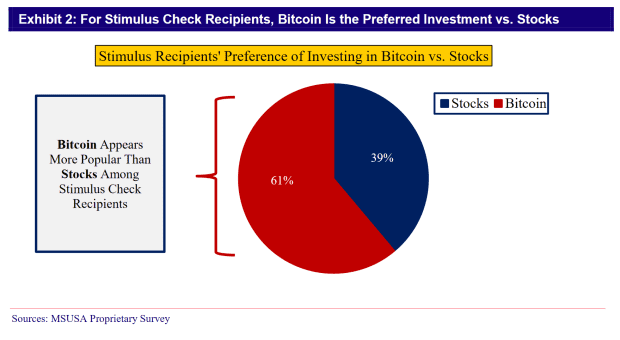

And between bitcoin and equity, cryptocurrency was by far the most popular option.

Mizuho values

“Bitcoin is the preferred investment option among check recipients. It comprises almost 60% of incremental spending, which could involve $ 25 billion in incremental spending on bitcoins derived from stimulus controls,” the analysts wrote. of Mizuho Dan Dolev and Ryan Coyne, in a note Monday (see chart above). “This represents 2-3% of Bitcoin’s current $ 1.1 trillion market capitalization.”

It is possible that some Americans have already received their money. The first batches of payments, which were made in direct deposits, had to be successfully obtained over the weekend. Paper checks and preloaded debit cards will begin arriving in the coming weeks, according to IRS and Treasury Department officials. The IRS said it would not charge the third round of payments on debit cards a person received in the first two rounds.

See: When will you get your $ 1,400 incentive? Some payments have already arrived, but many arrive on Wednesday

It all comes as Bitcoin unveils its trademark volatility, retreating on Monday after surpassing the $ 60,000 mark for the first time over the weekend. In recent operations, bitcoin BTCUSD,

fell more than 6%, to 56,337.

Shares, meanwhile, were mostly lower after the Dow Jones Industrial Average DJIA,

S&P 500 SPX,

and the Russell 2000 RUT of small cap

released record finishes Friday. Investors continue to monitor bond yields. The performance of the ten-year note TMUBMUSD10Y,

it has risen for six weeks in a row, causing a rotation towards large-cap growth stocks that flew to stocks more sensitive to the business cycle.

Also read: “There will be no peace” until the ten-year Treasury yield reaches 2%, the strategist says